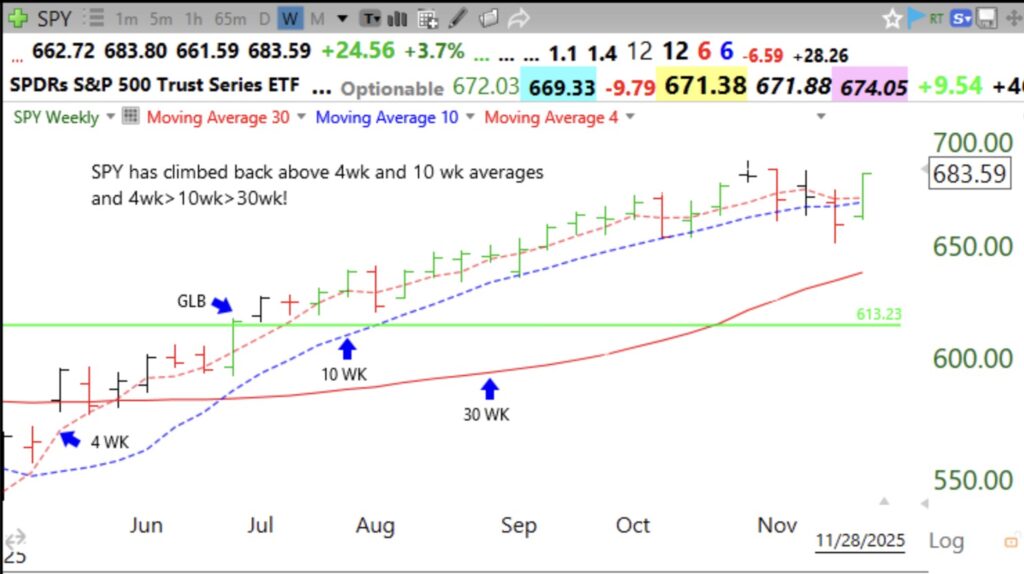

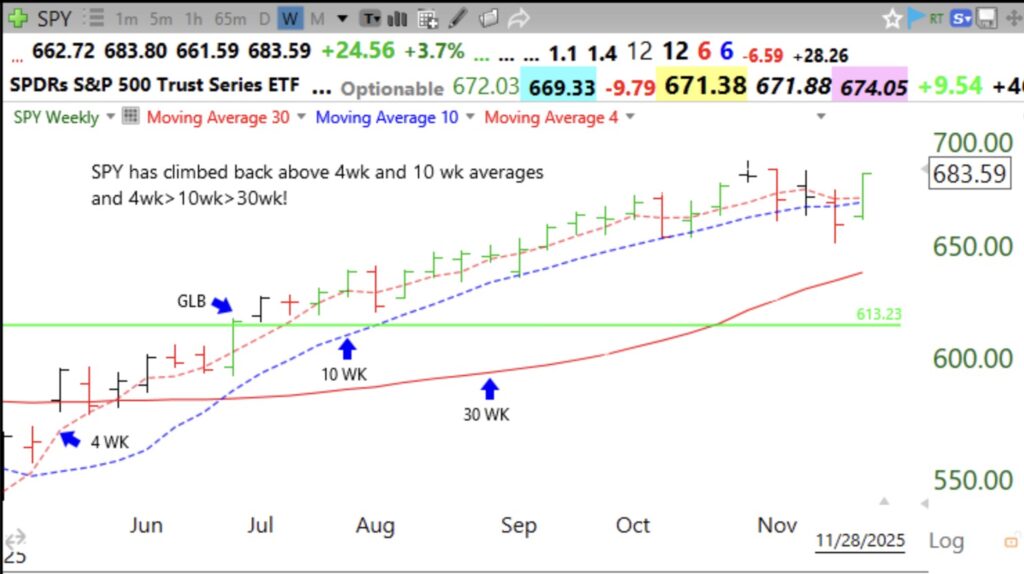

All averages are lined up on this weekly chart. Same as DIA and QQQ.

