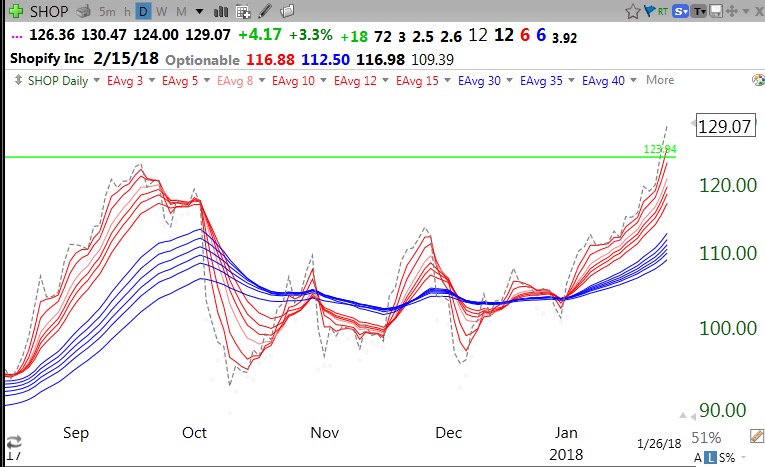

SHOP finally broke through its September all-time high (ATH) last week. This green line break-out (GLB) could be the beginning of a new advance, as long as it remains above the green line.

SHOP is in a new daily RWB up-trend.

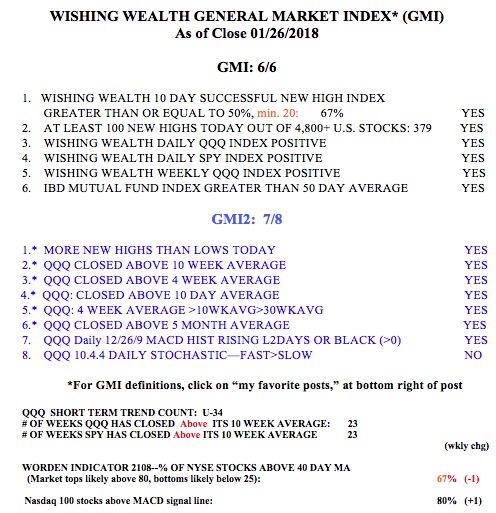

The GMI remains at 6 (of 6).