Blog Post: Day 3 of $QQQ short term up-trend; 52 US new highs and 35 lows; $QQQ closed above its descending trend line, will it hold? Recent IPO $SKWD gaps up to ATH, see charts

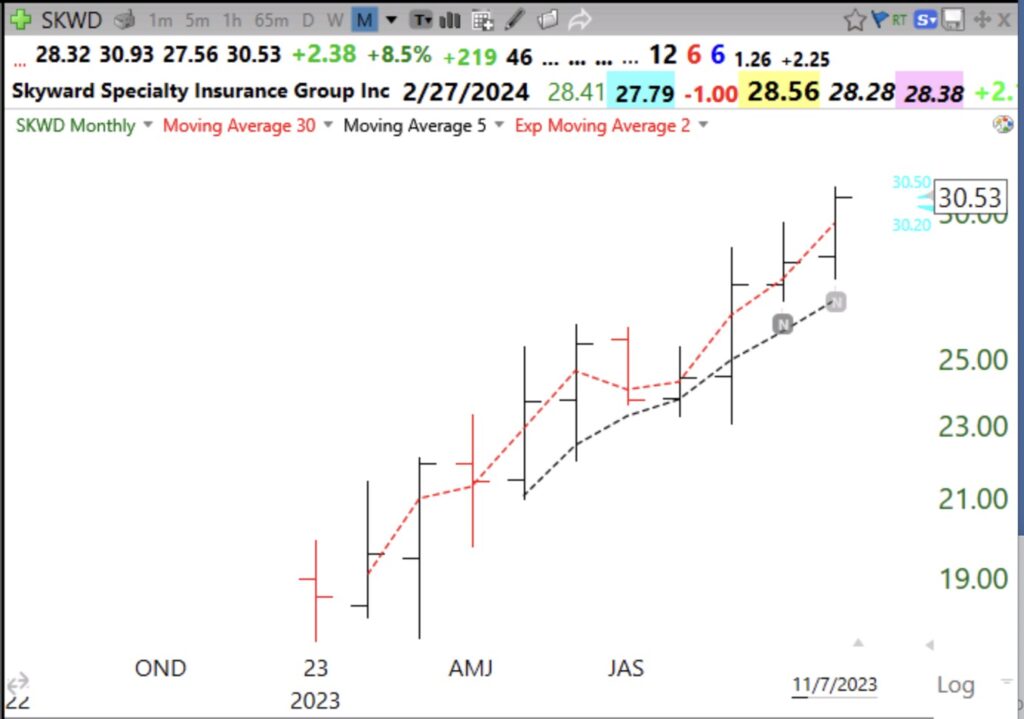

I tweeted out intraday Tuesday when SKWD gapped up to an ATH after releasing earnings. You might follow my tweets, @WishingWealth. Note the volume, which was reflected in TC2000 by the volume buzz. The monthly chart shows that it was a recent IPO.

It has not consolidated long enough to form a green line top. Earnings are expectewd to be up 71% in 2023 and it has an IBD comp rating=98. The “Ns” represent days I recorded a note in TC2000 after a purchase.