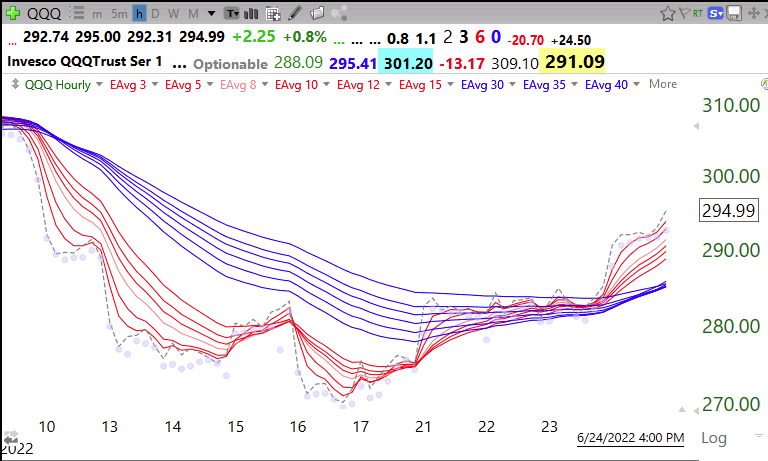

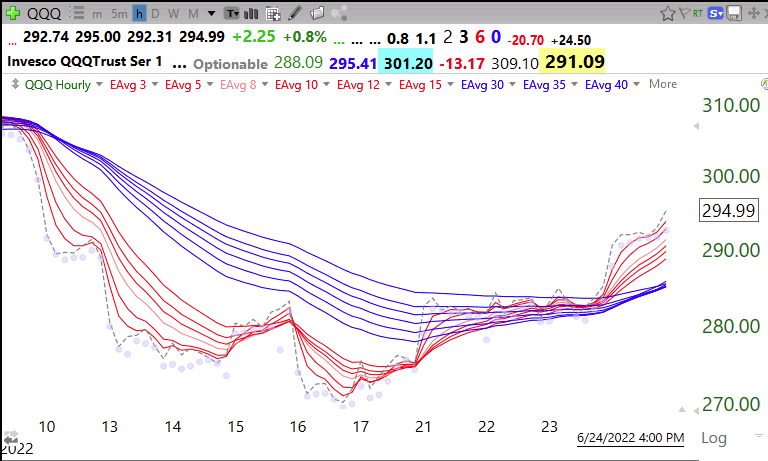

It is possible that the QQQ short term trend will turn up by the close on Monday. Any change in the short term trend needs to last 5 days for me to really trust it. However, I might buy a little TQQQ on Monday with a close stop. The GMI remains at zero and Red, see table below, and the longer term trend remains down. But a change in the longer term trend always begins with a change in the shorter term trend. Case in point, this hourly adapted GMMA chart shows QQQ is in a new RWB up-trend, for now. 69% of the Nasdaq100 component stocks are in a similar hourly RWB up-trend, which suggests to me this rally has some legs.

