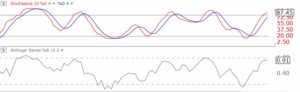

Daily stochastics for DIA, QQQ and SPY all above 90. With the indexes so overbought, it is possible we will get some retracement soon.

2nd day of QQQ short term up-trend; many stocks extended short term

A lot of stocks (63% of Nasdaq 100 stocks) have their stochastics in overbought territory. While I want to wade into this market, I think it best to wait a few days to see if the market retraces a little. The QQQ daily chart below shows the 10.4.4 stochastic at 87% and that this index is nearly touching the upper Bollinger band, at 91%. Both of these statistics are at levels where the index has topped out short term. Click on chart to enlarge. The SPY and DIA are showing similar extreme readings on these statistics.

GMI and GMI-2 each reach 4; IBD still sees correction but QQQ begins new short term up-trend

The GMI rose to 4 and I can now start to look at going long, but slowly. Tuesday was the first day of the new QQQ short term up-trend. There are just too many skeptics about this market. There are about 11% more bears than bulls in the Investors Intelligence poll and the market rarely plays to the majority. The 10.4.4 daily stochastics for the QQQ, DIA and SPY are all above 80%–overbought. This is the area where recent rallies have ended. So, I expect a retracement of the recent rise. The key to this market is whether the retracement takes back all of the recent gains or stops short and resumes the up-trend. If the rally resumes, I will have to get back into the market more quickly because I would expect a sharp rise. It is time to patiently wait to discern which way this market is going to go.

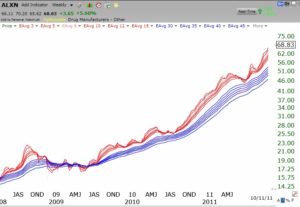

Meanwhile, ALXN hit another 52 week high on Tuesday. ALXN has a very nice chart as shown in this weekly GMMA chart. It has an RWB rocket stock pattern. Click on chart to enlarge.