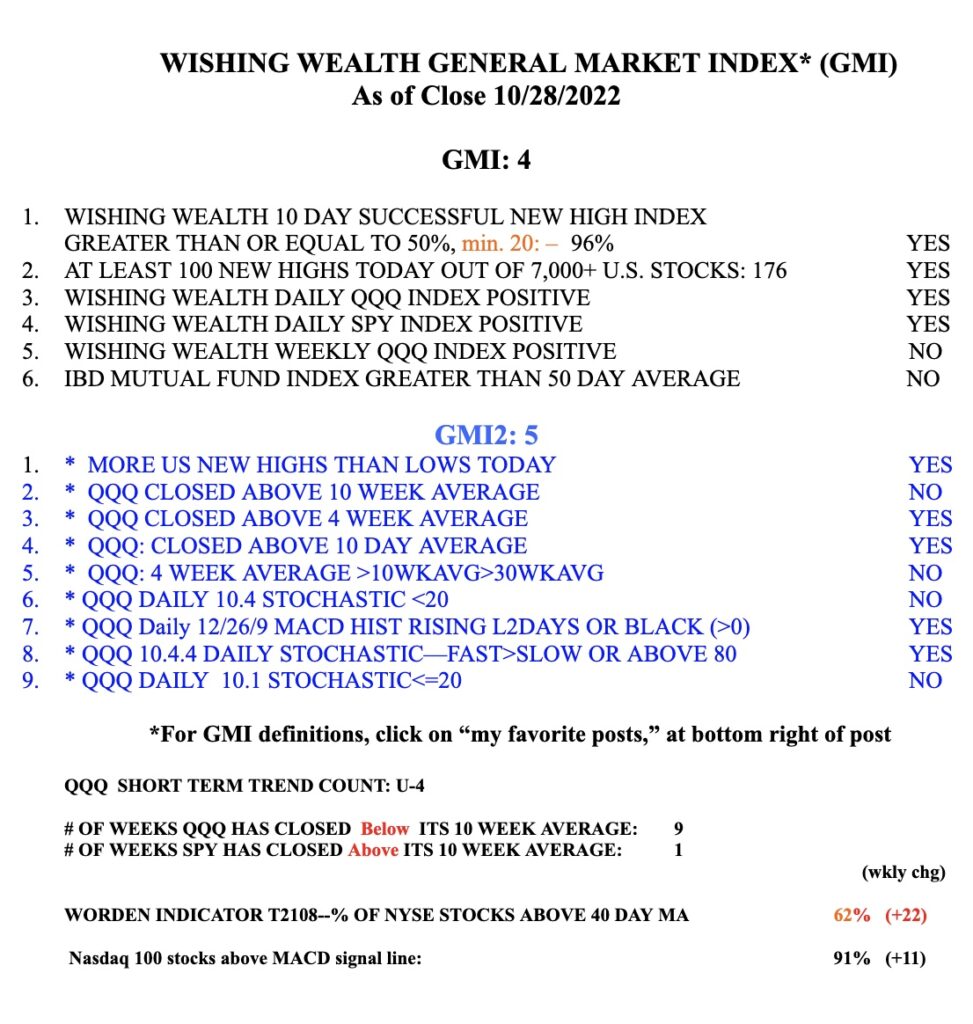

I am nibbling on TQQQ and will accumulate more if the new short term up-trend persists. Fed to meet this week and volatility may be high. I am recovering from Covid and keeping it brief tonight.

