Short and longer term trends remain up.

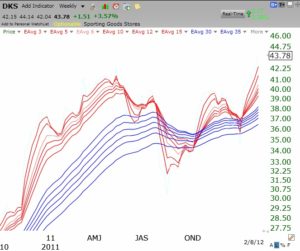

30th day of QQQ short term up-trend; RWB stock: DKS

There were 269 new highs and only 15 new lows on Wednesday. A stock with good fundamentals and hitting a new high is DKS. This weekly GMMA chart shows it to be an RWB stock breaking out of a base. Click on chart to enlarge.