Blog Post: Day 13 of $QQQ short term down-trend; IBD calls market back in confirmed up-trend after follow through day; My 10:30 weekly charts show $QQQ and $SPY still in Stage 2 up-trends, see charts and list of 21 stocks with weekly green bar

Note that the 10 week average remains above the 30 week average. I am looking for this ETF to climb back above its 10 week average and for that average to turn up. For now, I remain partially invested in growth mutual funds in my university pension accounts. The gray line tracks the weekly closes.

SPY is a little weaker.

These 21 stocks had a weekly green bar last week (recent ATH and 4wk>10wk>30wk and bounced up off of rising 4 wk and 20 wk high in RS) and are worth monitoring. They are sorted by price/lowest price past 250 days.

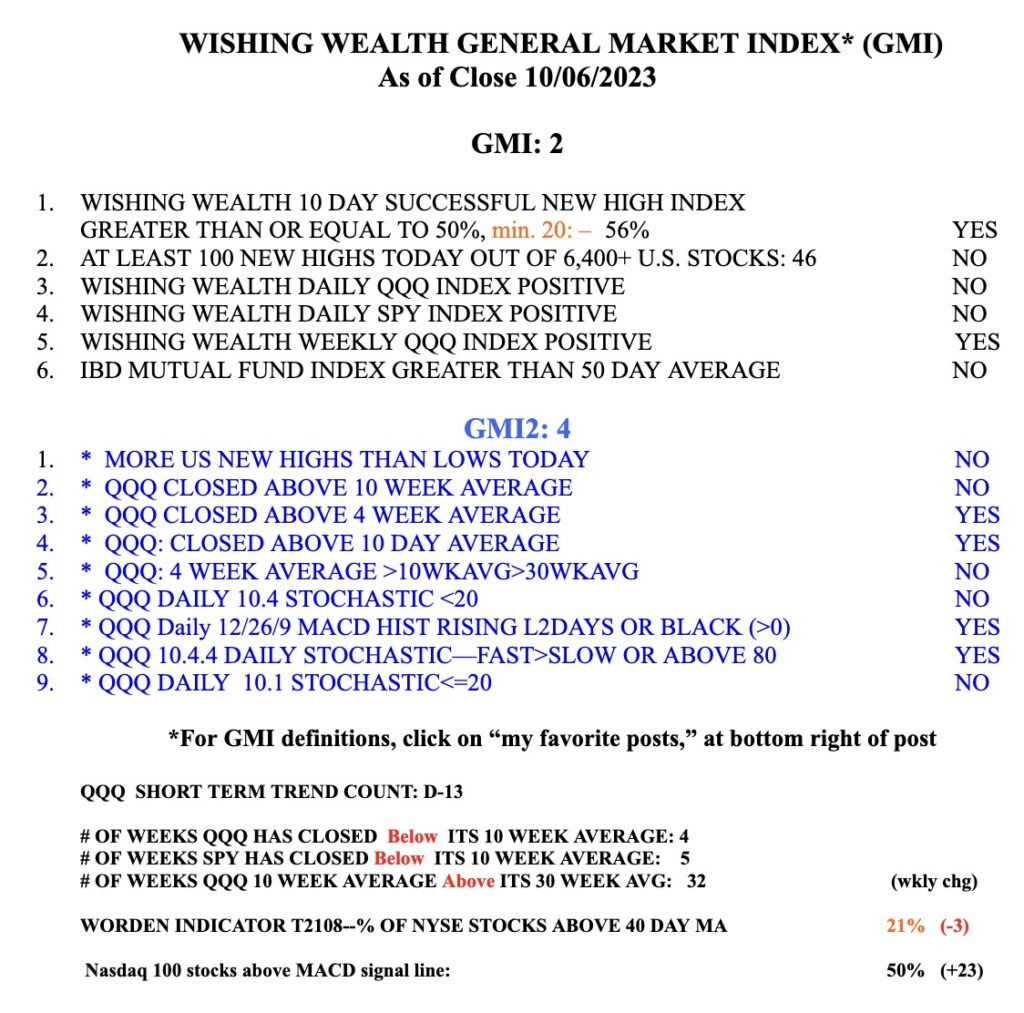

The GMI= 2 (of 6) and is still RED.

Blog Post: Day 12 of $QQQ short term down-trend; 29 US new highs and 167 lows; $QQQ is finding support right at its trend channel line (TCL, thanks to @TCLTRader), see daily chart

Vas, from @TCLTrader, comes to my class each year to teach his technical analysis based on the works of Al Brooks. Vas draws trend channel lines, TCLs, below a down-trend as I have drawn in the daily chart below. It is amazing how some TCLs predict in advance exactly where support or resistance occurs. You can learn Vas’ techniques by attending online the Northern Virginia IBD monthly MeetUps. The blue arrows designate the sentiment survey (% saying QQQ will rise near term) from my weekly undergraduate class.