SMCI had a wonderful GLB on January 19 and rocketed higher. However, note the huge volume on the down day on Friday. This could reflect a similar overbought situation with other high flyers. Be careful. We have had a strong market during the release of 4th quarter earnings. I suspect we are likely to have some weakness into late March until first quarter earnings are upon us. For now, I have close sell stops on my positions. I am unlikely to add anything new now but will look to buy future oversold bounces on any significant market weakness.

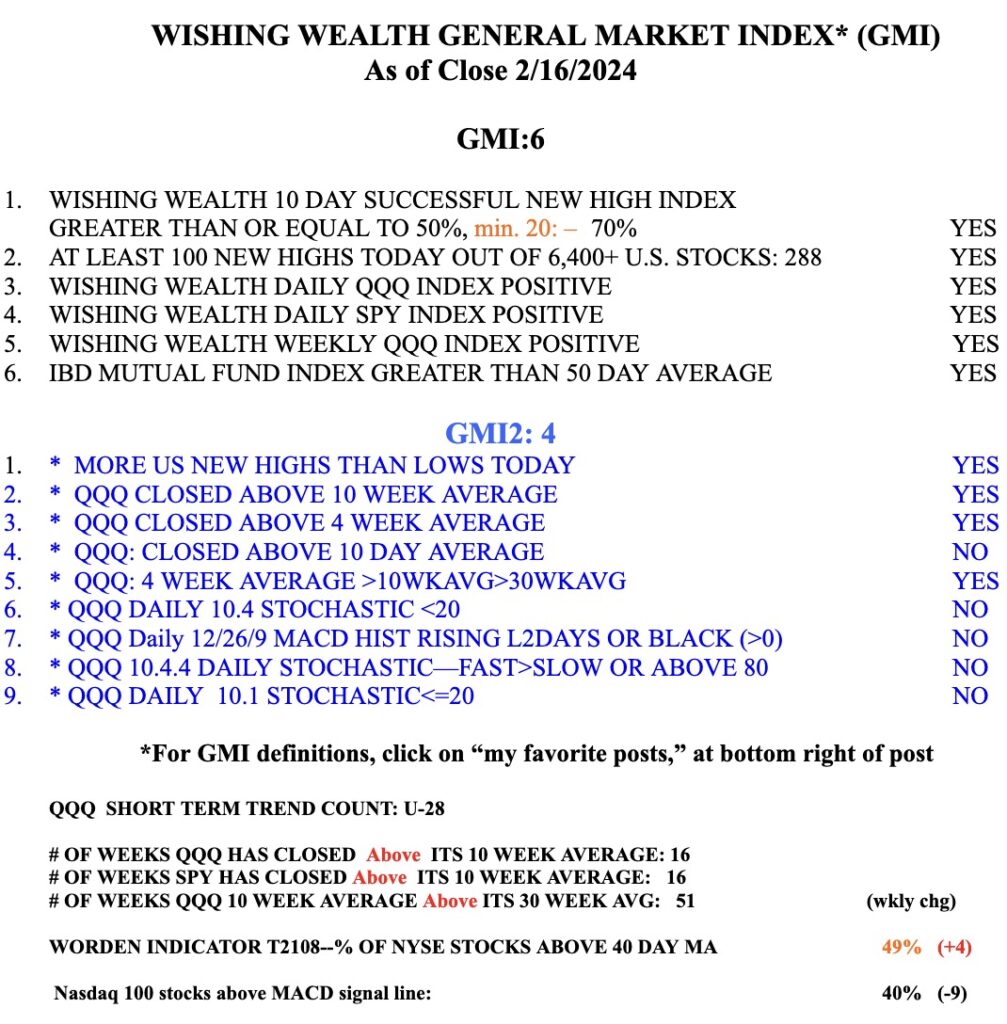

Blog Post: Day 26 of $QQQ short term up-trend; $UBER surges to ATH on above average volume after a successful GLB I posted about in mid January

On January 18 I said that UBER had finally closed above its February 2021 peak of 64.05 (its green line) to an ATH. After retesting the green line once it moved higher and took off today. UBER is in my GLB Tracker table and is 23.8% above its green line. Buying a GLB can work out! I tweeted this out intraday. Follow my tweets @wishingwealth