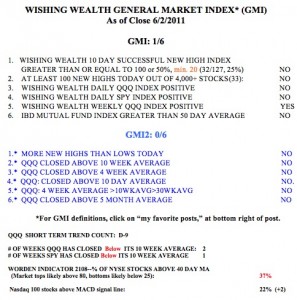

The GMI has come back to zero for the first time since last year’s correction/decline ended in August. This doe not mean that we have hit the end of the decline. The GMI was at or near zero a lot of the time between May and August, 2010 before the beginning of the September to February rise. The T2108 is now at 30%, last August it got as low as 38% but in May it got as low as 10%. So we are not at an extreme oversold level yet on T2108. In addition, the latest Investors Intelligence poll only shows 20% bears, a low level. Bottoms occur at much higher levels of bearish sentiment.

By my definition, the QQQ short term down-trend just completed its 10th day. There were 5x more new lows than new highs on Monday in my universe of 4,000 stock (80 to 15). I am therefore mostly in cash and expect my put protected long positions to be assigned at options expiration. The people who sold me put options for a few dollars will have to buy my shares from me at the strike prices of the options which are considerably above the current prices of my stocks. It is time for me to sit patiently on the sidelines and wait for the GMI to recover to 4 or more before I go long again. If I were prone to more aggressive trading, I would have begun to accumulate QID when the short term trend turned down.