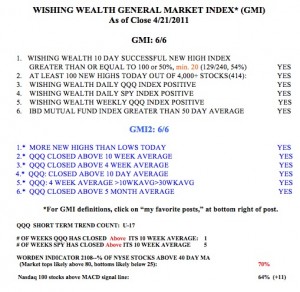

Unable to post today, GMI still at 6. 18th day of QQQ short term up-trend.

16th day of QQQ short term up-trend

Well, we all know now that the bounce off of support by AAPL earlier this week was for real. The up-trend continues….. Markets are closed Friday.