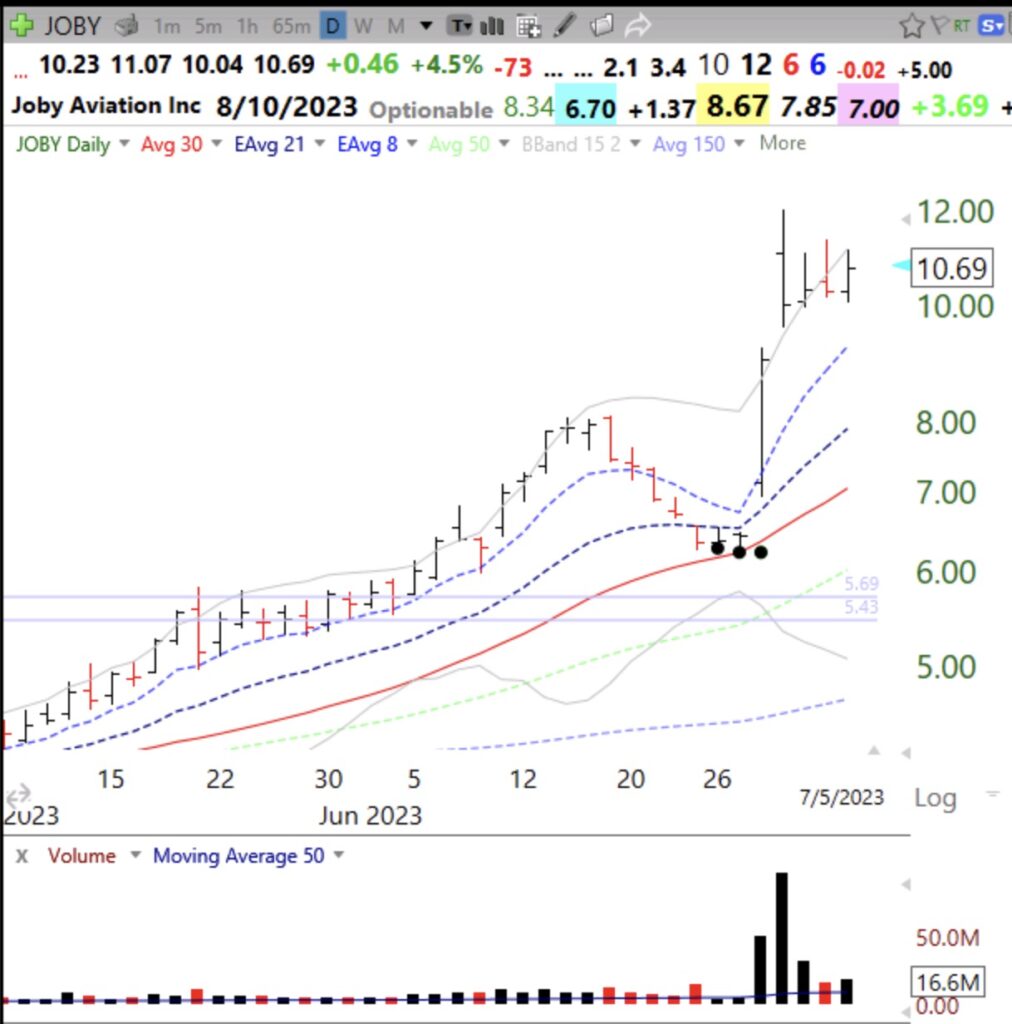

While I do not like cheap stocks, I must say that there may be something to the strength shown in the electric vertical take off and landing (eVTOL) industry. I wrote about JOBY recently and ACHR is another stock in the industry showing some life. Note the volume surges and the nice OSB (oversold bounce) signals, shown by black dots. When you research these companies you will find many large early investors in them, like car companies, the military and airlines.