General Market Index (GMI) table

Blog Post: Day 39 of $QQQ short term down-trend; IBD switches to market in confirmed up-trend but GMI still Red; 10 promising stocks at ATHs: $INSW,$LLY,$MRK,$CI,$COP,$CDRE,$NOC,$XOM,$BAH,$SGML

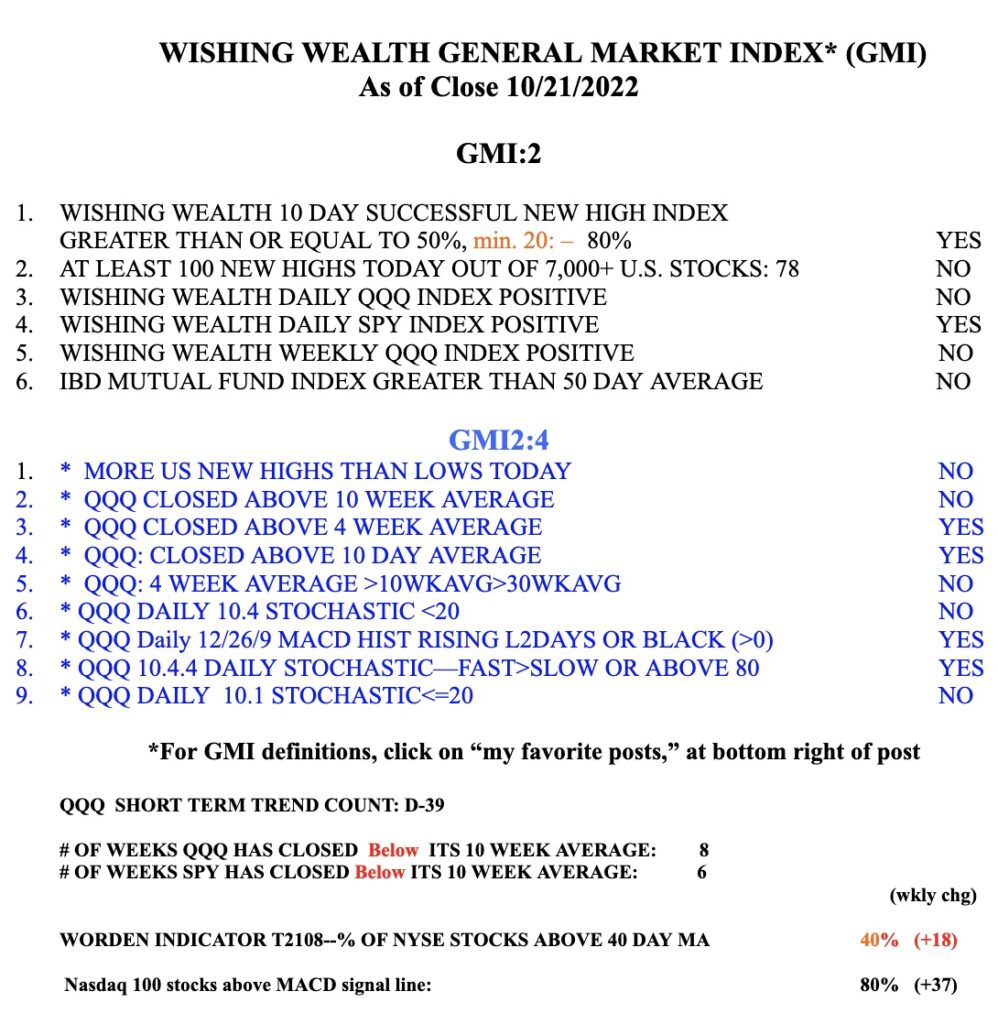

Friday was considered to be a follow through day, FTD, as defined by William O’Neil. An FTD is necessary but not sufficient for a new bull market to begin– every new bull starts after a FTD but not every FTD leads to a new bull market. There have been several failed FTDs lately. So we must wait and see.

In the mean time, a number of stocks came up on my ATH scan: INSW, LLY, MRK, CI, COP, CDRE, NOC, XOM and BAH. These are all on my IBD/MS recent watchlists. After its huge gap up on 9/28, LLY finally went to an ATH on Friday and bears watching, given its promising drug pipeline.

One stock at an ATH not on that watchlist, that I own is SGML. Its weekly chart has a weekly green bar and 4wk>10wk>30wk pattern. Lithium will be needed for all of those coming EV batteries. As long as it closes each week above its 4 week average I will hold it. Note the recent heavy volume.

