LULU has recently broken to a new all-time high. Check out this monthly chart. Click on chart to enlarge.

44th day of QQQ short term up-trend; T2108 declining

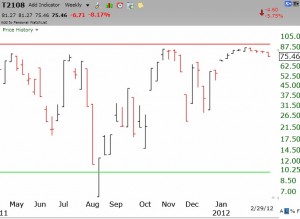

The gradual decline in the T2108 over the past 4 weeks (see weekly chart below) reflects weakening in the NYSE stocks. In addition, only 28% of the 5900 stocks in my stock universe advanced on Wednesday, and only 21% of the Nasdaq 100 stocks. Only 33% of the Nasdaq 100 stocks closed with their daily MACD above its signal line. Furthermore, the sudden collapse in gold and the many recent failed break-outs are flashing warning signs. It is likely that the post-earnings lull is beginning. I have cut my positions or hedged them by writing covered calls. AAPL looks extended to me and may sell off in advance of or just after the IPAD3 news is released next week. Be careful.