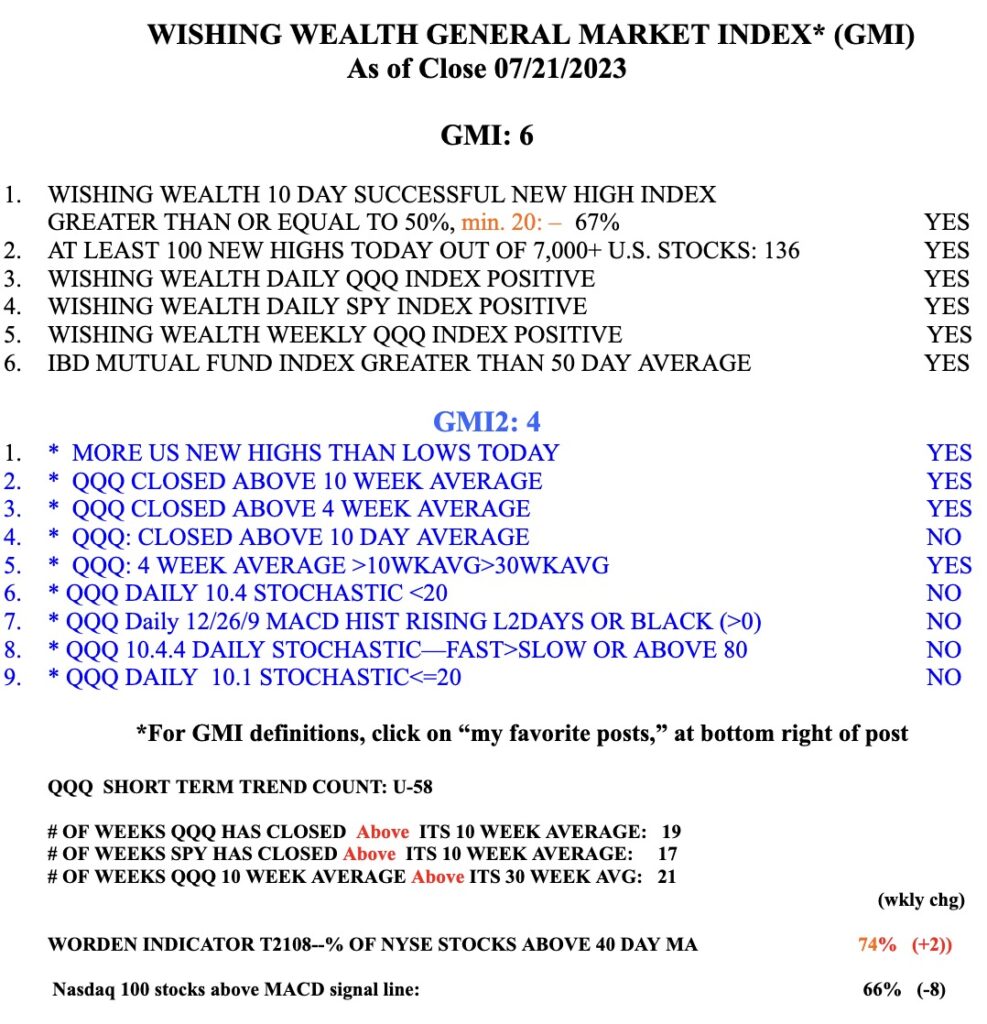

The GMI remains at 6 (of 6) and Green, but note that only 4 of the more sensitive components in GMI2 are positive. We need to get through the Fed meeting this week.

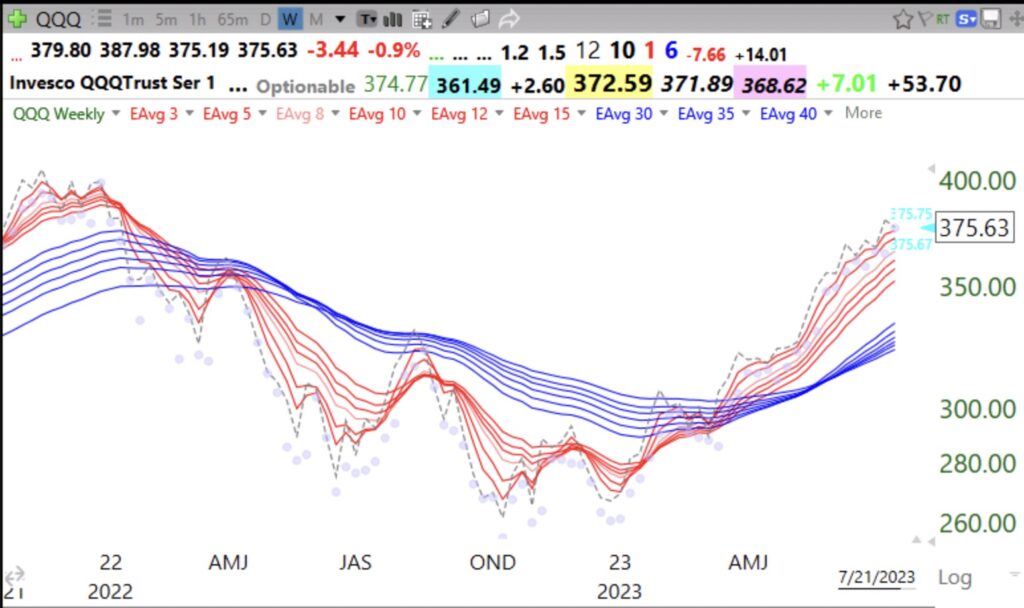

Blog Post: Day 57 of $QQQ short term up-trend; list of 4 growth stocks with Black Dot OSB set-up, see daily charts of $WWE and $KNSL

While many growth stocks were punished on Thursday, these 4 had promising bounces up off of oversold conditions. Each hit a recent yearly high or ATH (all-time-high). They are worth researching. Here is the list and the daily chart of WWE. Note that WWE is above its last green line top and has also found support at its lower 15.2 daily Bollinger Band. I bought a little in the after market and will exit if it trades below Thursday’s low (104.34).

Here is what a successful OSB set-up looks like.