List sorted by last column, c/c250. SEZL is up almost 9X, and had a GLB on 5/9/2025.

Screenshot

Stock Market Technical Indicators & Analysis

List sorted by last column, c/c250. SEZL is up almost 9X, and had a GLB on 5/9/2025.

Screenshot

While we have had a nice rebound from the April lows, this weekly chart shows that SPY (as well as DIA, IWM, QQQ) still has a 10 week average below its declining 30 week average. During bull advances the 10 week can remain above the rising 30 week average for months. See also the weekly chart from 2016-2019. Until the 10 week crosses above the 30 week and the 30 week turns up, I remain very cautious and mostly on the sidelines. The May 21 Boston IBD Meetup is full. If you register here you will receive a free recording of my presentation.

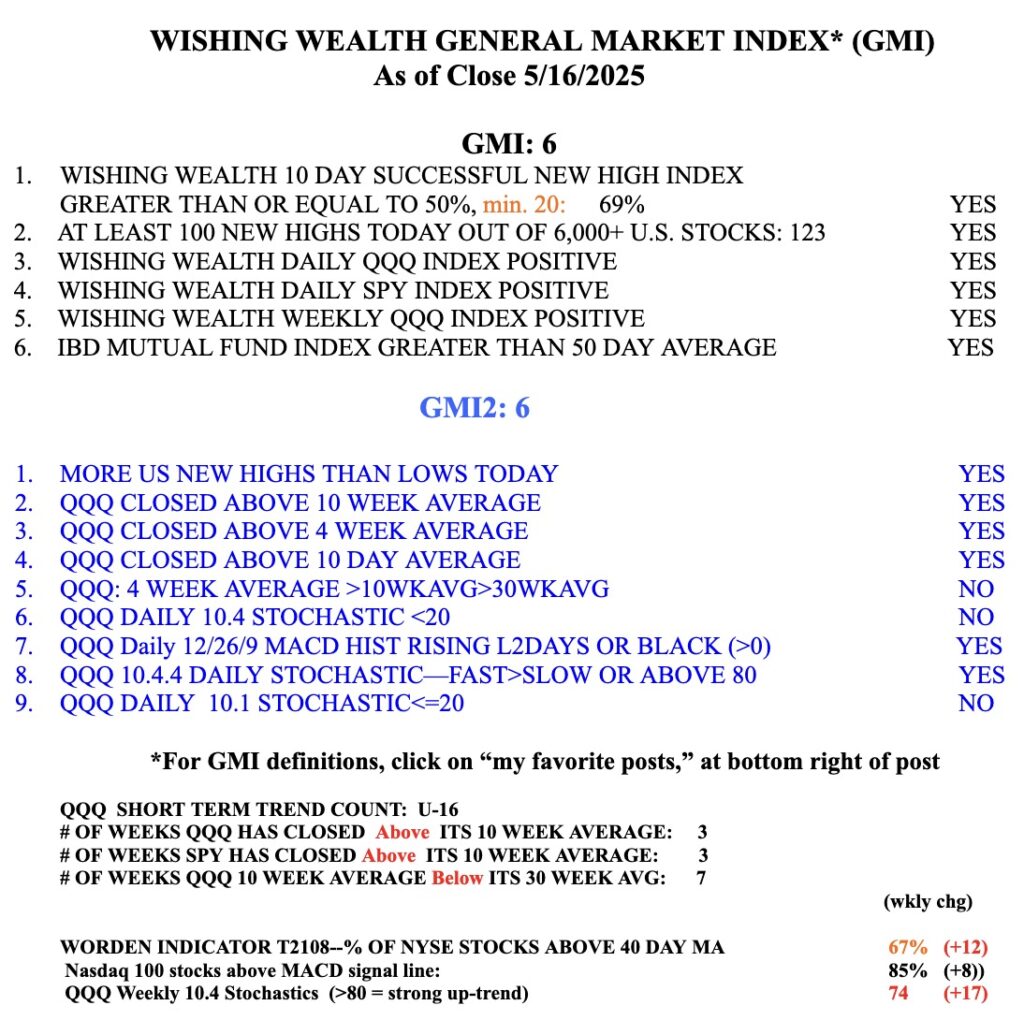

The GMI remains Green and at 6 (of 6) but QQQ is still in a Stage 4 down-trend.