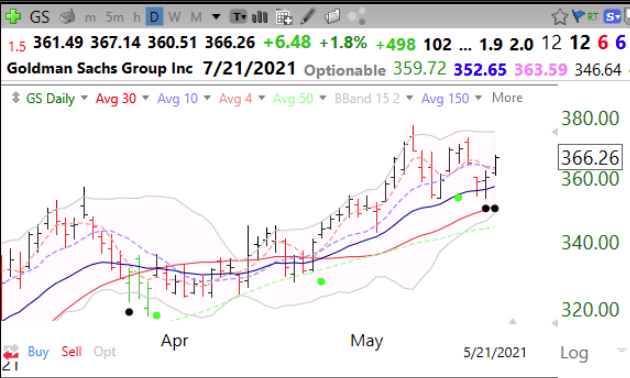

I revised my OSB scan. It detects stocks near a recent ATH that have bounced from an over-sold level. Here are two I think are promising as long as the bounce lows hold. Note the black and green dot signals. Did you know that GS has a PE=8!!! And GS has an IBD comp rating=98.

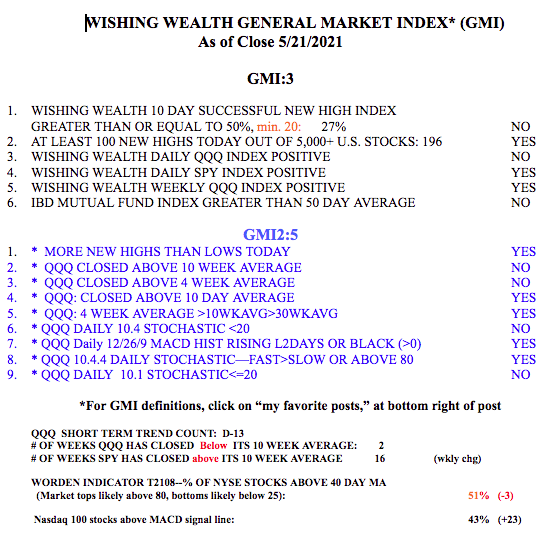

