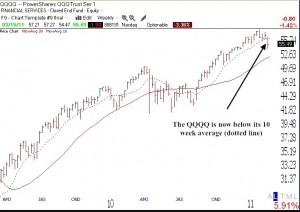

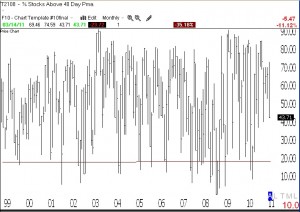

The down-trend continued and the T2108 fell to 28% on Wednesday, not far from the area where bottoms occur. I remain in cash and in QID until the trend turns up. With the T2108 near oversold territory this is not the time for me to add to my short positions.

By the way, LULU, which I have written about several times, has held support during this decline. Note the daily chart below. (Click on chart to enlarge.) Prior resistance level (note the horizontal line) has now become support, just below $74. To me, any stock in a strong up-trend that held during the recent decline has shown high relative strength and is therefore very promising. When the market strengthens, LULU may take off. LULU reports earnings on Thursday, March 17th.