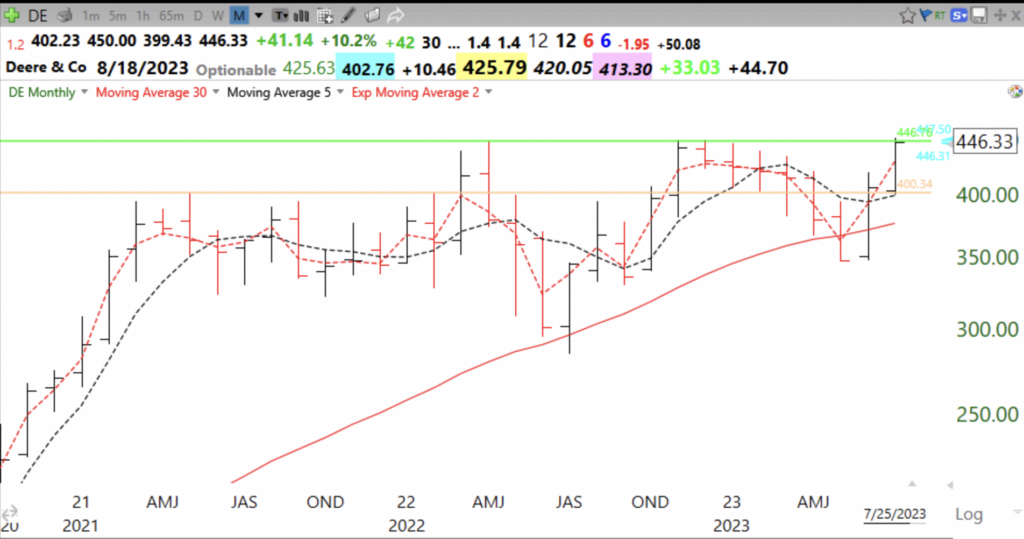

A black dot indicates an oversold bounce. SKX also had a GLB (green line break-out to ATH). Note the huge volume on Friday after earnings were released. I love their new slip-in shoes. I bought some.