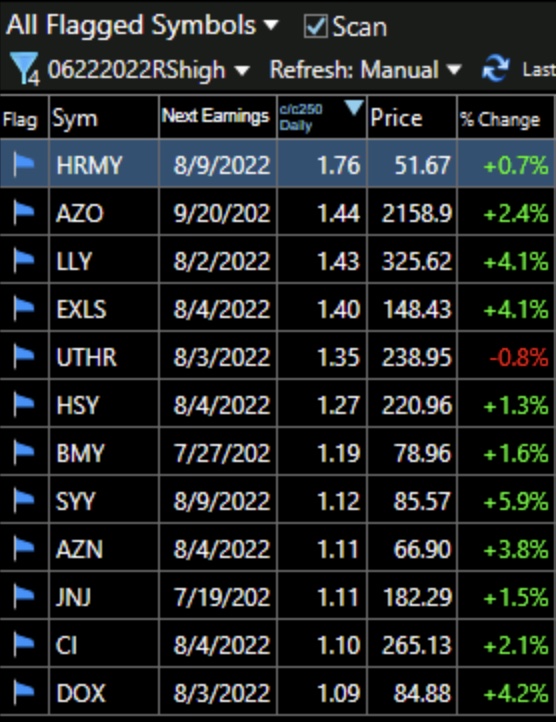

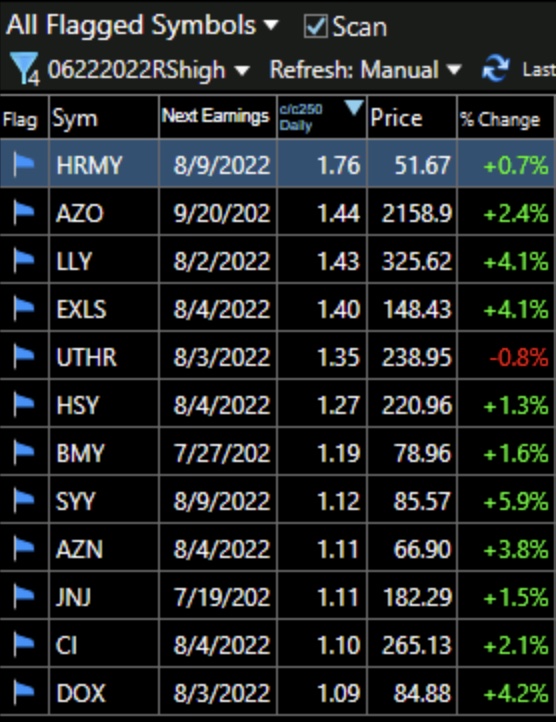

I ran a scan of my watchlist of 780 promising IBD/MarketSmith list stocks, that looked for stocks near an ATH that had weekly relative strength vs. SPY at a 50 week high. These 12 stocks came out. Maybe some of these stocks will become market leaders. They are sorted by change from a year ago. For example, HRMY is up 76% from 250 days ago. Any stock that can come through the recent market down-trend near an ATH is worth monitoring. The fallen leaders may never come back to an ATH, as many people who bought at higher prices and rode them down are grateful to sell as soon as they can get their original investments back….

My talented stock buddy, Judy, alerted me a while ago to LLY, which was picked up by this scan. Lilly has a drug in phase 3 trials that could prove to be an amazingly effective new treatment for obesity. Study participants had reductions in weight of >20%! Perhaps this is why LLY reached an ATH on Friday. Notice the successful retest of the green line break-out, GLB, from March. If this new drug gains FDA approval, LLY could rocket up. If it fails, it could become a submarine. I am watching for high volume up days to suggest that traders know that more good news will come out from the ongoing clinical trials. Stay tuned….

