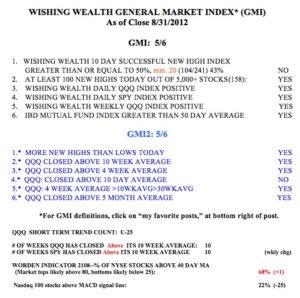

The GMI and GMI2 are each holding at 5 (of 6) and the last GMI signal was a Buy on July 30. Note, however, that only 22% of the Nadaq 100 stocks closed with their MACD above its signal line, a sign of short term weakness. I am a little concerned that we are in September, the worst month for the market. Let’s see if AAPL can lead the techs higher. Only three stocks came up in my new high with great fundamentals scan: CAB, TCBI, CCI.

24th day of QQQ short term up-trend

GMI and GMI2 have each declined to 4 (of 6). I have been raising stops and reducing exposure. I am wary of September, the weakest month.

23rd day of QQQ short term up-trend

The following 11 stocks came up in my new high + good fundamentals scan: SHW,DDS,CNQR,TFM,VAL,CYBX,TJX,SXL,SCBT,FRAN,ANN. Check them out for possible winners.