The GMI remains Red.

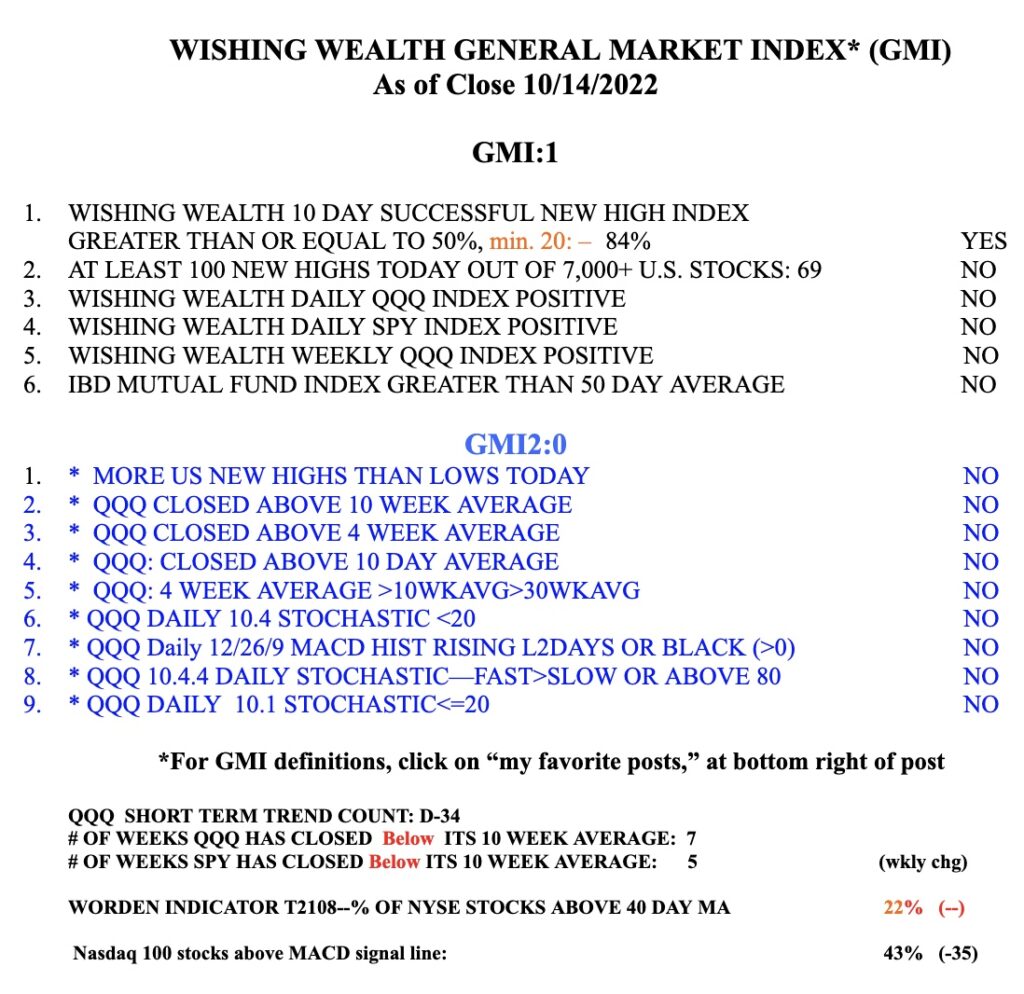

Blog Post: Day 34 of $QQQ short term down-trend; $INSW hits another ATH, see daily and weekly charts

This daily chart shows the 8 ema (dotted line) and 21 ema. Note that the 8 crossed above the 21 last July and has remained above it since. This crossover could be a potential set-up as long as the stock is in a Stage 2 up-trend, which the weekly chart confirms. Note the weekly chart shows 4wk avg>10wk avg> 30 wk avg, a strong Stage 2 pattern. Note the series of weekly green bars indicating a bounce up off of the rising 4 wk avg.

GMI remains RED and registers 1 (of 6).