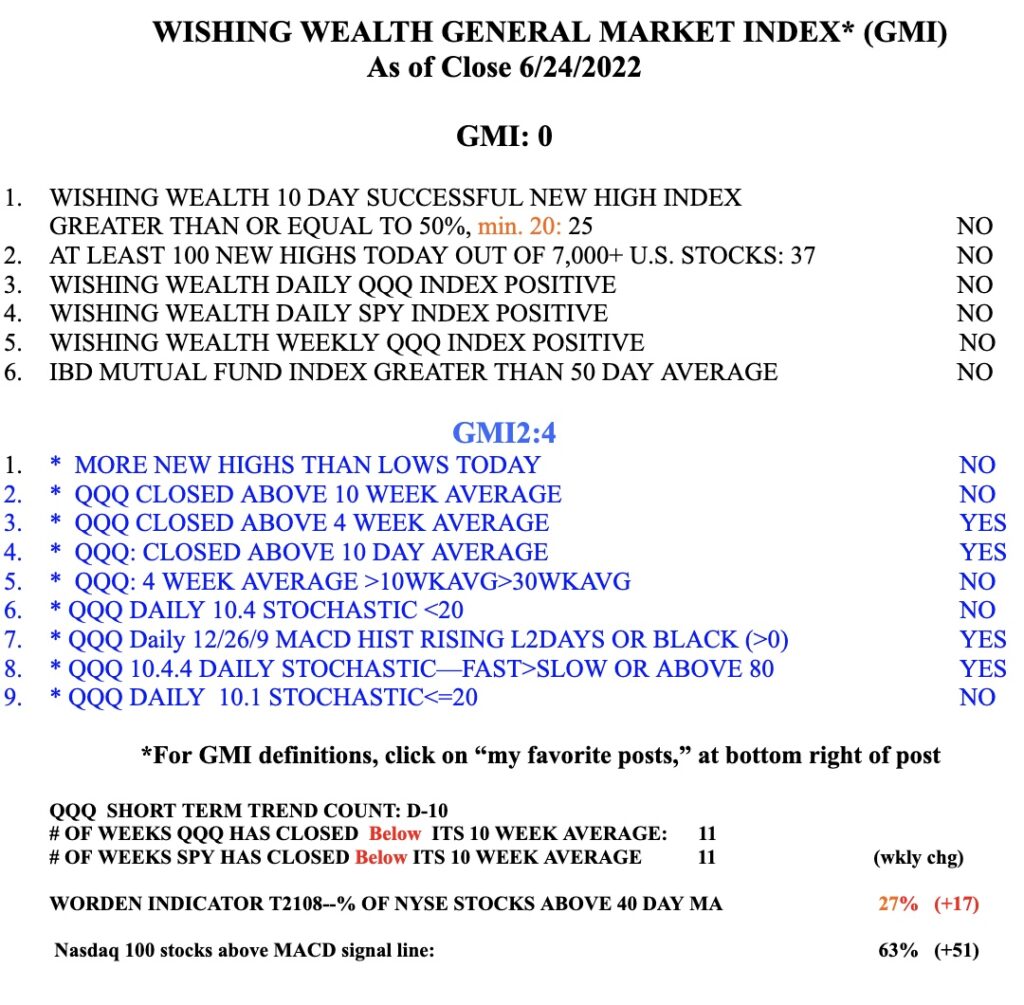

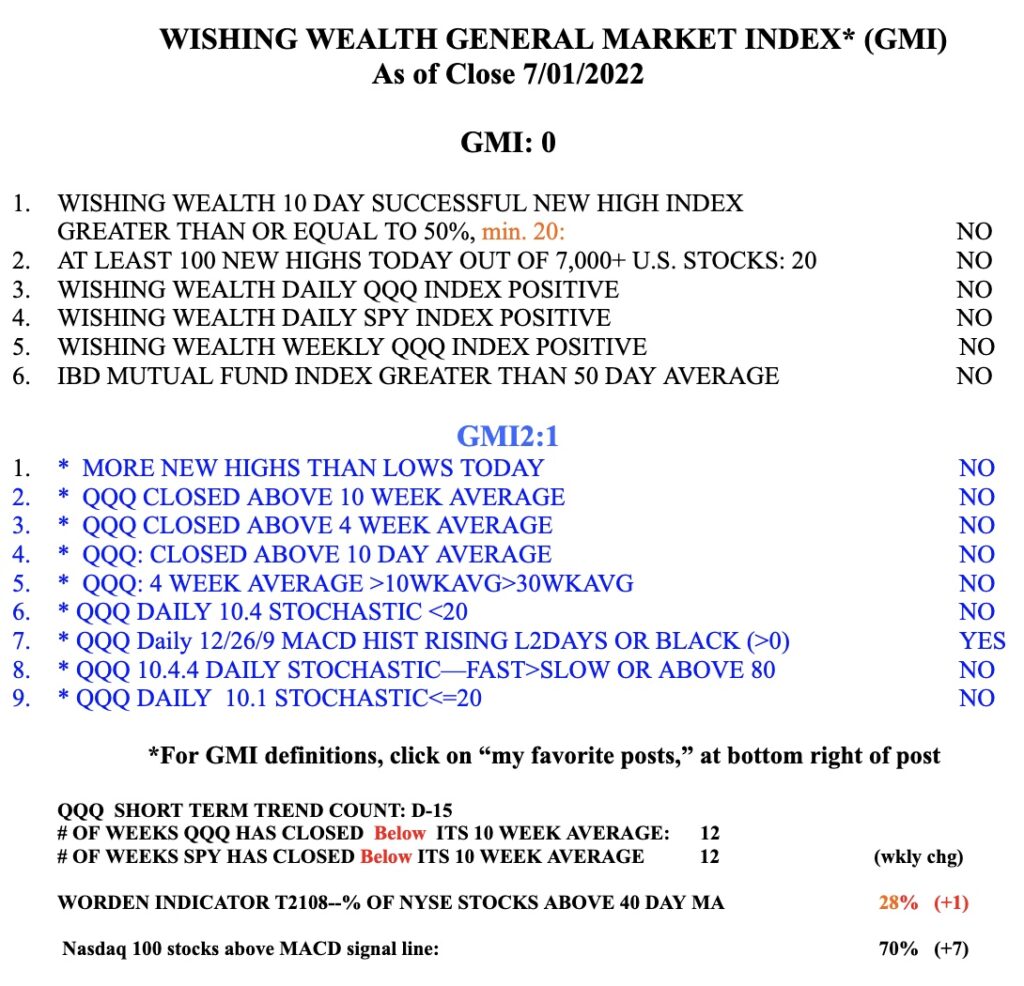