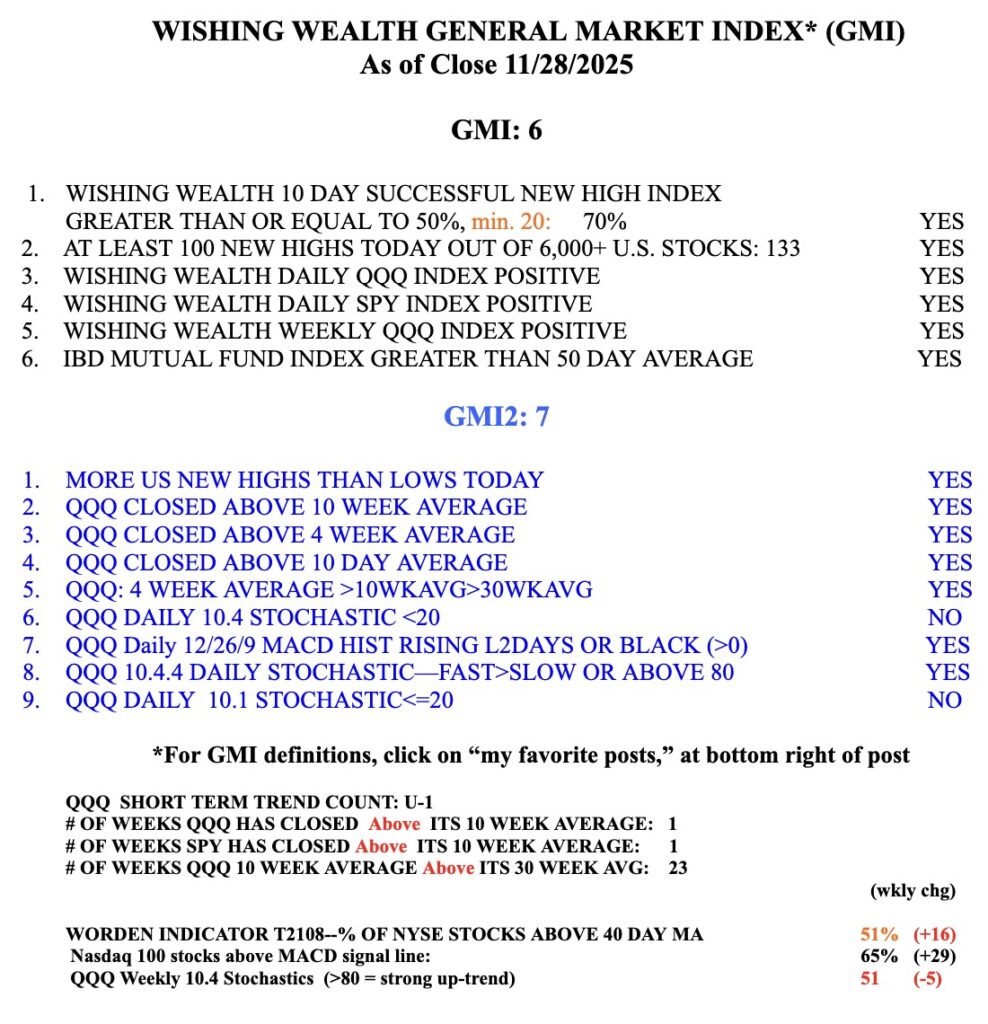

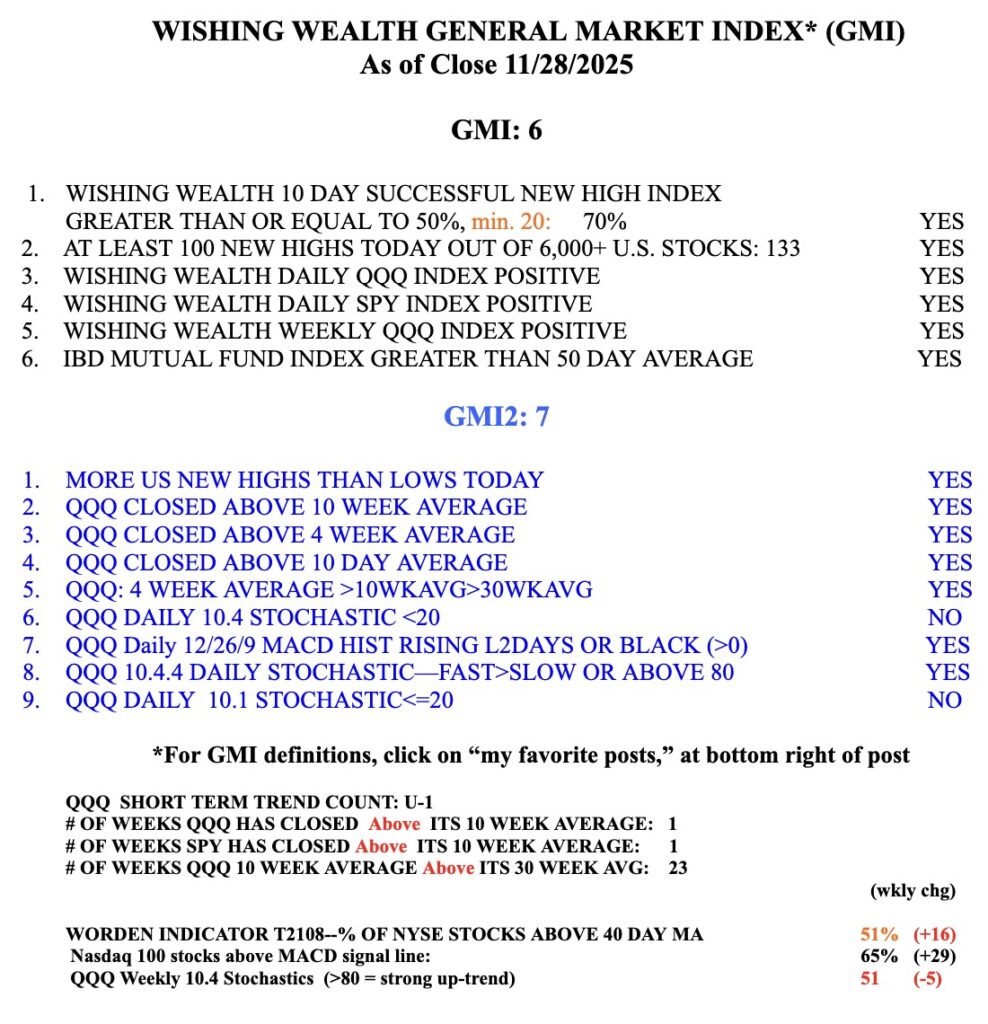

GMI=6 and GREEN!

Stock Market Technical Indicators & Analysis

All averages are lined up on this weekly chart. Same as DIA and QQQ.

GMI=6 and GREEN!

