Blog Post: Day 4 of $QQQ short term up-trend; 124 US new highs, 7 lows and 61 at ATH; see list of 10 stocks that doubled from a year ago and reached an ATH last Friday

These stocks are at least 2x their closing price a year ago, as shown in the last column. VRT is 4.1x its price a year ago. Nicolas Darvas and David Ryan liked to buy stocks that have already doubled in price. A stock that has already doubled is likely to be capable of going much higher. As with people, a stock’s past behavior can suggest its future behavior. Look at the GLB tracker table on this site to see evidence that stocks that break out to an ATH can move higher.

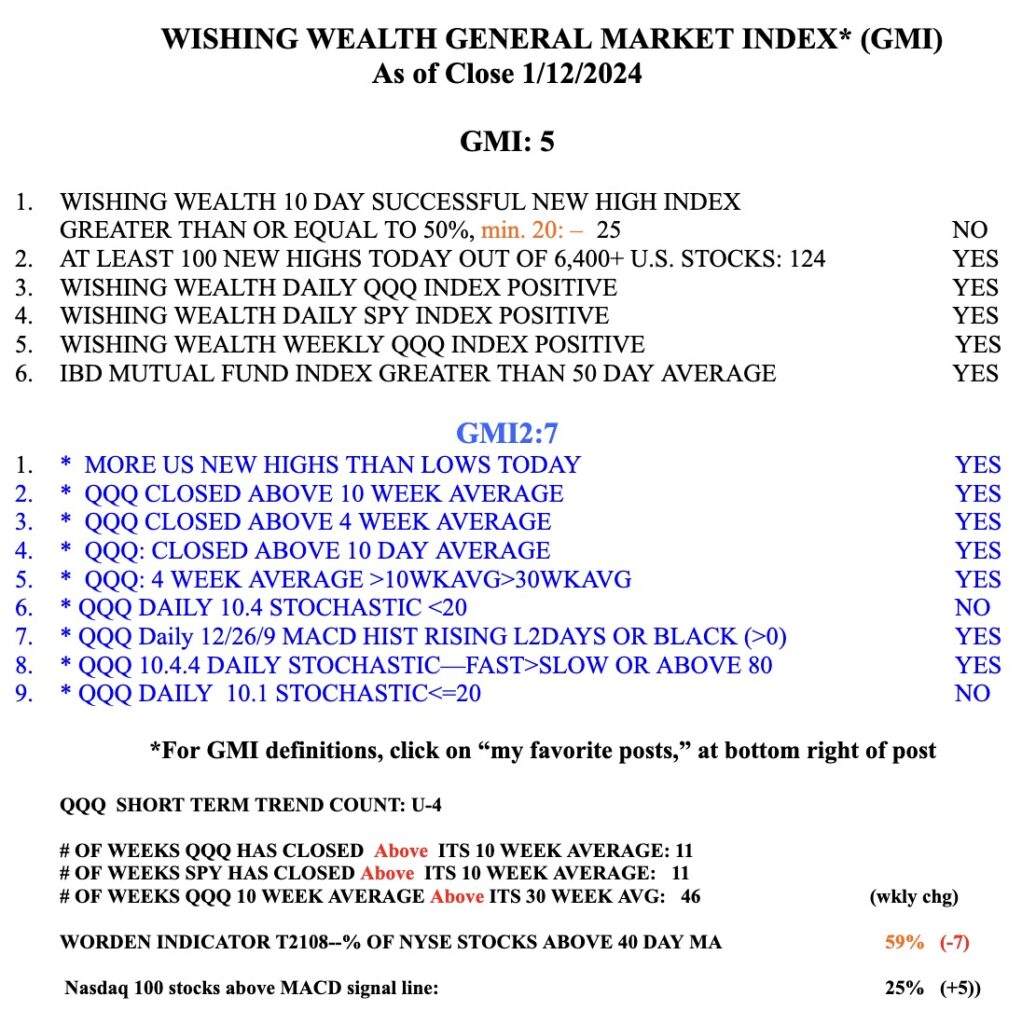

The GMI is Green and is at 5 (of 6). The GMI measures the longer term market trend. My separate QQQ short term trend indicator is also rising and is at day 4 (U-4). The market often rises when earrings are released. That means the rest of January could be strong. But I prefer to react primarily to what is currently happening rather than to anticipate future market behavior. 79% of the Nasdaq 100 stocks closed Friday above their critical 50 day averages. I own some TQQQ.