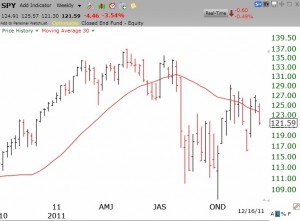

Friday was the 4th day of the current QQQ short term down-trend. Only 29% of the Nasdaq 100 stocks closed with their MACD above its signal line and both the SPY and QQQ have closed below their critical 10 week averages. I am in cash in my trading accounts and will start moving out of mutual funds and into money market funds in my university pension. The longer term averages appear to be continuing Stage 4 declines. The weekly chart of the SPY (S&P 500 ETF) shows it to be back below a declining 30 week average (red line). This is a very ominous pattern. The QQQ has a similar bearish pattern.

Only 29% of the Nasdaq 100 stocks closed with their MACD above its signal line and both the SPY and QQQ have closed below their critical 10 week averages. I am in cash in my trading accounts and will start moving out of mutual funds and into money market funds in my university pension. The longer term averages appear to be continuing Stage 4 declines. The weekly chart of the SPY (S&P 500 ETF) shows it to be back below a declining 30 week average (red line). This is a very ominous pattern. The QQQ has a similar bearish pattern.

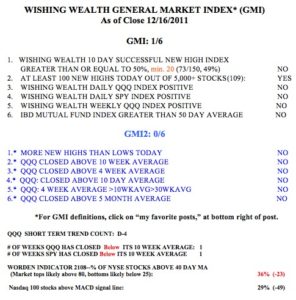

GMI back to 0 (of 6); hedged and in cash

With the GMI at 0, I am totally hedged and in cash. Another flat or down day will give me a second day with GMI less than 2, a major sell signal. I did not wait for this confirmatory signal to lighten up, however, because with the GMI at 0, I am ready to get defensive. I may start to transfer money in my university pension from mutual funds to money market funds. I do not like the current market pattern.