Comfortably in cash on the sidelines.

No one knows when this market will bottom

Once a decline begins, no one, including all of the media pundits, can accurately predict the bottom. It is up to every person to determine his/her acceptable level of risk. Contrary to the prevailing media wisdom, one does not have to stay in the market all of the time. One can get out and wait for an up-trend to emerge. The often cited studies that say that one ‘s portfolio underperformed if s/he were out of the market during the days with the largest gains fail to note that one did the best if s/he was out of the market during the days with the worst declines!

I think it is possible to time the market. People also say that once you get out you will miss the bottom and some of the subsequent rise. Hogwash! If I get out of a mutual fund at say, 80, and it falls to 60, as long as I get back in before it goes back above 80, I have managed the risk and done well. And maybe I will get back in around 70 and come out way ahead. I have not exited my university pension mutual funds because of their unacceptable rules against market timing. However, if I were in mtual funds or better still, exchange traded funds which I could trade at will, I would have taken some money off of the table by now.

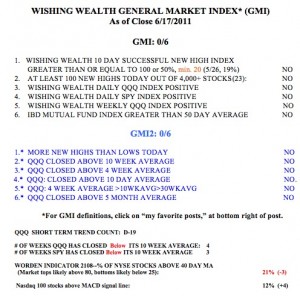

The technicals are terrible, as reflected in the GMI and GMI2 both registering zero. My trading account doubled since I went back into the market last September at the beginning of the multi-month rally. On September 7, the GMI reached 5 and began a long stream of 5’s and 6’s. Think how well I could do if I only stayed in the market when the GMI was strong! So, I did give up some of my gains as the GMI weakened, but my trading account is still up about 70% since last September. My trading gurus, Darvas and Livermore, used to say that no one forced a person to be in the market and one should only go in when the conditions look favorable. And they couldn’t look much worse right now.

The GMI and GMI2 are both zero out of 6. All of my short and long term indicators are negative. I do not try to interpret how political and economic events might affect the market.  If the reasons for the market’s movements typically become evident after the move, it makes sense to focus on the movement of the market and to not attempt to read the tea leaves. So, almost all of my indicators are designed to discern the current trend of the market. Once I know that, the correct strategy becomes clear to me. The QQQ short term down-trend has now lasted 19 days, but we had a 29 day decline in June, 2010, and a 69 day decline in December, 2008. If we are at D-19 now, it could continue for a while.

If the reasons for the market’s movements typically become evident after the move, it makes sense to focus on the movement of the market and to not attempt to read the tea leaves. So, almost all of my indicators are designed to discern the current trend of the market. Once I know that, the correct strategy becomes clear to me. The QQQ short term down-trend has now lasted 19 days, but we had a 29 day decline in June, 2010, and a 69 day decline in December, 2008. If we are at D-19 now, it could continue for a while.

However, I do have an indicator that gives me some idea of how oversold the QQQ is now, relative to other recent declines. The chart below of the weekly 10.4.4 stochastic suggests to me that the current decline is approaching the severely oversold levels seen at other recent market bottoms, even during the 2008 debacle. Note that the fast stochastic line (black) in the bottom panel is almost below the horizontal line designating 20%.(Click on chart to enlarge.) However, other big declines ended below the 20% level. So, we may have more to go on the downside. But for me, this is not the time to begin to go short. Then again, no one knows for sure.

18th day of QQQ short term down-trend; options to expire

All of my indicators are negative. I will be 100% cash in my trading accounts after option expiration this weekend. All of my put protected positions will be assigned at higher prices (the original strike price) to persons who sold me the puts. T2108 is at 19%, heading towards the extremely oversold area where bottoms occur. If it gets into single digits, I will look for a bottom.