Using the modified GMMA to dissect the DOW-30

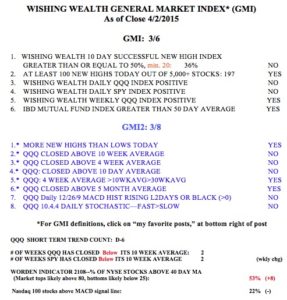

With the GMI stuck at a middle 3 reading (see table below), I thought it might be useful to analyze the Dow-30 stocks according to the patterns I have been writing about that use a modified GMMA chart.  It is noteworthy that a little less than one half (14) of the Dow 30 stocks remain in a strong RWB up-trend. Ten stocks are too close to call with their 6 red short term exponential averages overlapping with their 6 blue longer term averages such that there is no white space between the two sets of averages. Finally, six stocks are in solid BWR down-trends with all of their shorter term averages well below their longer term averages. I only want to own stocks showing RWB patterns because they are in strong up-trends. BWR stocks are for shorting, and I would never hold any of them long. The fact that about one third of the Dow 30 stocks are in No-W patterns (no clear up or down-trends) could signify a market in transition. I provide an example of each pattern below.

It is noteworthy that a little less than one half (14) of the Dow 30 stocks remain in a strong RWB up-trend. Ten stocks are too close to call with their 6 red short term exponential averages overlapping with their 6 blue longer term averages such that there is no white space between the two sets of averages. Finally, six stocks are in solid BWR down-trends with all of their shorter term averages well below their longer term averages. I only want to own stocks showing RWB patterns because they are in strong up-trends. BWR stocks are for shorting, and I would never hold any of them long. The fact that about one third of the Dow 30 stocks are in No-W patterns (no clear up or down-trends) could signify a market in transition. I provide an example of each pattern below.

RWB up-trend: UNH

No-W, indeterminate trend: JNJ

It is possible JNJ (and the other 9 N0-W stocks) is in the process of transforming from a multi-year RWB up-trend to a BWR down-trend, like XOM did in 2014. Only time will tell…………

It is possible JNJ (and the other 9 N0-W stocks) is in the process of transforming from a multi-year RWB up-trend to a BWR down-trend, like XOM did in 2014. Only time will tell…………