Stocks on my recent IBD/MS watchlists, sorted by last column, close /close 250 days ago. KGS was a recent IPO in 6/23.

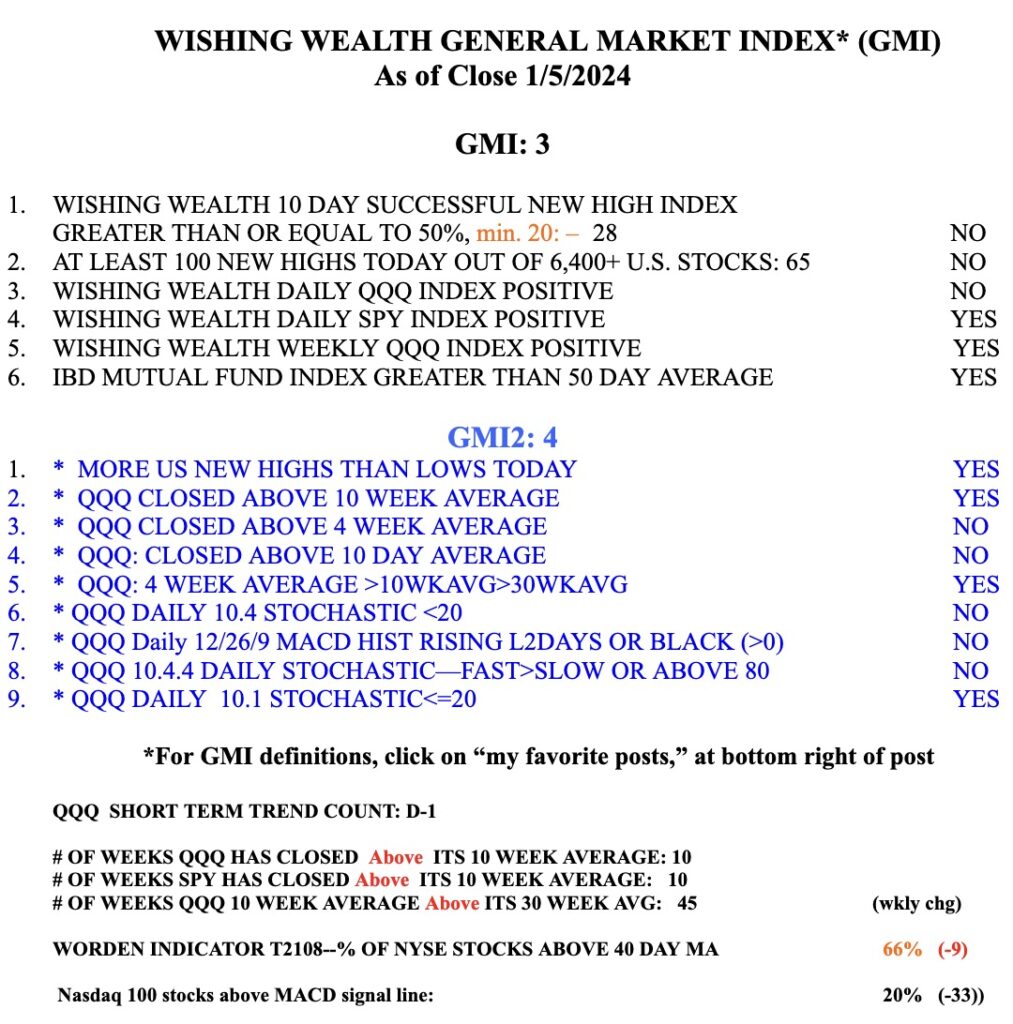

The GMI, at 3, still signifies a longer term up-trend. However, within this up-trend, QQQ has begun a short term down-trend. About 40% of these short term down-trends end within 5 days. If QQQ’s short term down-trend persists I may gradually accumulate some SQQQ.