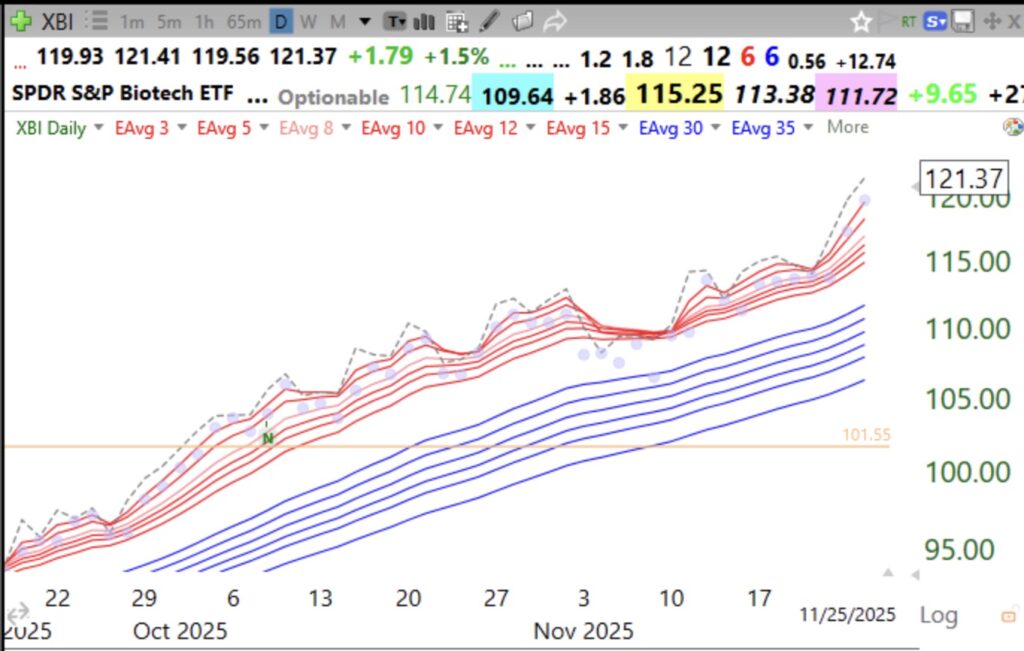

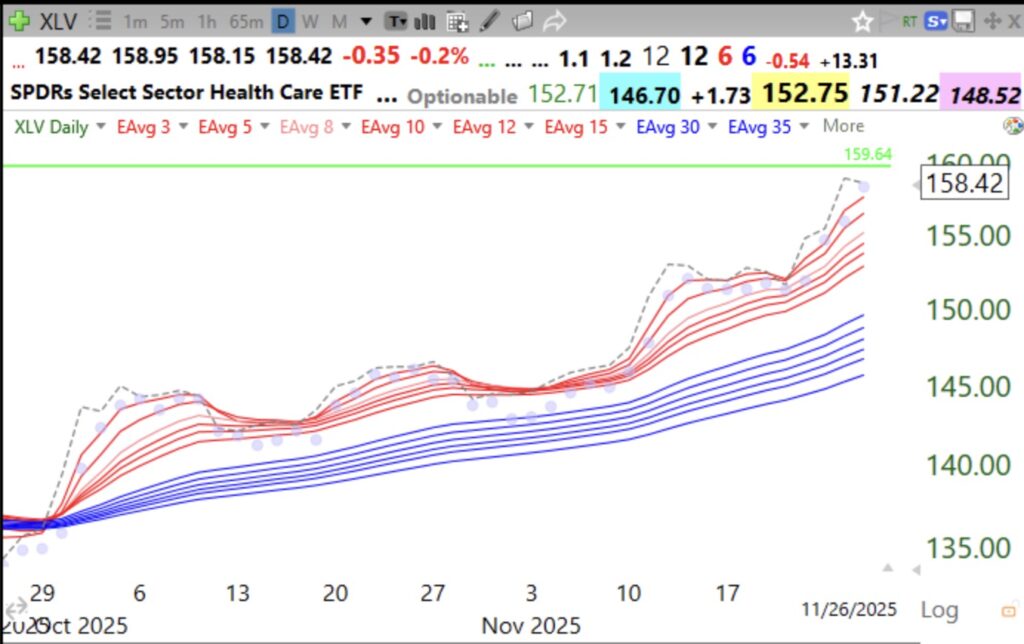

This may be related to the unusual strength in biotech ETFs. Check out XBI, BIB, LABU. IBBQ

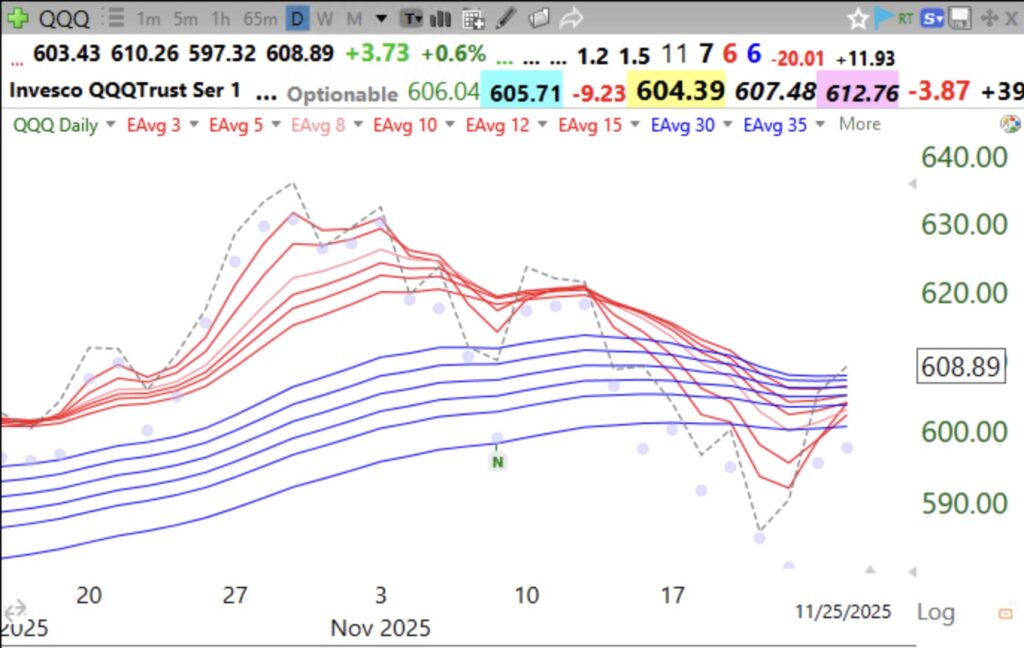

The dotted line is the daily close. It has now retaken all 12 of the short (red) and longer term (blue) exponential averages. Another strong day on Wednesday might turn the GMI GREEN. The QQQ short term trend remains down but could reverse later this week. The AI stocks have not recovered but many other stocks are strong. It could be that the overbought AI stocks are being shot first and the other stocks will fall after a brief rise to overbought. I sold my SQQQ and will buy TQQQ if the QQQ short term trend turns up. In addition, biotech stocks remain strong. Check out INSM and the biotech ETF, XBI, see its RWB up-trend in its Guppy chart below.