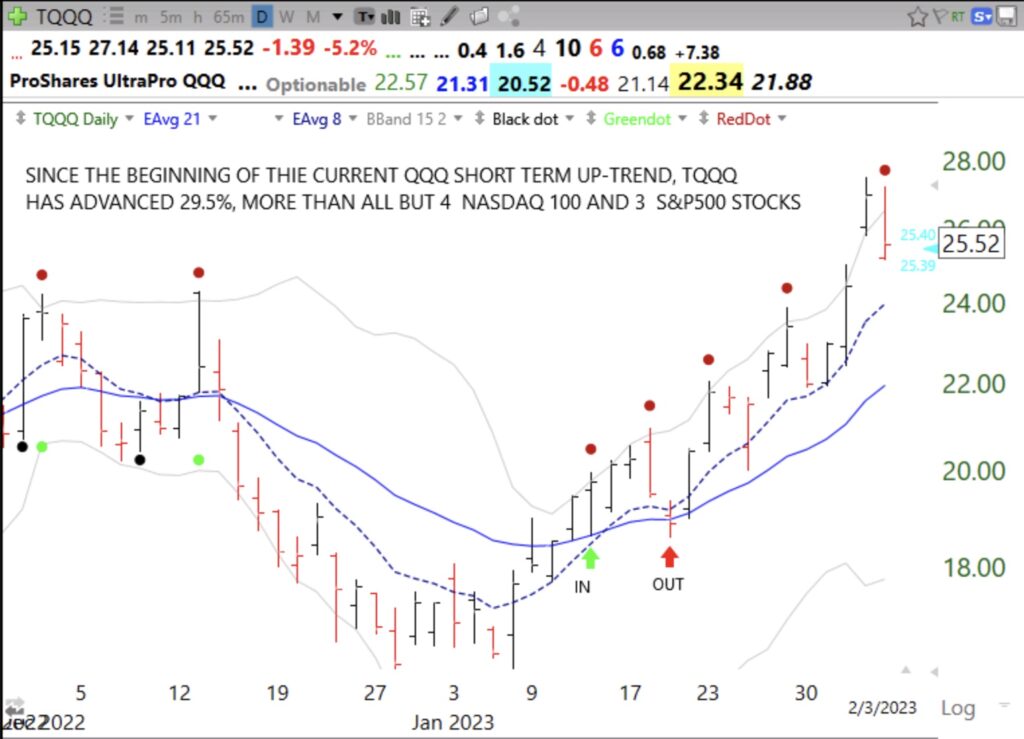

I confess I did buy some TQQQ at the beginning of the new QQQ short term up-trend (green arrow on chart) and posted about it, but allowed myself to get shaken out on 1/19 (red arrow) and did not buy back in. Not buying back in compounded my first mistake. I need to let my computer trade for me because I let myself be shaken out even though my objective rules said that the short term up-trend was still intact :-(. See the daily chart of TQQQ below.

TQQQ even beat all but 4 of the 668 stocks in my aggregate watchlist of recent IBD50 and MarketSmith Growth 250 stocks! If you search my blog on “TQQQ” you will find that I have replicated this analysis and found similar results for years. Maybe it just does not pay for me to try to find winning individual stocks when I can just buy the 3x leveraged ETF, TQQQ. By the way, I also found 16 leveraged ETFs that beat TQQQ! TSLL, CONL and KOLD were each up over 80%! Remember, however, these leveraged ETFs fall much faster than the underlying index or security when the trend reverses down, so you need a really good exit strategy, especially one better than mine!

