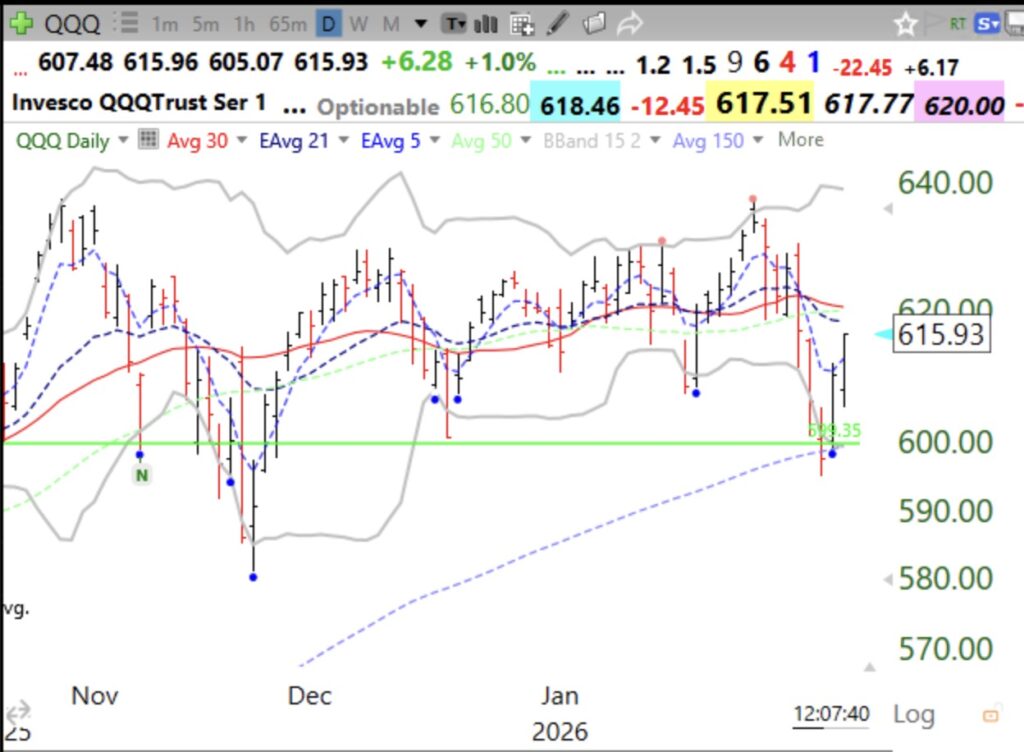

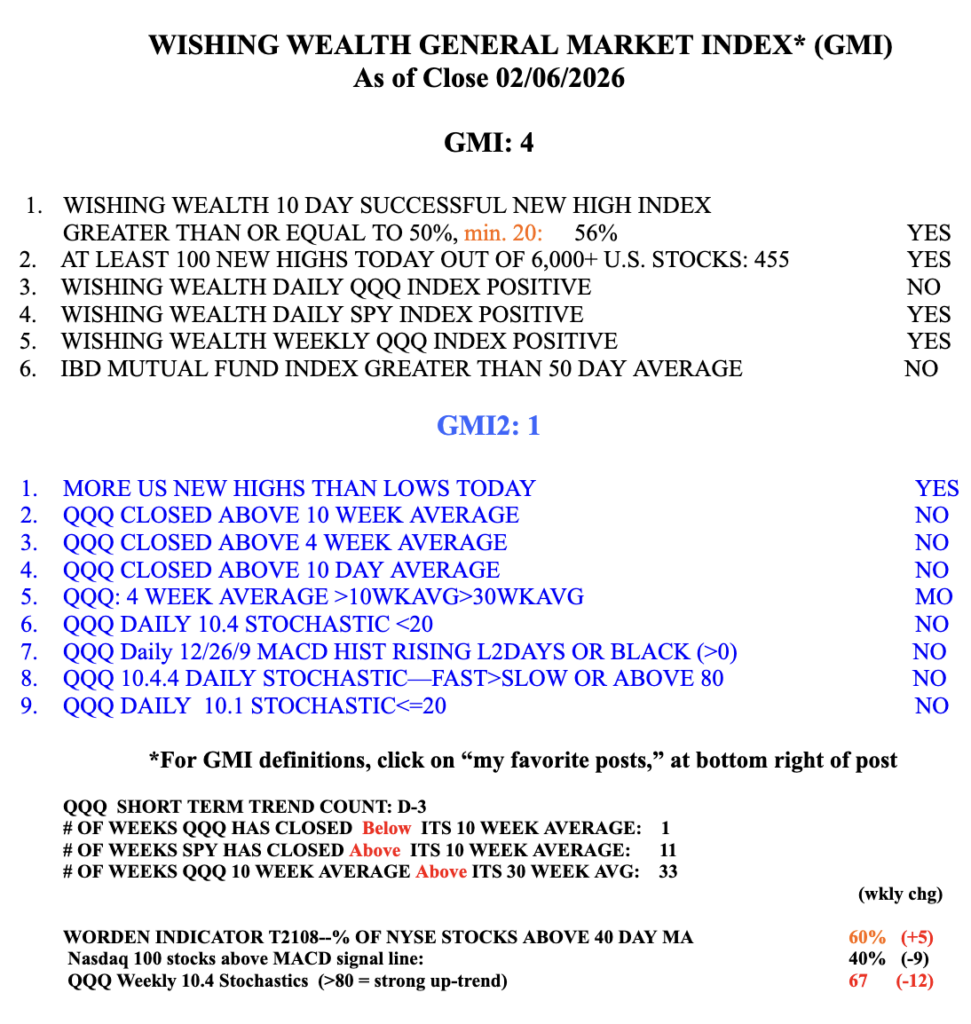

It is possible to find some new leaders to trade. But with most of the former leaders weakening, it is best for me to be mainly in cash. For me, a rising launched rocket is one that climbs continually above its rising 5 day EMA. I use TC2000 to find stocks that have had a GLB, are hitting all-time highs, and that are finding support at their rising 5 day EMA. When the market straightens out I will show some of these scans and how I trade them. There is a tab on this blog with a discount coupon for TC2000.