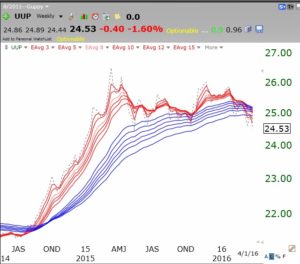

This GMMA chart of the dollar index (UUP) suggests to me that the dollar’s up-trend is over. A weakening dollar implies lower interest rates and more profits for large US international companies that must translate their foreign currency earnings back into dollars. This may be why the market is strengthening— in anticipation of brighter second quarter forecasts to come with the imminent first quarter earnings reports.

Below are five GLB (green line break-out) stocks that came up in my TC2000 alerts the past 30 days.

Below are five GLB (green line break-out) stocks that came up in my TC2000 alerts the past 30 days.

Not all GLB stocks work out but I must admit, most of the recent alerts have worked out. In a rising market, buying GLB stocks breaking to all-time highs can be a profitable strategy. GGG just broke out on Friday. Will it also prove to be a winner?