The key to prospering in the market is to have developed a set-up, defined by objective conditions which leads one to expect that a stock will rise almost immediately. The set-up must also suggests a price at which to set a stop loss to sell out with a small loss if the set-up fails. If the set-up is good, one will likely end up with a lot of small losses and a few big winners that more than make up for the losses. I ran a new scan on the Dow 30 and found that NKE came up. NKE has recently had a green line break-out (GLB) to an all-time-high (ATH). It bounced on Friday from an oversold position. If I bought this bounce I would immediately place a GTC stop order to sell, just below the bottom of the bounce, at 164.67. If the stock trades below this price then the set-up has likely failed and I would quickly exit with a minimal loss. This scan also ensures that all identified stocks are already in up-trends and have recently reached an ATH. Note the black dot signal too, one indicator of being oversold. I do not own NKE. This example is for educational purposes only.

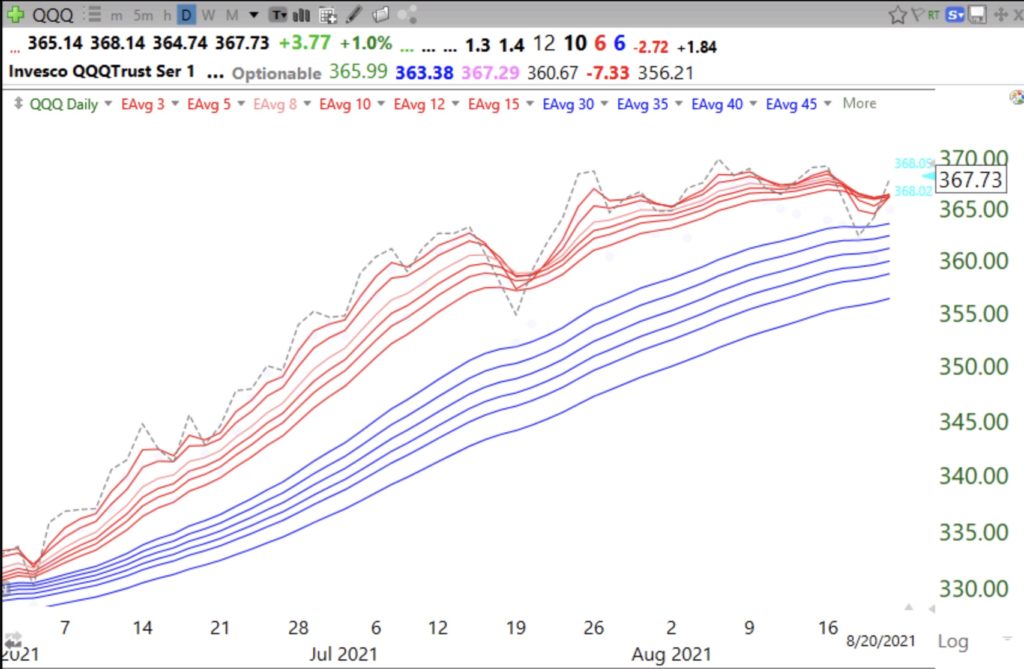

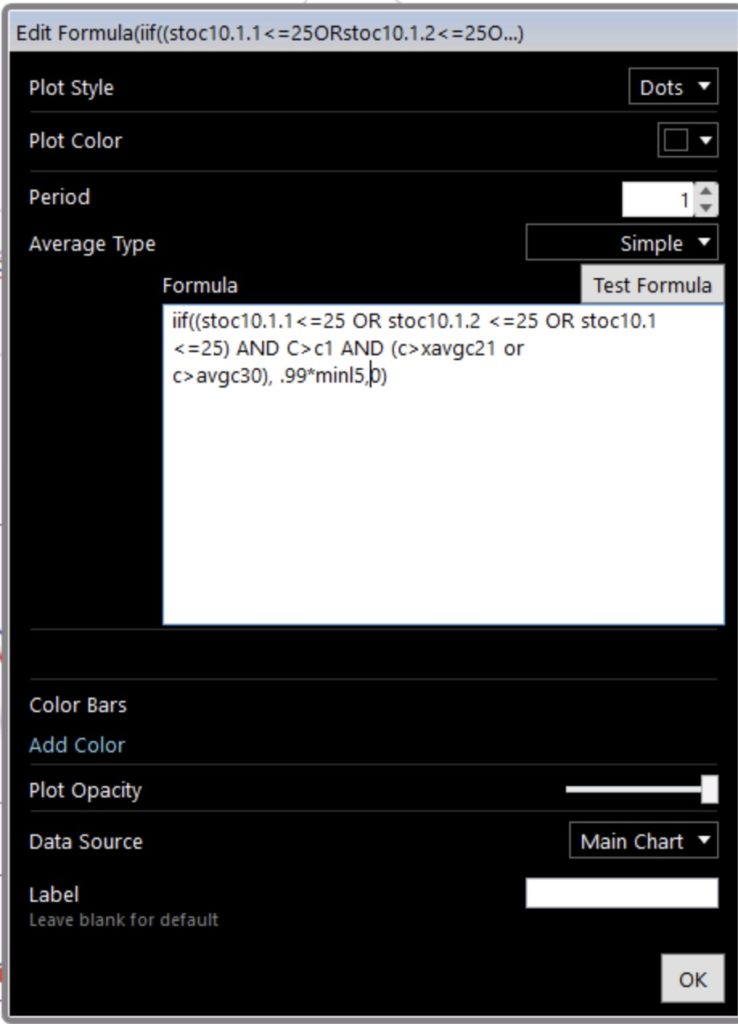

By the way, QQQ also was identified by this scan! Note the recent bounce up off of the lower daily 15.2 Bollinger band, one component of this scan.

QQQ has also closed (dotted line) back above all of the short term averages (red lines). Looking to buy TQQQ if it holds.

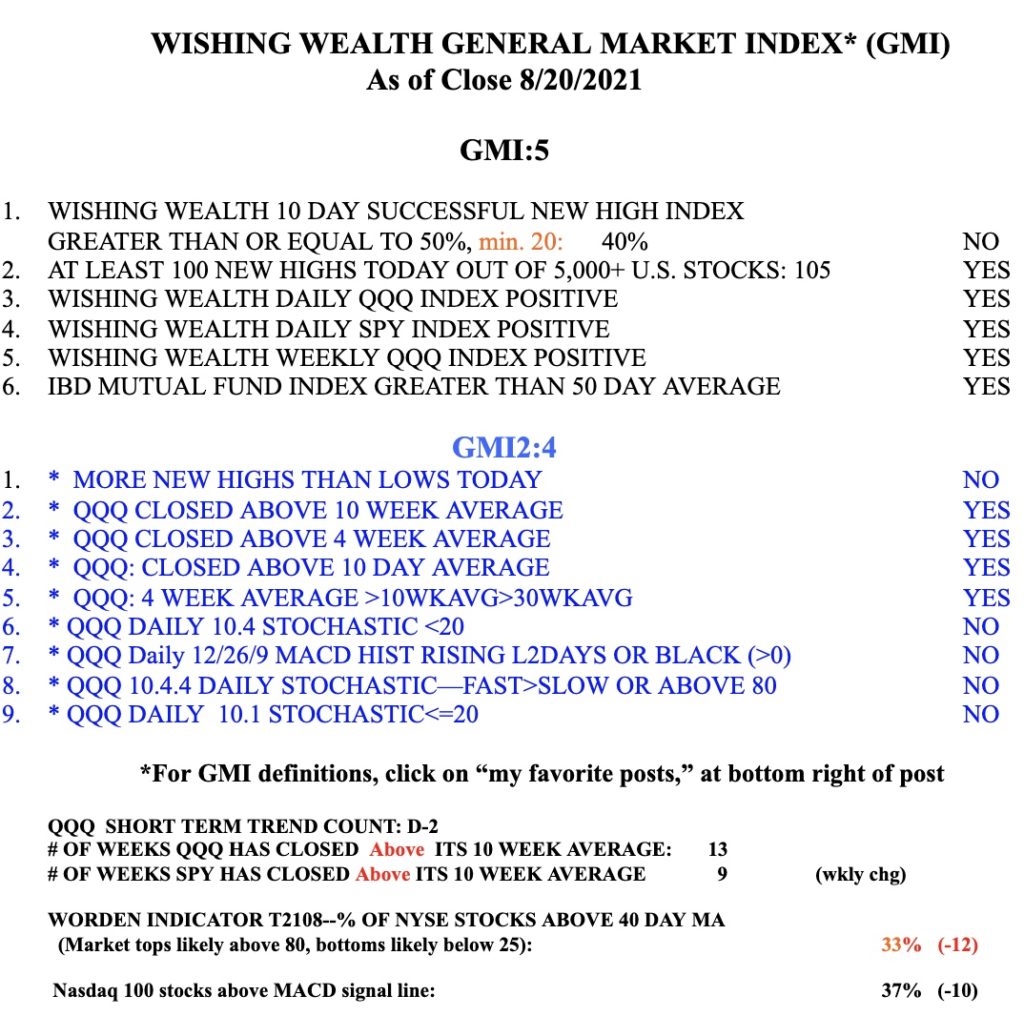

The GMI is at 5 (of 6) and on a continuing Green signal. My shorter term trend indicator, currently at D-2, may change to an up-trend after Monday’s close.