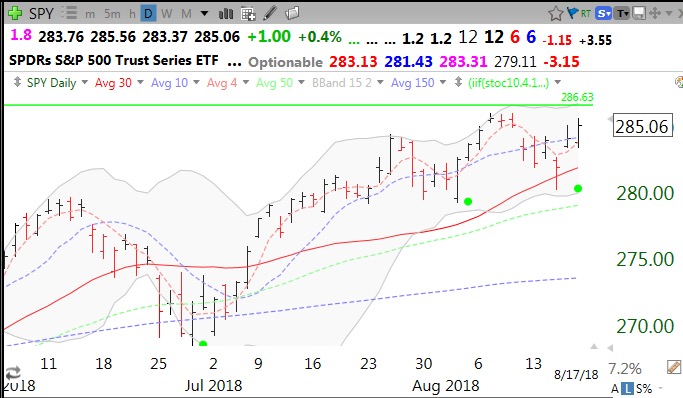

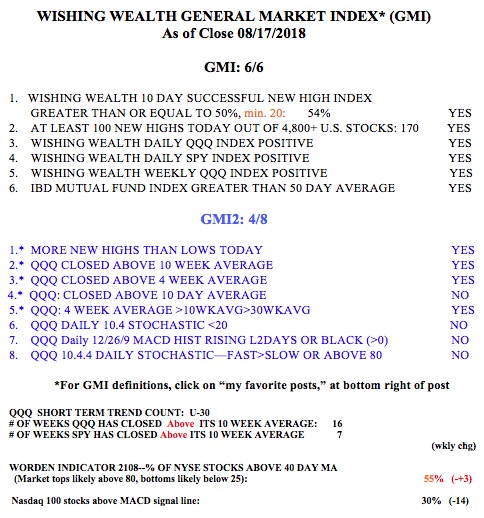

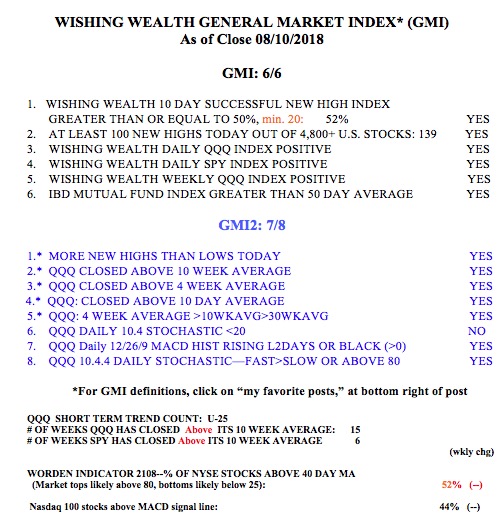

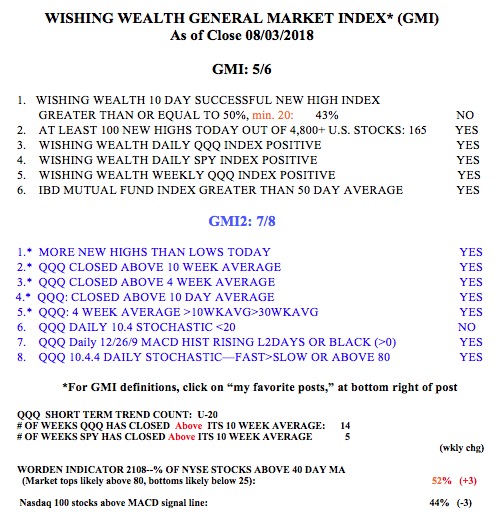

General Market Index (GMI) table

With GMI=6 up-trend is intact but rest of world markets look terrible

How long can the US market remain strong when most other world markets look terrible? Our tariffs are hitting them when they are already on their knees. Who will we sell to?

One example is this weekly chart of an ETF representing Germany–Stage IV decline!!! There are so many more world index charts with patterns like this.

And Japan:

And China:

But the U.S. may have hit a wall at its green line ATH last week?

16 Stocks with a Green Dot Bounce from Oversold

I prefer to buy up-trending stocks that have bounced from oversold levels and have resumed their advance. The green dot signal video tutorial, available at my TC2000 club, shows how I put a green dot on my daily charts. I ran this weekend a TC2000 scan that detected green dot stocks over $70 (I have more success with expensive stocks) that were recently very oversold. One of the 16 stocks that came up was CRM. Check out its daily chart below. Note the recent green dot and the bounce off of the rising 50 day average (green dotted line) and off of the lower Bollinger Band. CRM reports earnings on 8/28. Four prior green dot signals have worked for CRM but the signal can fail at anytime. A decline back below a green dot would be the spot for my stop loss or an exit point.

The other stocks that came up on this scan appear below. It will be interesting to see which of these stocks continue to rise. A lot depends on the general market’s trend. Note that I have not researched these stocks. This list is for educational purposes only and is provided to help others understand and evaluate this set-up. In late August I begin my course with 180+ university freshmen who will learn everything about technical analysis that I have learned since I was their age.

The GMI remains Green and at 5 (of 6).