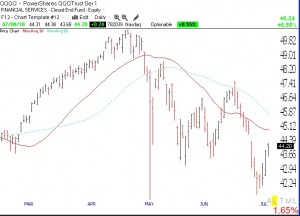

The down-trend continues for now. We have had a bounce up from the bottom of the 8.6% decline in the QQQQ that began on June 21. That decline took the QQQQ to a closing low below the closes on the day of the flash crash and the two subsequent declines in May and June. Now we have to wait to see how far this bounce can go. If it stalls out before the June 21 peak (at the 50 day average, dotted green line), the next decline could be quick and furious. On the other hand, if the rally can surpass that peak, we could get a new up-trend. For now, the daily and weekly trends remain down. Click on chart below to enlarge.

Was Wednesday a follow-through day for a new up-trend? Pension now 100% cash

IBD said tonight that Wednesday’s rally was a follow-through day on a new market up-trend. William O’Neil, publisher of IBD and successful trader, has written that all market bottoms come after a follow-through day. However, not all follow-through days succeed. According to my criteria, we are a long way from a change in trend. Yes, we got a bounce from a very oversold condition, with the stochastic on the major index ETF’s near zero. We will just have to wait to see if this rally has legs. For now, Wednesday was the 8th day of the current QQQQ short term down-trend. The GMI remains at zero, but the more sensitive GMI-R moved up to one.

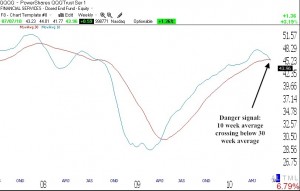

I may be wrong, but today I moved the rest of my university pension funds from mutual funds to a money market fund. I was hoping for a rally that would allow me to sell out at a higher level, and seized the opportunity today. If I am wrong and the major indexes resume an up-trend, I will move back into stocks, but it will take a strong up-trend and a GMI reading above 4 to convince me. Take a look at the bearish signal in the weekly chart of the QQQQ below (click on chart to enlarge), where the 10 week average (blue) is crossing below the 30 week average (red). In an up-trend the reverse happens.

You can catch my next Worden webinar on August 24 at worden.com. My first webinar is also stored there, scroll down to “A word from the professor.” Contact me at: silentknight@wishingwealthblog.com

7th day of QQQQ short term down-trend; WDC–a good short?

The QQQQ short term down-trend completed its 7th day on Tuesday. I remain mainly in cash with some short positions. I read a very interesting comment on the current debate on economic policy by David Brooks. I hope you like it. Meanwhile, all of my indicators are negative. It was so easy to make money on the long side when the GMI was 5 or 6 for so long. Now, I must refrain from taking on any long positions. Many key stocks look very weak right now. Time for me to be very defensive.

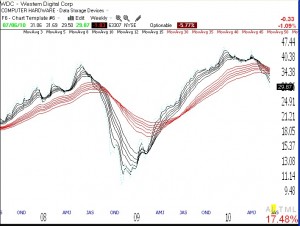

There were 107 stocks that came up in my submarine scan on Tuesday night. Below is one that has come up several times. The GMMA weekly chart for WDC below (click on to enlarge) shows that the short term weekly averages (black lines) are now crossing below the longer term averages (red). As a possible short, it is good to find a stock that was a prior leader (WDC quadrupled in 2009) and peaked about 4-6 months ago. The stock also has a lot of high volume spikes (not shown) on weeks in which the stock declined. These are all properties that might lead me to short a stock like WDC. What do you think? You can email me at: silentknight@wishingwealthblog.com My next Worden webinar is on August 24.