I especially like APP because it is a recent IPO and has strong fundamentals. According to MarketSmith, it will move to profitability this year and then is estimated to have earnings up 215% in 2022. Last quarter’s eps +167% and sales +123%. Funds only own 13% of shares. Worth watching now that it has had a GLB. Earnings due 10/28.

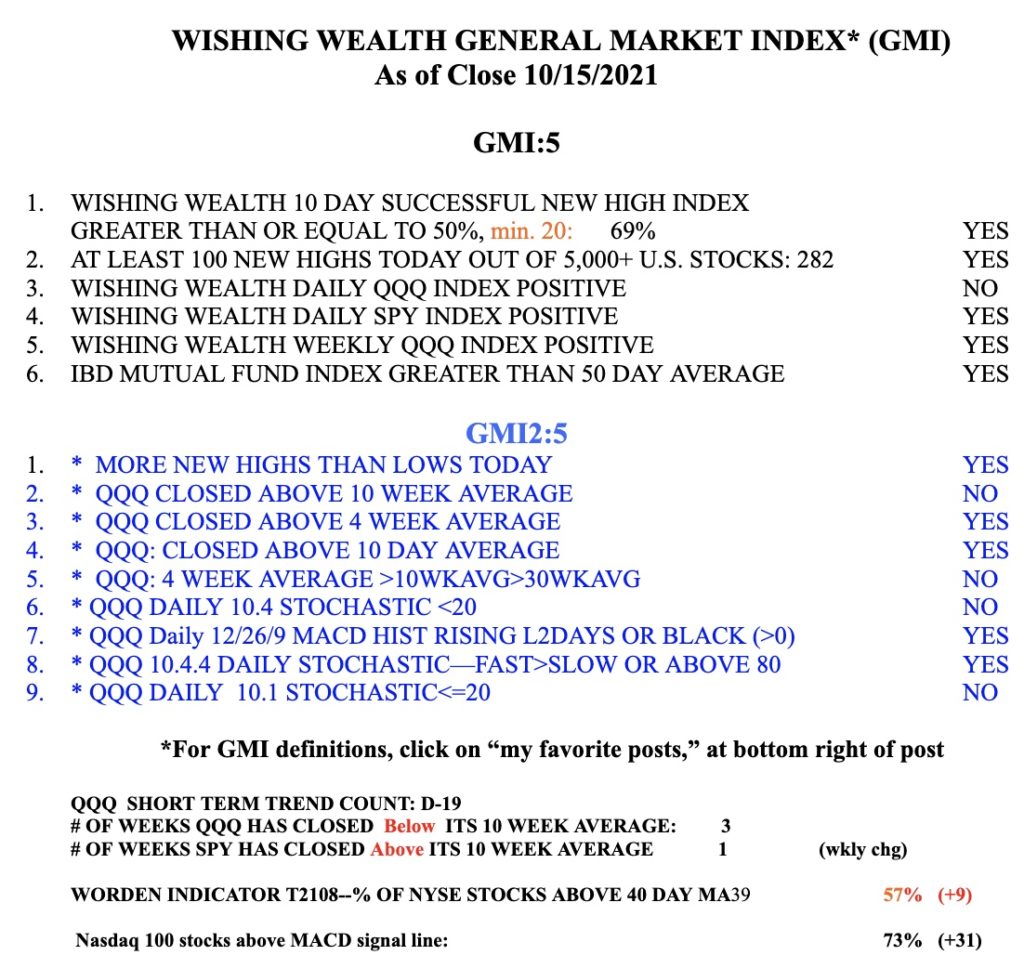

SPY has now closed above its 10 week average.