With just about all of the leaders having been shot down, it remains to be seen if the rest of the market will follow. In cash and short.

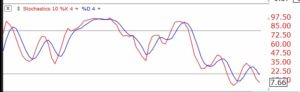

12th day of QQQ short term down-trend

I remain short and mainly in cash in my trading accounts. There were 122 new lows and only 47 new highs in my universe of 5800 stocks.