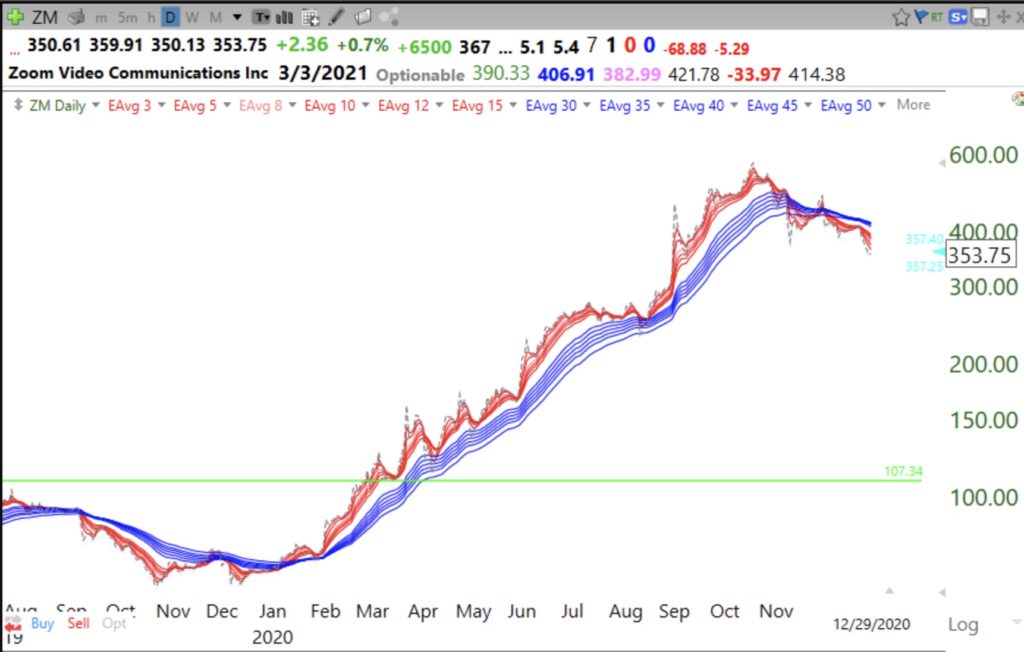

Jesse Livermore once wrote how easy it was to unload stocks on the public during a decline from highs. ZM may not be a bargain here. I never buy a stock when its shorter term averages (red) are declining below the falling longer term averages (blue).