I am almost 100% cash in my trading accounts. My little voice said “this is too easy,” on Tuesday, a reliable signal for me, typically occurring at market tops, reflecting the fact that most of the stocks I follow were rising unusually fast. This weekly chart of the Dow Transports shows it to be right at a possible Head and Shoulders top neckline. Will it hold?

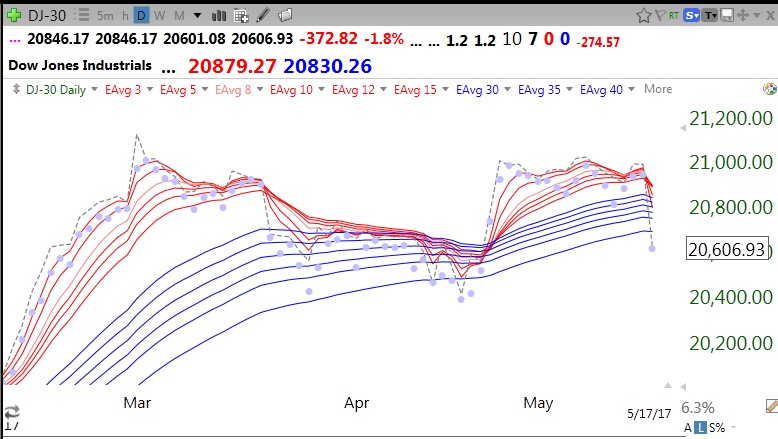

The daily RWB pattern of the Dow 30 industrials is now gone, with a 0/0 pattern. This means the Index closed (dotted line) below all 12 Red and Blue averages. The up-trend will likely resume when it has a 6/6 reading again. Sell in May may work this year.

The daily RWB pattern of the Dow 30 industrials is now gone, with a 0/0 pattern. This means the Index closed (dotted line) below all 12 Red and Blue averages. The up-trend will likely resume when it has a 6/6 reading again. Sell in May may work this year.