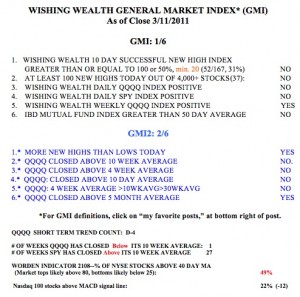

The key to profiting in the stock market is to be in long positions during up-trends and on the sidelines or short during down-trends. Because the longer term trend of the market remains up, I keep my university pension funds invested in mutual funds. However, in my shorter term trading accounts, I refuse to stay in the market during times like these. The GMI is registering 1 (of 6) and the new GMI2 is 2 (of 6). With most of my market indicators negative, the odds are against my making money on the long side. One more day of the down-trend, will provide more evidence of the staying power of the down-trend. Once a down-trend extends for 5 days, it often continues (see below). The QQQQ (Nasdaq100 index ETF) closed below its 10 week average on Friday, after staying above it for 26 straight weeks.  This is a significant breakdown in the up-trend that began in September. The SPY (S&P500 Index ETF) is sitting right on its 10 week average and therefore reached week 27 above its 10 week average. I have found that when the QQQQ closes below its 10 week average, I am unlikely to make money buying tech stocks. It does not mean that the market will enter a long down-trend, only that the odds have shifted against going long. Similarly, the IBD Mutual Fund Index is now below its 50 day average for the first time since this rally began in September. When these growth mutual funds do not do well, neither will I. That is why this index is one of the components in the GMI. Only 22% of the Nasdaq 100 stocks closed with their MACD above its signal line, another sign of short term weakness. And the Worden T2108 Indicator is 49%, in neutral territory. I look for the T2108 to fall below 20 to signal that a market decline may be near an important bottom.

This is a significant breakdown in the up-trend that began in September. The SPY (S&P500 Index ETF) is sitting right on its 10 week average and therefore reached week 27 above its 10 week average. I have found that when the QQQQ closes below its 10 week average, I am unlikely to make money buying tech stocks. It does not mean that the market will enter a long down-trend, only that the odds have shifted against going long. Similarly, the IBD Mutual Fund Index is now below its 50 day average for the first time since this rally began in September. When these growth mutual funds do not do well, neither will I. That is why this index is one of the components in the GMI. Only 22% of the Nasdaq 100 stocks closed with their MACD above its signal line, another sign of short term weakness. And the Worden T2108 Indicator is 49%, in neutral territory. I look for the T2108 to fall below 20 to signal that a market decline may be near an important bottom.

So, if this is not the time to be long, what can one do, other than to sit in cash? The answer is to short individual stocks in a margin account, buy put options , or buy inverse index ETF’s that rise when the market declines. I have been writing about inverse ETF’s lately. My favorite is QID, which aims to rise 2x as much as the QQQQ declines. But there are a number of other ultra inverse ETF’s to buy to bet on a market decline.  I ranked all of the 3X ETF’s in a watchlist I created using the new TC2000 software, according to how well they performed in the period from the recent peak of the QQQQ on 2/16 through Friday’s close on 3/11, a time during which the QQQQ declined -4.06%. The top 10 gainers during this period of a declining market rose between +15.5% to 7.02%! (Click on table to enlarge.) So this is how one might profit from a declining market. However, please note that one must quickly exit from one of these ultra inverse ETF’s when the down-trend ends. What goes up 3X as fast declines 3X as fast. For those students participating in the virtual trading contest (UMDSMC), you might want to buy some of these ultra inverse ETF’s in stages, only adding to your position if the decline in the market continues. Working backward from the current 4 day decline, the length of recent declines, according to the way I define them, has been: 2,3,2,16,4,12,29 and 19 days, respectively. Note that none of the declines that reached 5 days lasted fewer than 12 days…..

I ranked all of the 3X ETF’s in a watchlist I created using the new TC2000 software, according to how well they performed in the period from the recent peak of the QQQQ on 2/16 through Friday’s close on 3/11, a time during which the QQQQ declined -4.06%. The top 10 gainers during this period of a declining market rose between +15.5% to 7.02%! (Click on table to enlarge.) So this is how one might profit from a declining market. However, please note that one must quickly exit from one of these ultra inverse ETF’s when the down-trend ends. What goes up 3X as fast declines 3X as fast. For those students participating in the virtual trading contest (UMDSMC), you might want to buy some of these ultra inverse ETF’s in stages, only adding to your position if the decline in the market continues. Working backward from the current 4 day decline, the length of recent declines, according to the way I define them, has been: 2,3,2,16,4,12,29 and 19 days, respectively. Note that none of the declines that reached 5 days lasted fewer than 12 days…..