Friday is option expiration day. Tech stocks should rise early, in reaction to GOOG’s good earnings. The GMI and GMI-R remain at their maximum levels. Below is a daily chart of ARMH, which just bounced from its 30 day average after having an oversold stochastic reading. ARMH has been a strong RWB stock. If I bought ARMH, I would place a stop below the 30 day average just below the recent low, at 17.69. Click on chart to enlarge.

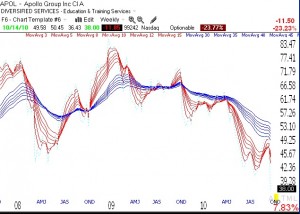

Meanwhile, APOL fell 23% on Thursday. Given that it was a BWR stock, are we surprised?