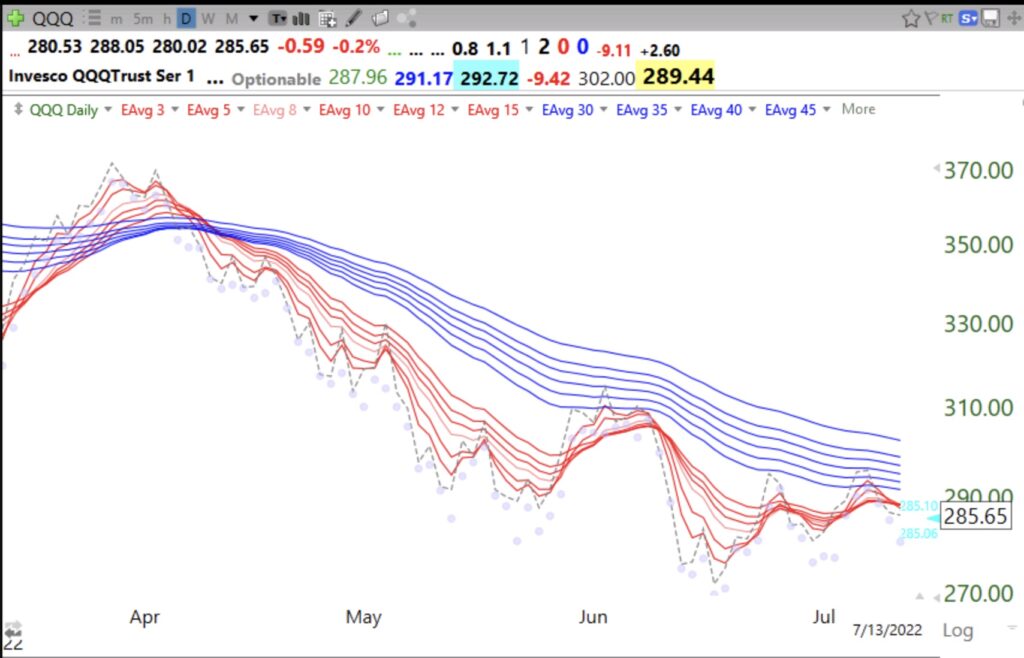

In this daily chart, all of the red lines are declining below all of the blue lines with a white space between them= BWR decline. This is the time for me to be mainly in cash. Remember to catch my presentation on Saturday at 2:40 pm EST at the third day of the TraderLion 2022 conference. The recordings of presentations from all days are also available on their site. The link to Saturday’s program is here.