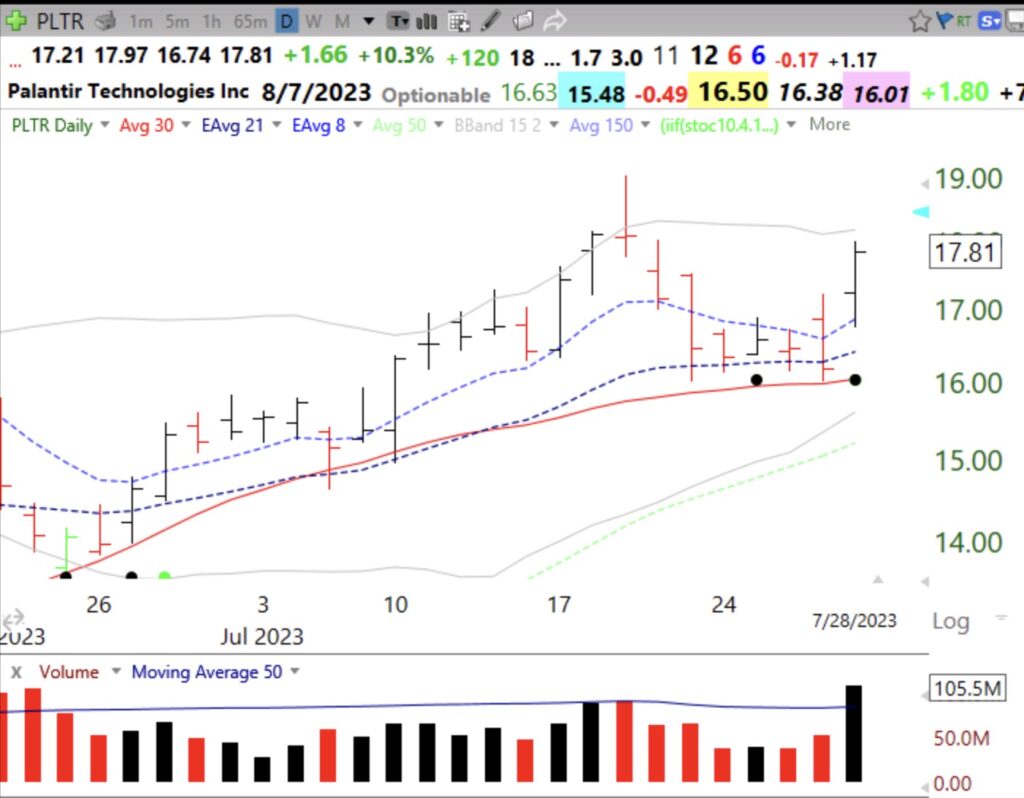

PLTR is way down from its ATH= 44.91.

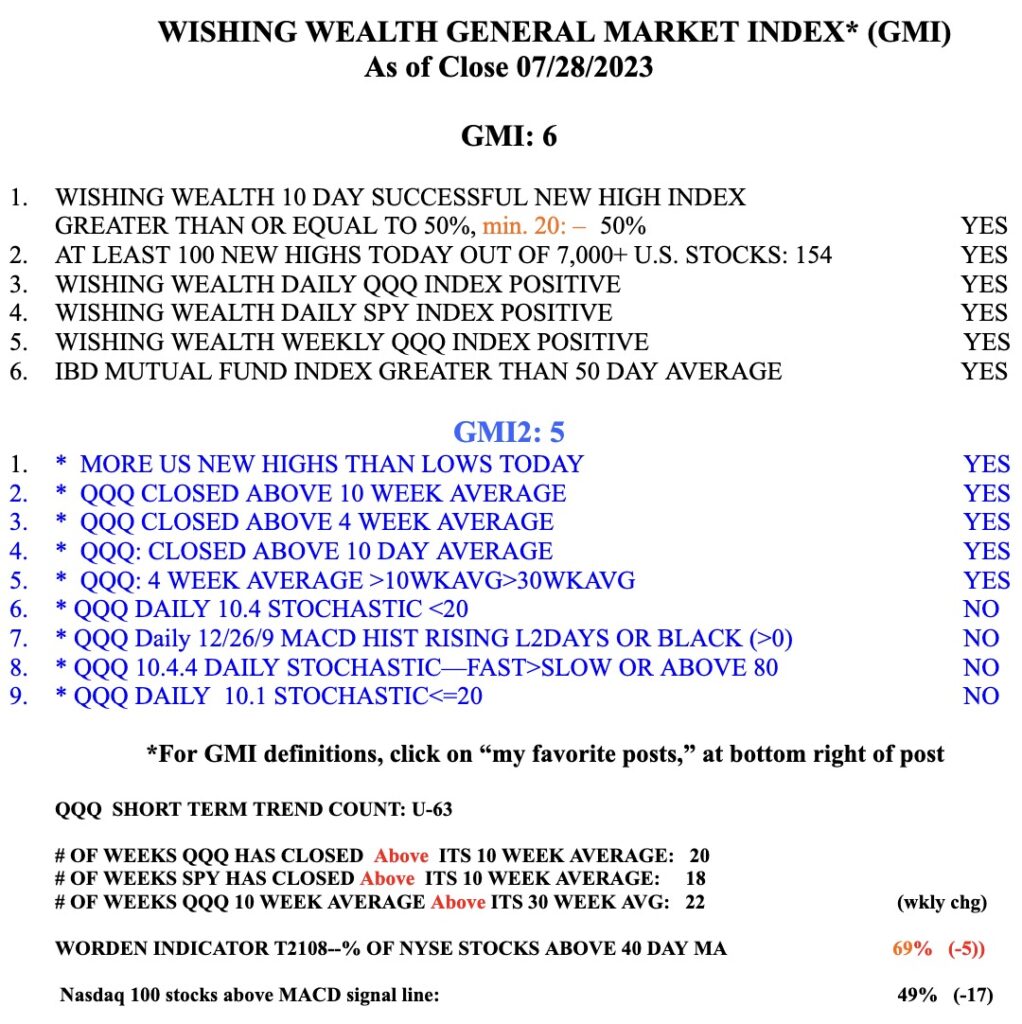

The GMI remains Green, at 6 (of 6).