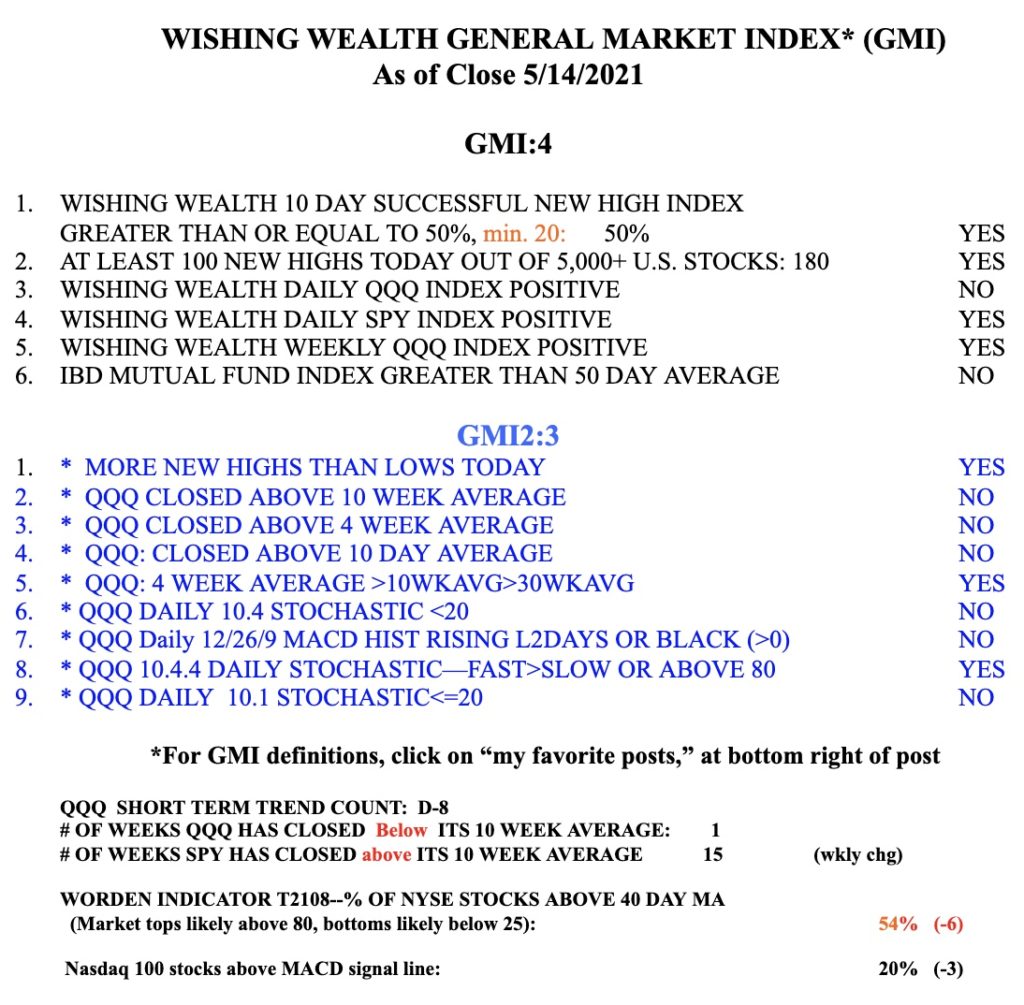

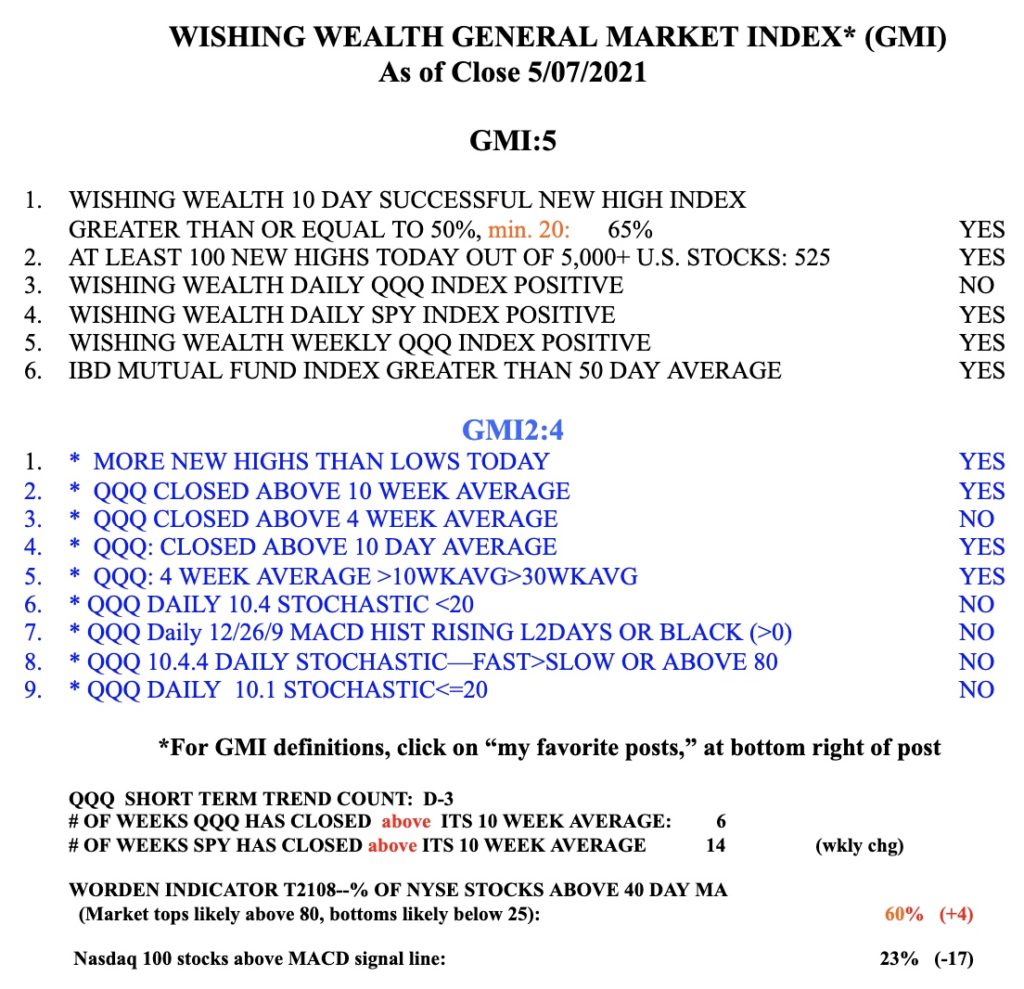

The GMI remains on a Red signal. Even though SPY and DIA are doing well, QQQ is weak. This is a very difficult time to be in the market profitably. Much easier to trade growth stocks when the GMI is Green and consistently registering 5 or 6.