TITN has an IBD comp rating=99 an EPS rating= 99, and RS= 96. On November 30 when it released earnings up +91% it had a gap up on huge volume in a GLB. It then retested the green line and broke above its 9 week base to an ATH on above average trading volume on Monday. See daily, weekly and monthly charts. Watch to see if it falls back into the base or goes on to another ATH. It is expected to have earnings +64% in 2023, according to MarketSmith.

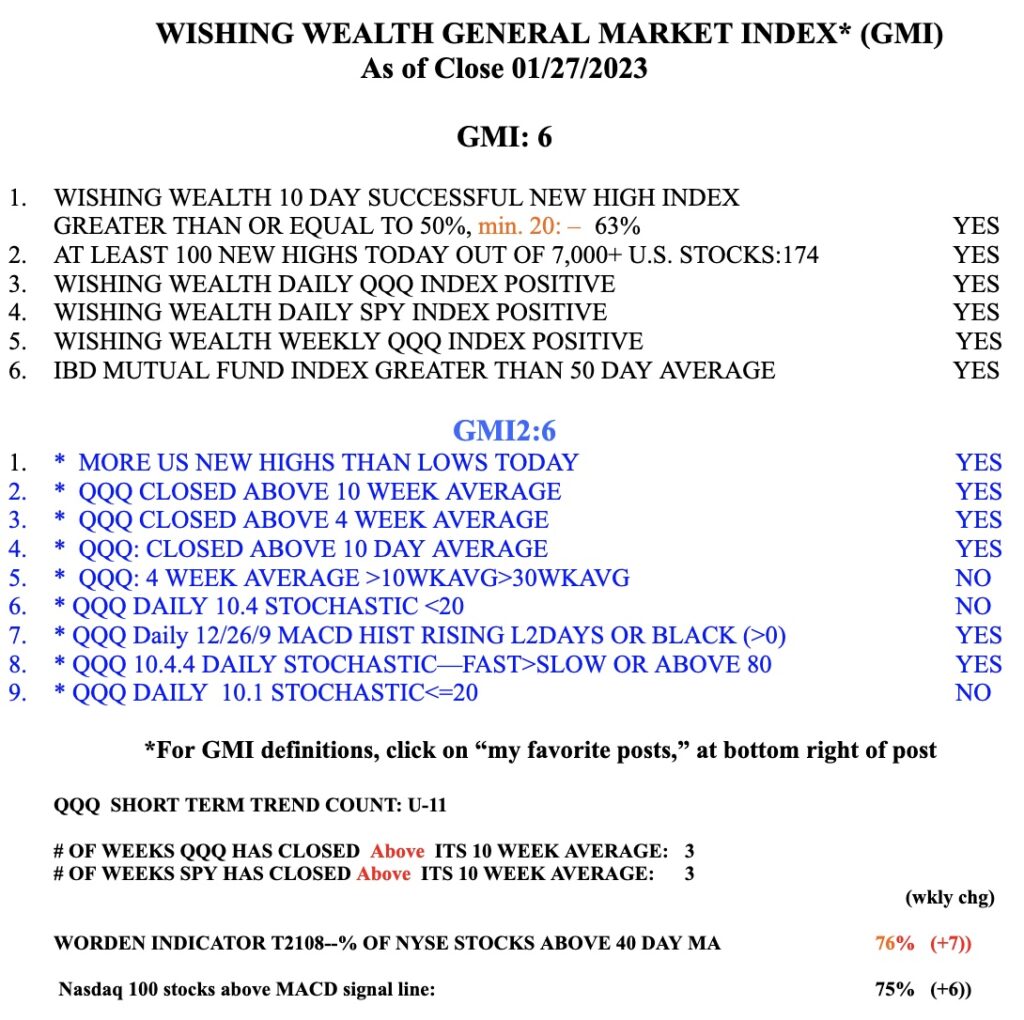

Blog Post: Day Day 11 of $QQQ short term up-trend; GMI=6 (of 6) and Green; 25 stocks at ATH on Friday, see list for possible market leaders plus example charts of $BWMN and $WIRE

I remember long before the internet that the major media typically called a bear market bottom or bull market top about 6 months after it had occurred. It took that long for the editors to believe a major change in trend. So we cannot trust the pundits to tell us when to get in or out of the market. However, my objective GMI indicator suggests that it may be time to wade back into the market. When the GMI is 6 (of 6) it is likely that a longer term up-trend has begun. Don’t dwell on the news. The market turned up at the end of March, 2020 near the beginning of the pandemic while most people remained skeptical and were too scared to enter. If we focus on the Fed, the debt crisis and refunding of the government and the war, we have many reasons to stay out. However, as I hear pundits saying to stay away from tech stocks and to invest in income stocks instead, it makes me think a new bull market for growth stocks is on the horizon.

Below is a list of stocks on my IBD/MarketSmith watchlists that reached an ATH on Friday. The list is sorted by earnings release date. Somewhere on this list are some major market leaders. Time to research and monitor them.

One stock not on this watchlist that has a very interesting weekly chart is BWMN. It is a recent IPO and had a GLB (green line break-out to an ATH) recently. As long as it closes above the green line, 22.82, it is a successful GLB. (I could not resist taking a very small position.)

Another interesting chart with a GLB is $WIRE.

The GMI is 6 (of 6) and Green.