Blog Post: Day 44 of $QQQ short term up-trend; 108 US stocks at ATH, most since 12/29/2021! See the one chart that tells me if QQQ is in a bull or bear market

This weekly chart shows the 10 week average (dotted line) and the 30 week average (red solid line). The gray line is the weekly close. When the 10 week average crosses above the 30 wk and the 30 wk starts rising we are in a new bull market. The early sign of a possible down turn will be a weekly close back below the 30 week average. These signals have helped me to be in rising markets and out of declining markets since 2000.

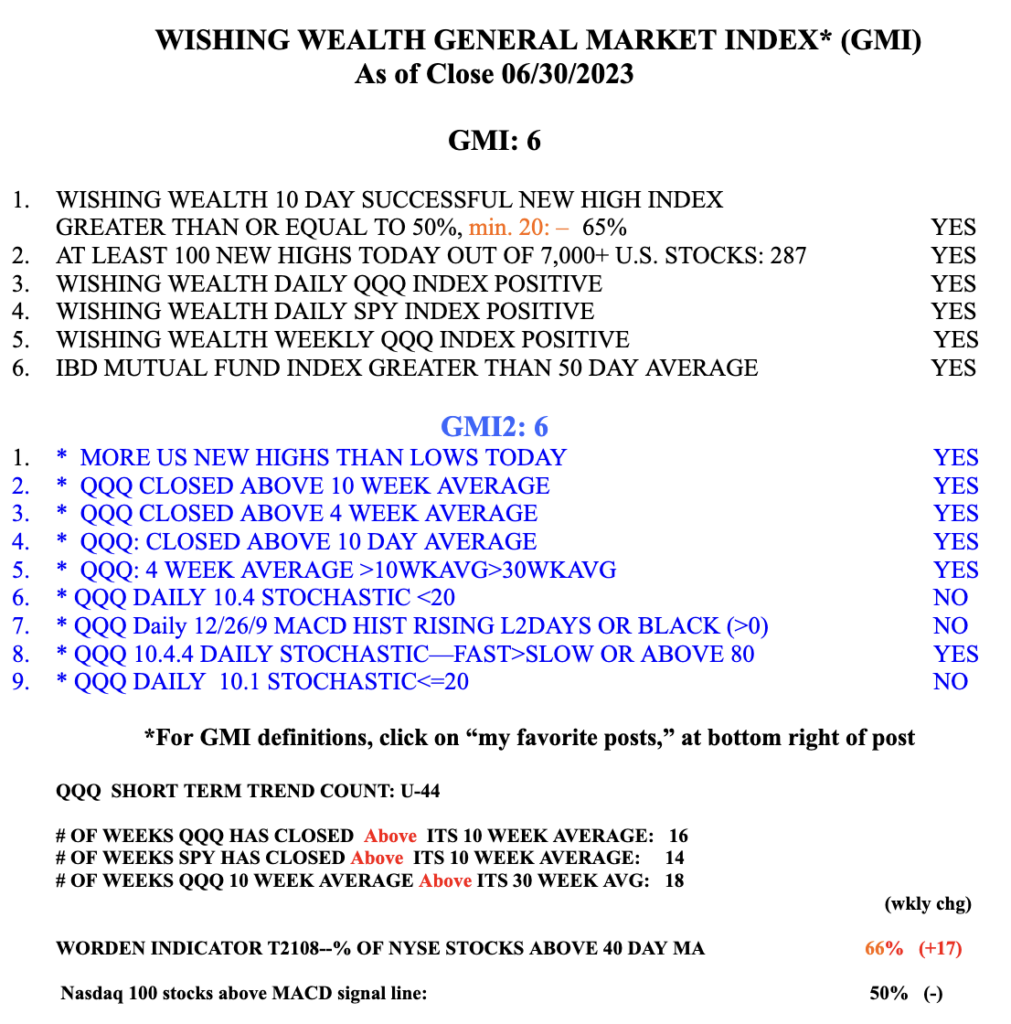

Meanwhile the GMI is Green and registers 6 (of 6). It turned green on 3/30/2023. The 10 week crossed above the 30 week earlier, on 3/3/2023.