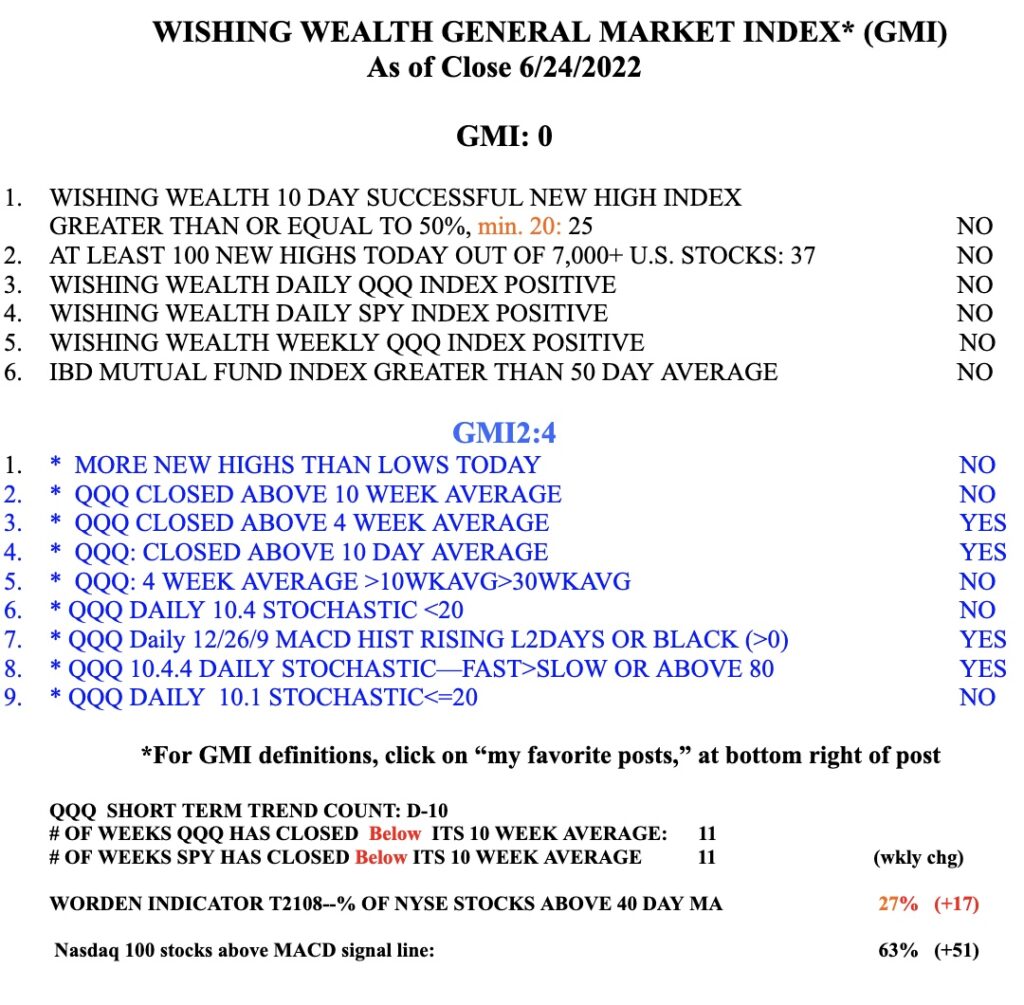

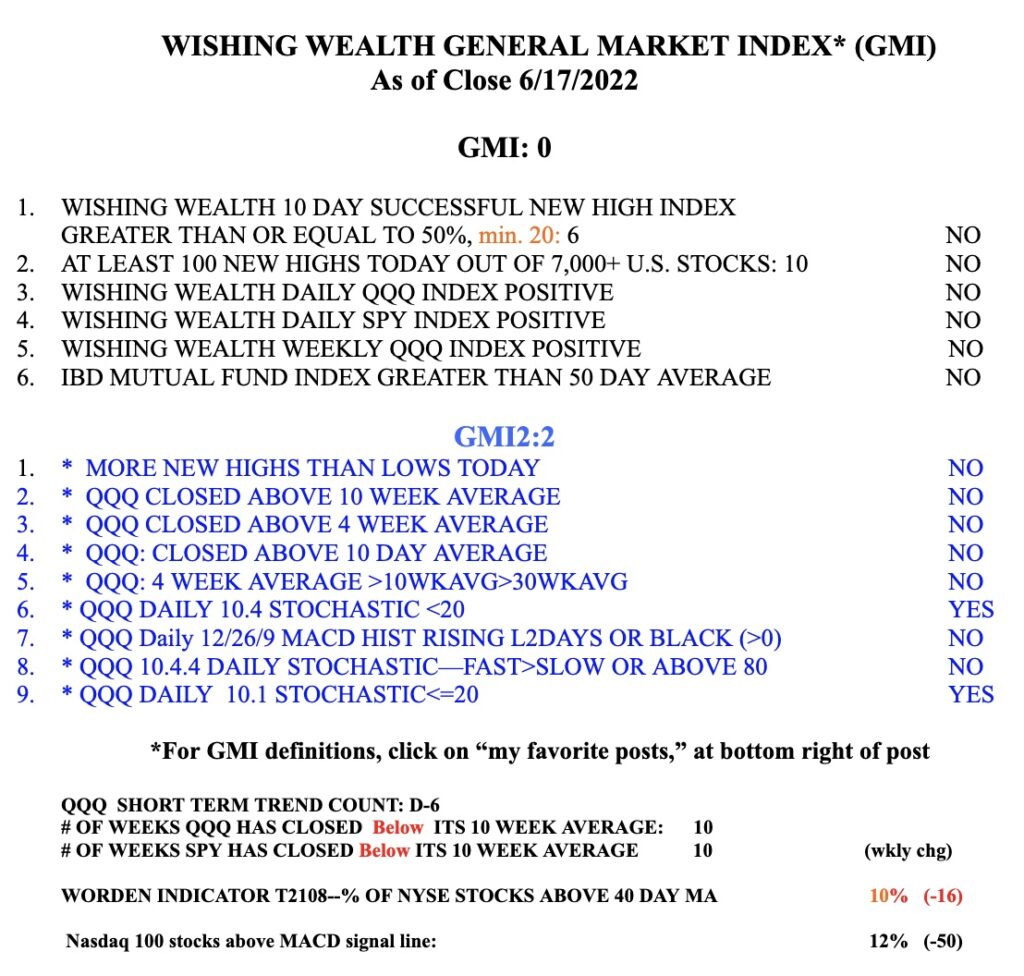

The GMI is on a Red signal and is 0 (of 6). It will be interesting to see how long the current counter trend rally continues.