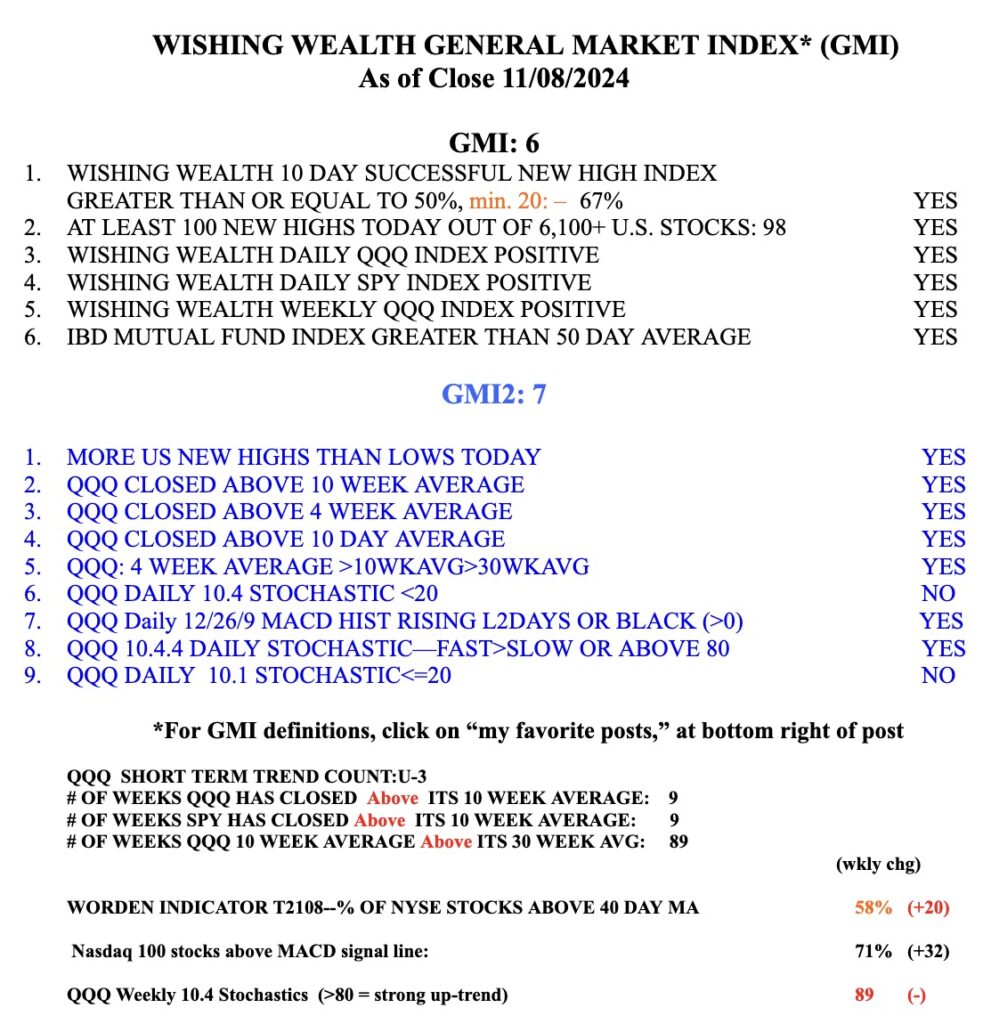

Stock Market Technical Indicators & Analysis

QQQ was very oversold but instead of dropping it found support and took off. Both my short term indicator and GMI reversed up. My longer term indicators had never signaled a major decline, however. I just was on the sidelines until the election passed. There were an amazing 811 US stocks at 52 week highs and 330 at an ATH! TC2000 sounded an alert when IBIT broke out and I tweeted about it intraday. This was an IPO GLB. The monthly chart looks like a flag pattern that may result in a continuation move the size of the earlier flag pole. Note Wednesday’s unusual volume.