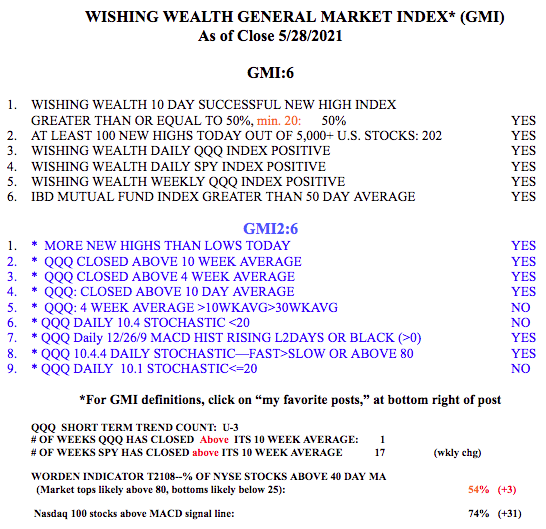

QQQ held on the edge of the cliff on Friday and the QQQ short term up-trend survived. Thus far, the Sell in May and go away theme has been more right than wrong. I was amazed to run a scan over the weekend for launched rocket stocks and to find only 1% ($GOOGL) among the Nasdaq 100 (the QQQ ETF) stocks, but 7% among the S&P500 stocks and 11% in my watchlist of 730 stocks that have been highlighted in the past on lists of promising stocks on investors.com or on the MarketSmith Growth 250 lists. This analysis showed me clearly that the QQQ type tech stocks have not been the place to find winning stocks. So this is why so many traders have opined on social media that this has been a very difficult “hard penny market” of late. Note that in the GMI table below I show that SPY has closed above its critical 10 week average for 18 straight weeks, compared with only the last 2 for the QQQ.

My extraordinary student, Richard Moglen, was introduced to technical analysis during my university honors course for undergraduates and has become passionate about stock trading and educating others. Richard’s youtube tutorials and interviews with accomplished traders are an invaluable educational resource and he has recently joined theTraderLion team. Richard will introduce me this Saturday to present at the TraderLion’s first annual trading conference. Experienced Portfolio Managers, Hedge Fund Managers, US Investing Champions, and Veteran Traders will share their insights at this live event. This free 2-day event will be streamed live on TraderLion’s YouTube channel youtube.com/traderlion on Saturday, June 12th and Sunday, June 13th. The presentation topics will range from entry setups to risk management and trading psychology. To stay in the loop visit https://www.traderlion.com/

TraderLion is dedicated to educating people about trading and I will be pleased to present some of the set-ups and concepts I have developed based on my experience with the trading and investing the past 50+ years. I will speak at 2:30-3:45 and hope to see you there. Please go to the TraderLion site above for more information about the event…..

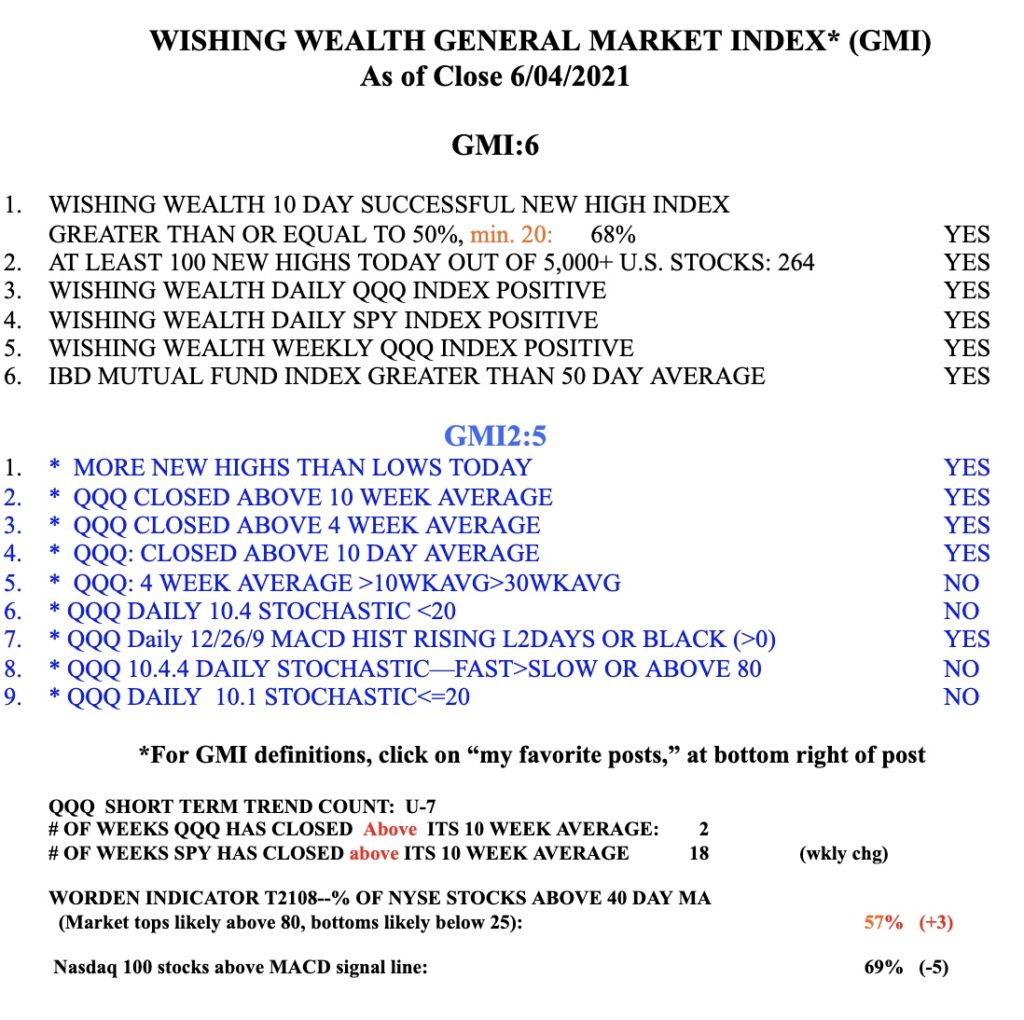

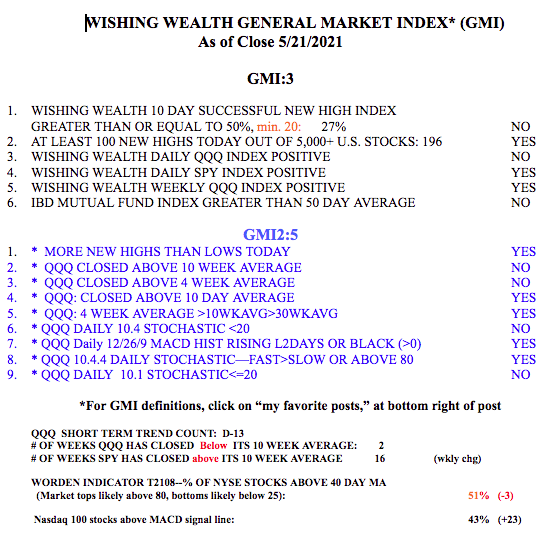

The GMI remains positive at 6 (of 6).