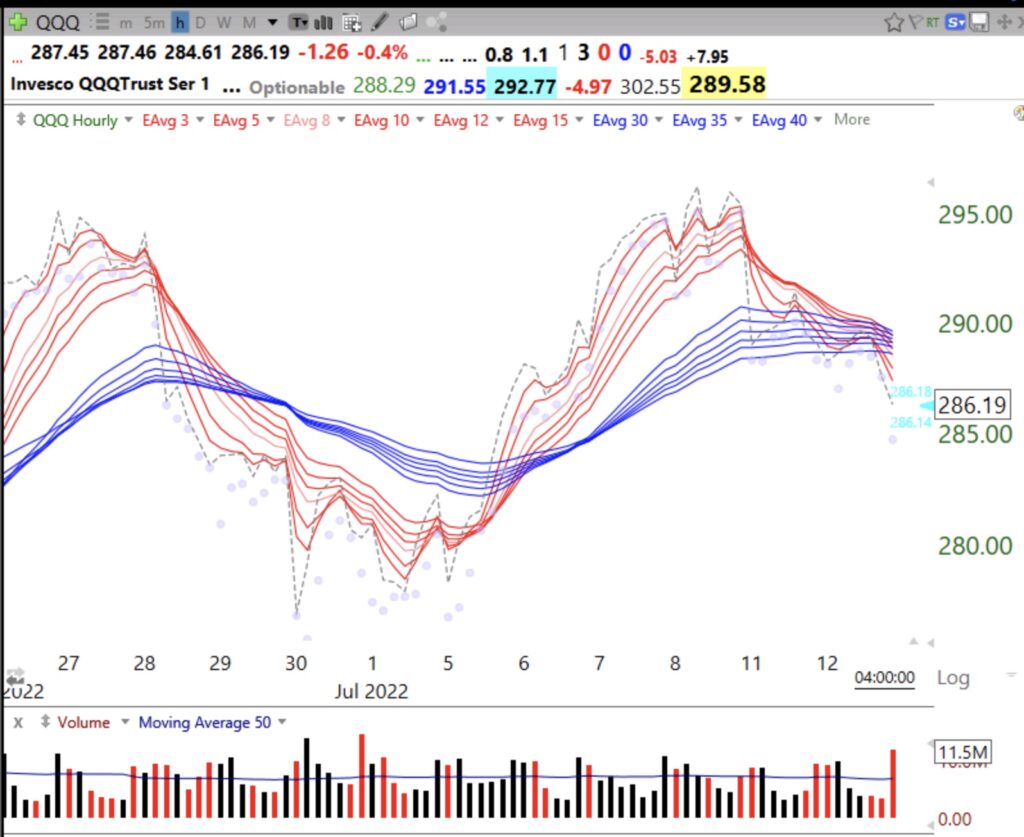

Blog post: Day 1 of new $QQQ short term down-trend; Hourly GMMA looks weak, see chart; GMI=0

The hourly GMMA chart shows that QQQ closed (dotted line) the last hour below all 12 averages. I nibbled at SQQQ. If the new short term down-trend reaches day 5, I will be more confident that it will be significant. Note the large volume at the end of the day. See the 10:30 Weekly chart. Cash is king right now.

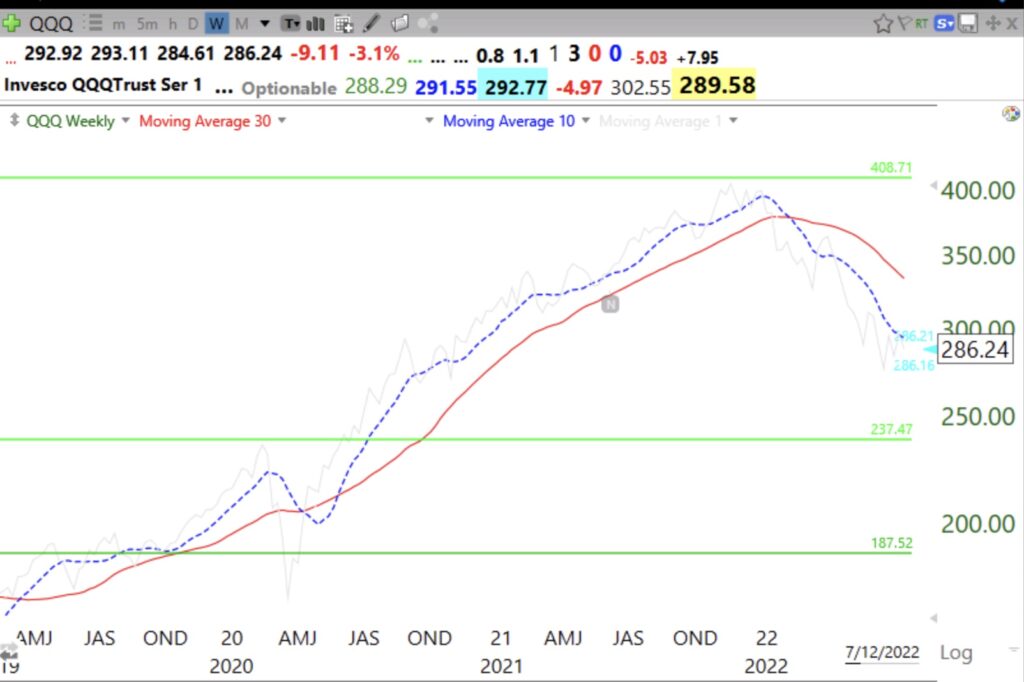

Look at this ominous 10:30 Weekly chart of QQQ.