I put an alert in TC2000 to text me if SEDG has a GLB (green line break-out). I intend to tweet it out as soon as I get the signal. Solar has been hot lately, (pun intended). See the weekly chart below. MarketSmith listed SEDG under their Stock Ideas tab as a stock near a Cup with Handle pivot. MarketSmith is a great tool that my students are learning to use.

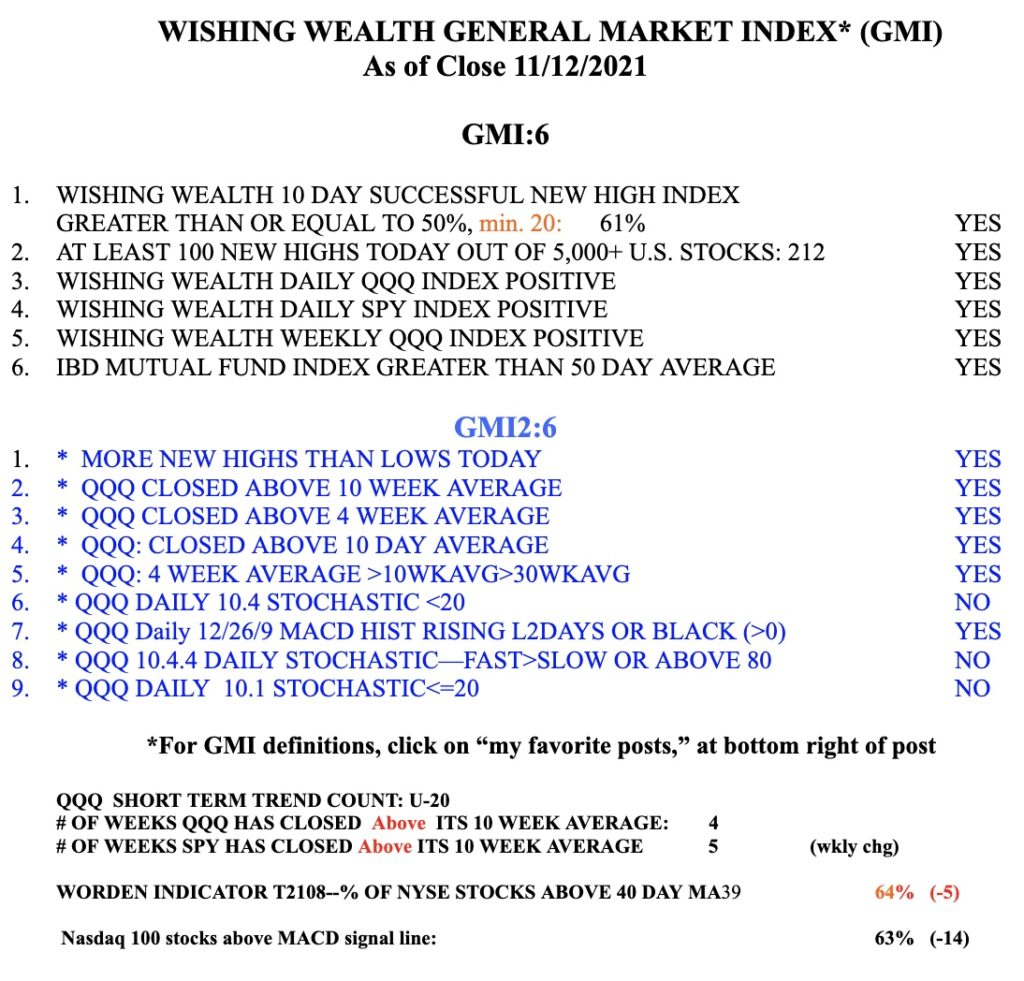

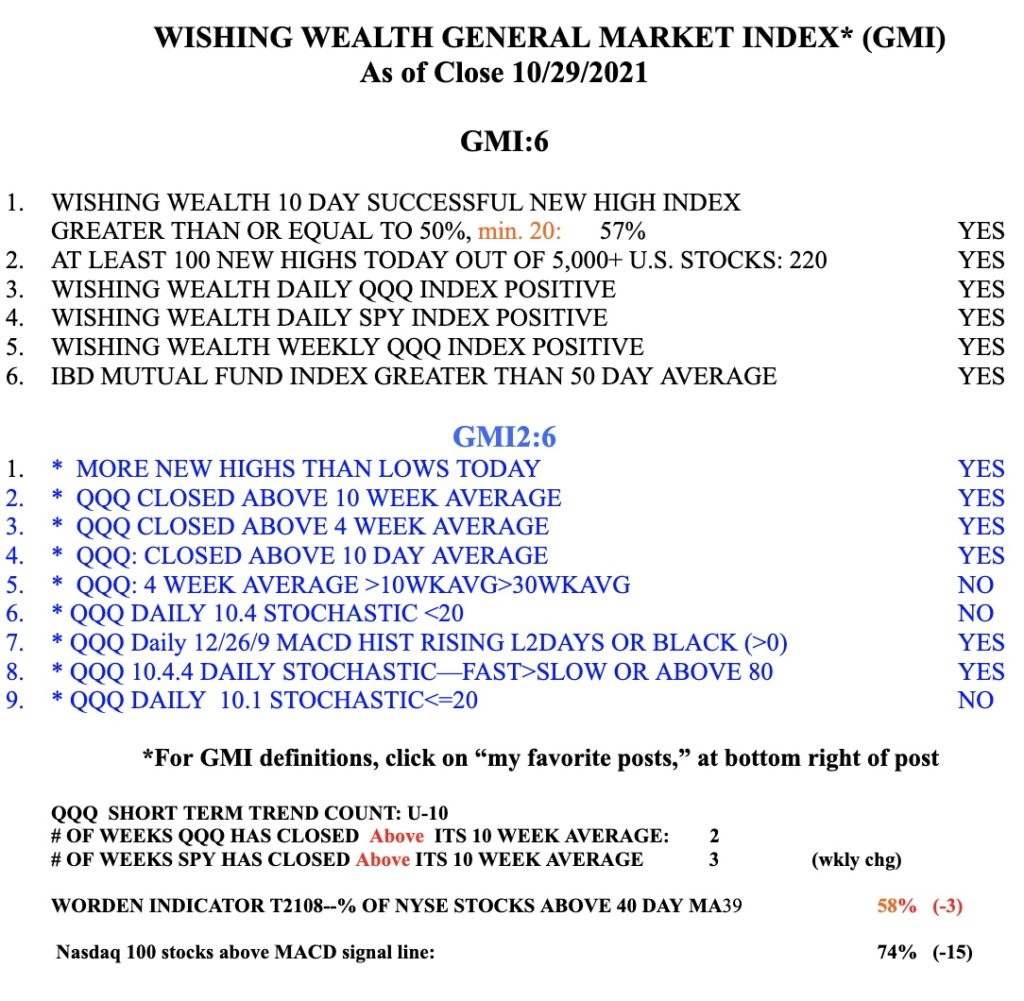

General Market Index (GMI) table

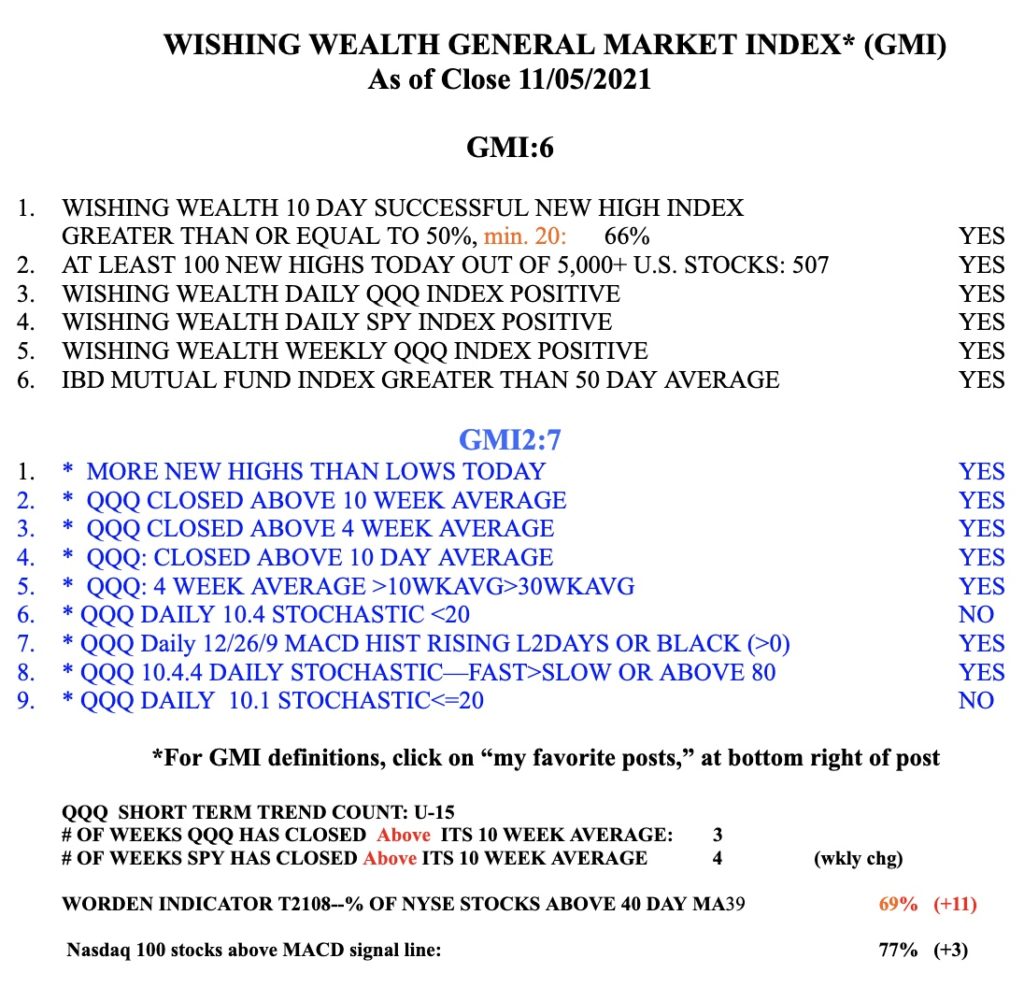

Blog post: Day 15 of $QQQ short term up-trend; Hot market, 507 US stocks with new highs Friday; Some growth stocks with GLB breaking out of nice multi-week bases: $AMAT, $NXST, $MCHP, $AFG, $SI, $FFIN, see weekly charts; GMI is 6 of 6 and Green

This market is getting very frothy. I am watching for the Fed to raise rates and kill the bull. But the GMI remains strong for now…

I took some time this weekend to look at my watchlist of recent IBD50 and MarketSmith250 growth stock lists and found 6 stocks that merit further research. All had a green line break-out (GLB) to an all-time-high last week after a strong advance followed by a multi-week consolidation. My undergraduate students–check your TR to make sure they meet your criteria for purchase during the class trading simulation. I found these using a new TC2000 scan I shall share with the class next week. Note that AMAT reports earnings on 11/11.