I wrote about IIPR when it was $82 in April, 2019. That post also shows how to use GLBs with IPOs.

My final 10 thoughts for my fall semester freshmen class on technical analysis; GMI remains Green

It took 14 weeks for my freshmen students, most of whom never bought a stock, to be able to understand and appreciate these final thoughts that I sent them after they had completed my course. I thought others might appreciate seeing them. And now I turn to ponder whether I want to offer a similar not-for credit course for non university students and adults? Proceeds will go to the university.

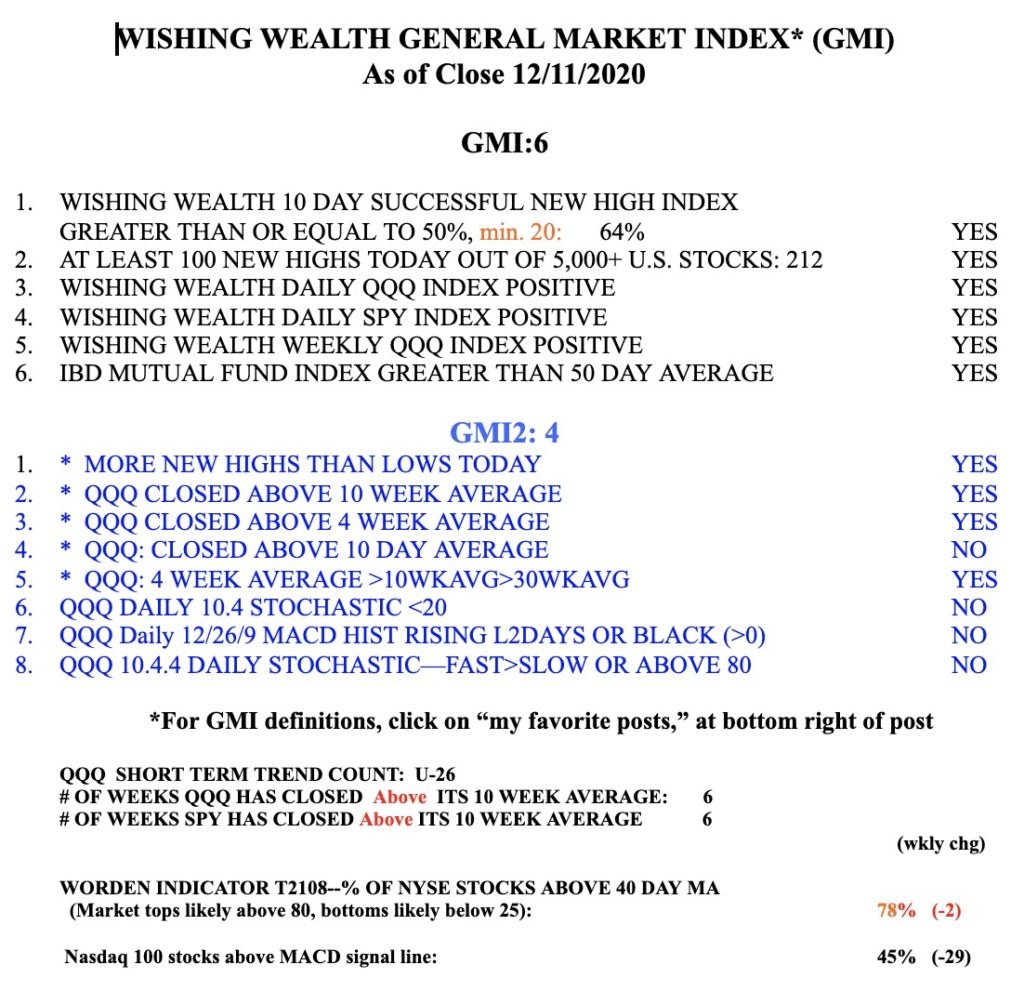

The GMI remains at 6 (of 6) but the GMI2 is only 4 (of 8) and is more sensitive to short term weakness. So the longer term trend remains up but the shorter term is showing some deterioration.