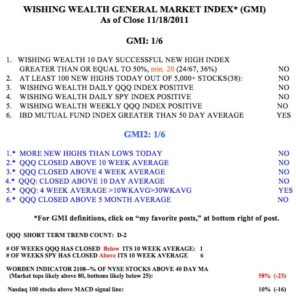

The GMI went to zero for the first time since October 7. The IBD Mutual Fund index is now below its 50 day average. It is good to be on the sidelines. Keep an eye on HITK–it came up in my DARVAS scan.

Another stock that came up in my Stage 4 scan is HLF, which just closed below its 30 week average (red line). It looks like HLF may have put in a double top. Note the heavy selling (red spike) three weeks ago. Click on chart to enlarge.