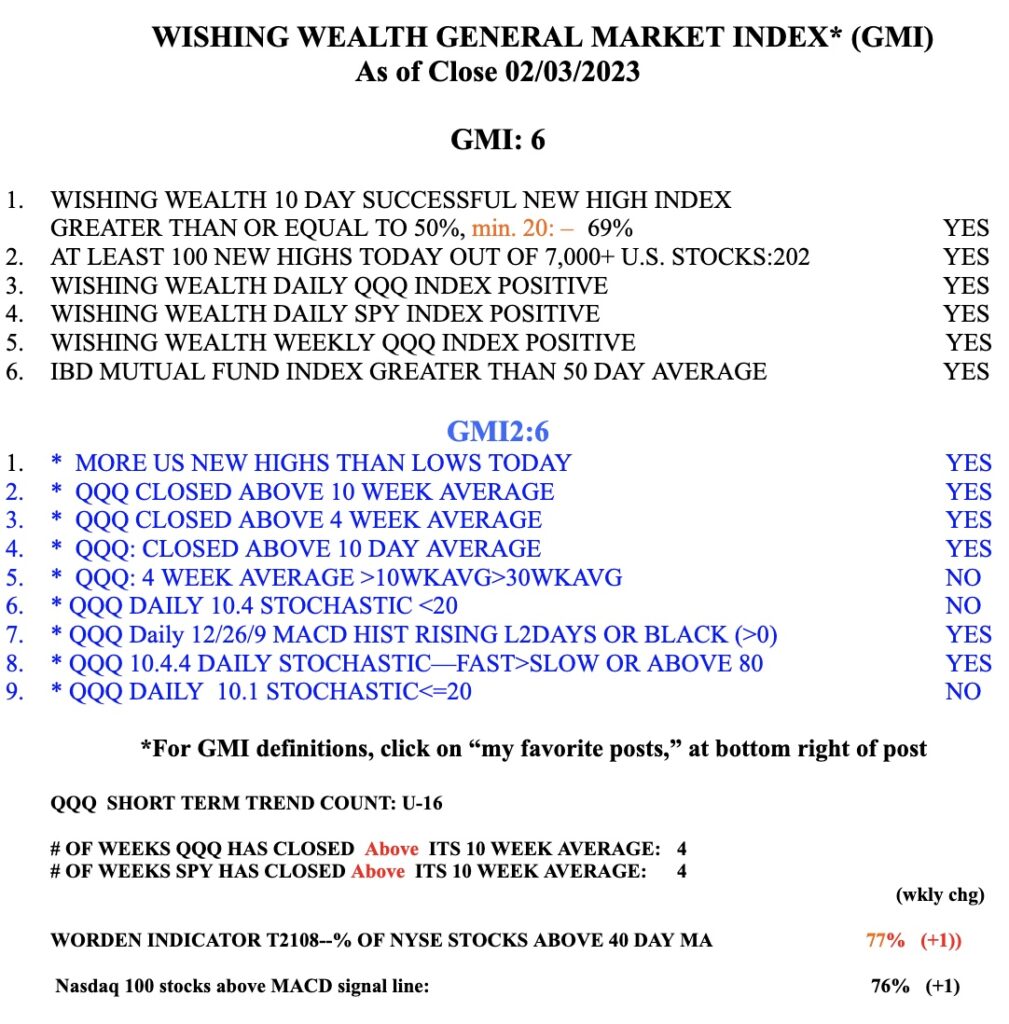

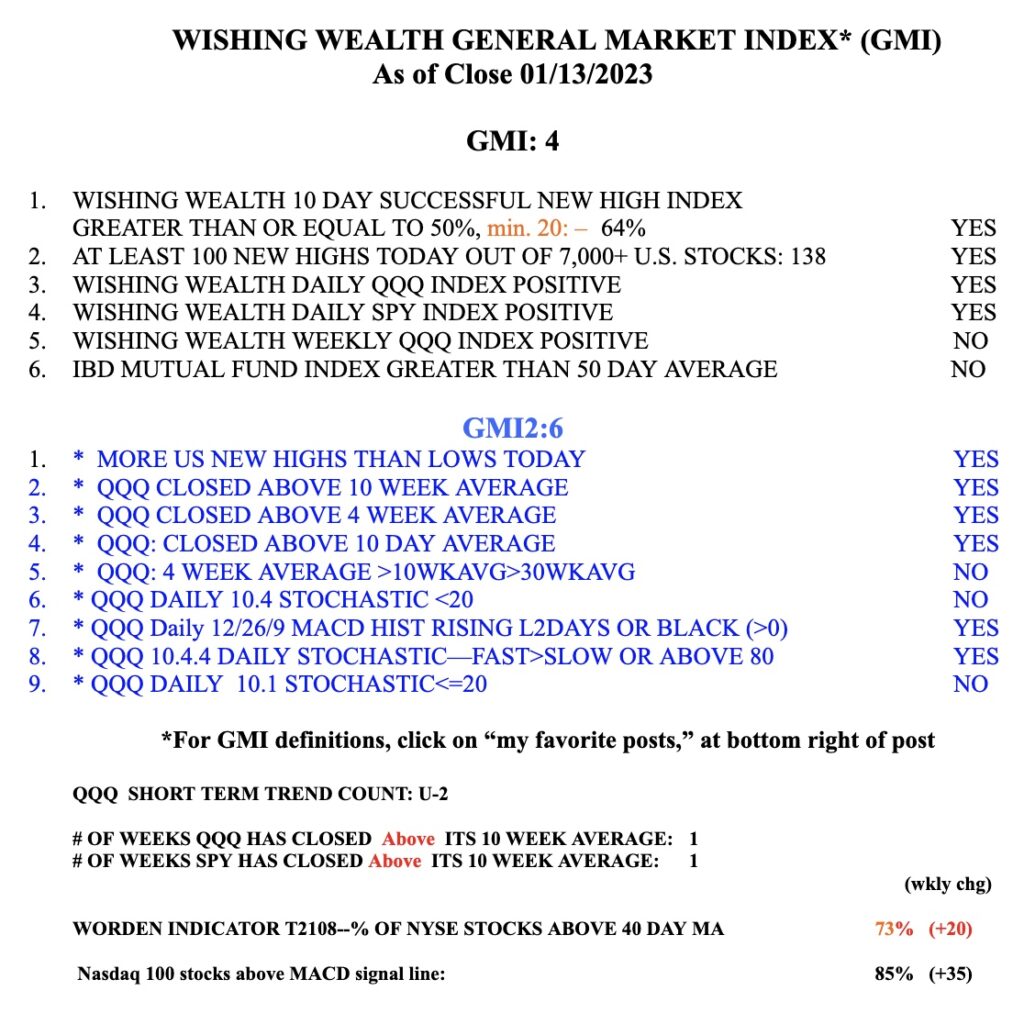

The GMI signal remains Green at 6 (of 6). It flashed Green at the close on January 13. I post my QQQ short term trend count in the table below and on each almost daily blog post.