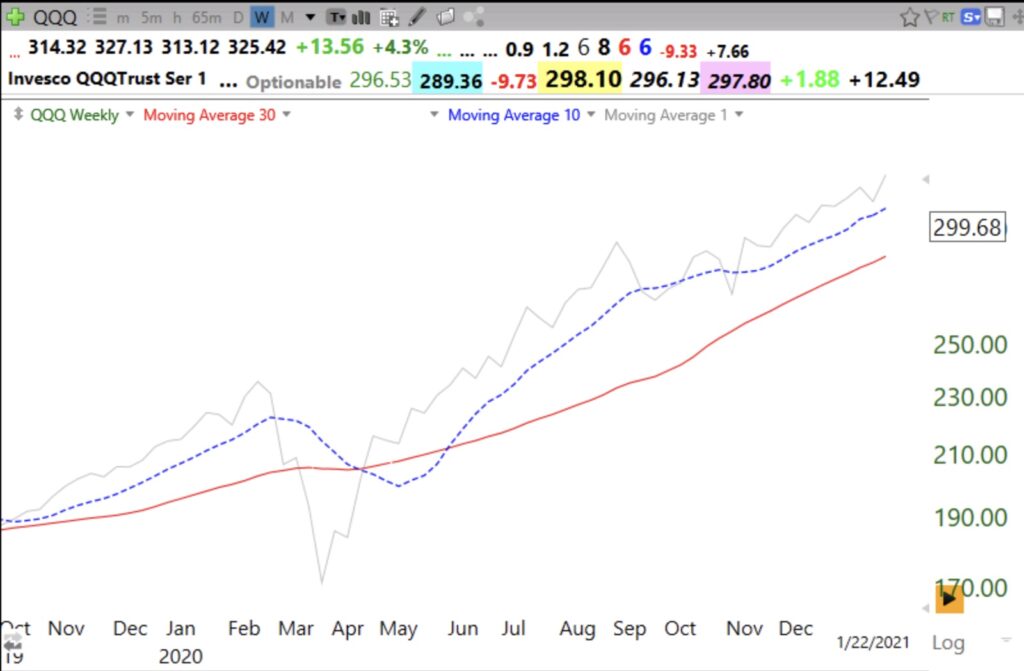

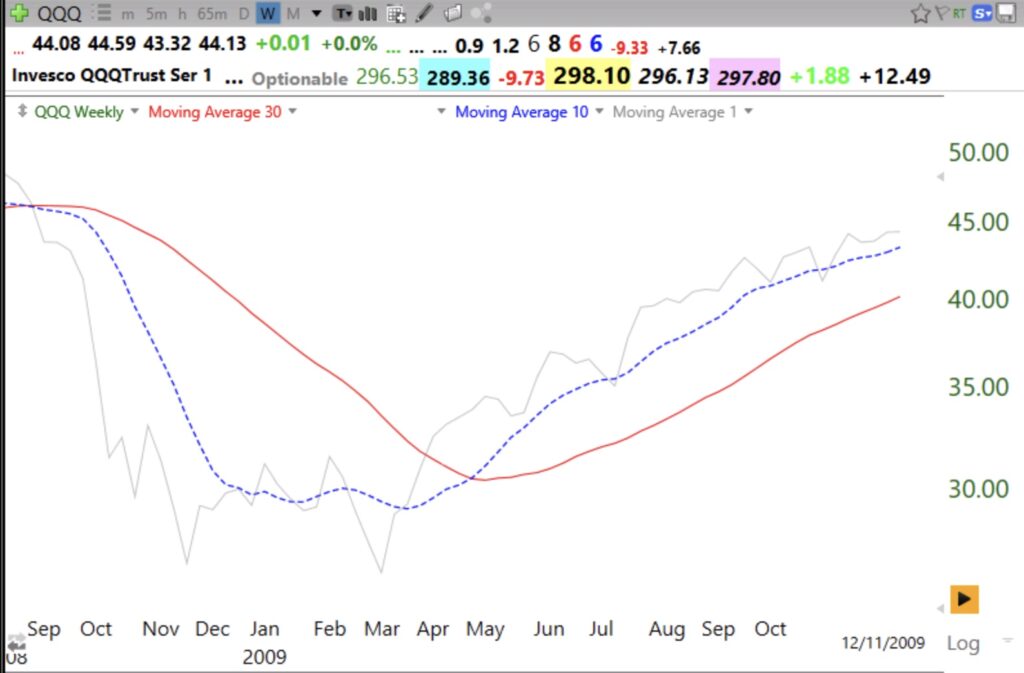

This weekly 10:30 chart of QQQ shows the 10 week average (dotted line) above the 30 week average (red solid line) and the index weekly close (gray line) is above both averages. Note the higher volume last week. This is the pattern of bottoms. The final evidence for me of a new longer term up-trend will be if the 30 week average should turn up. My accounts are mainly in cash with a very small position in TQQQ (because of Day 1 of the QQQ new short term up-trend) and some QQQ itself. A weekly close below the 30 week average would invalidate the up-trend. Remember, QQQ contains non-financial companies and the absence of banks may be one reason for its better performance. Another reason may be the AI revolution, which could lead to a rise like the one that occurred in the 90s as the internet craze was born. My monthly Kiplinger Retirement Report just came and included a piece discussing 8 AI related stocks, most of whom I would not consider buying because of their long term charts. The only one’s I like are MSFT and NVDA, but they are not near their ATHs yet, see weekly charts…

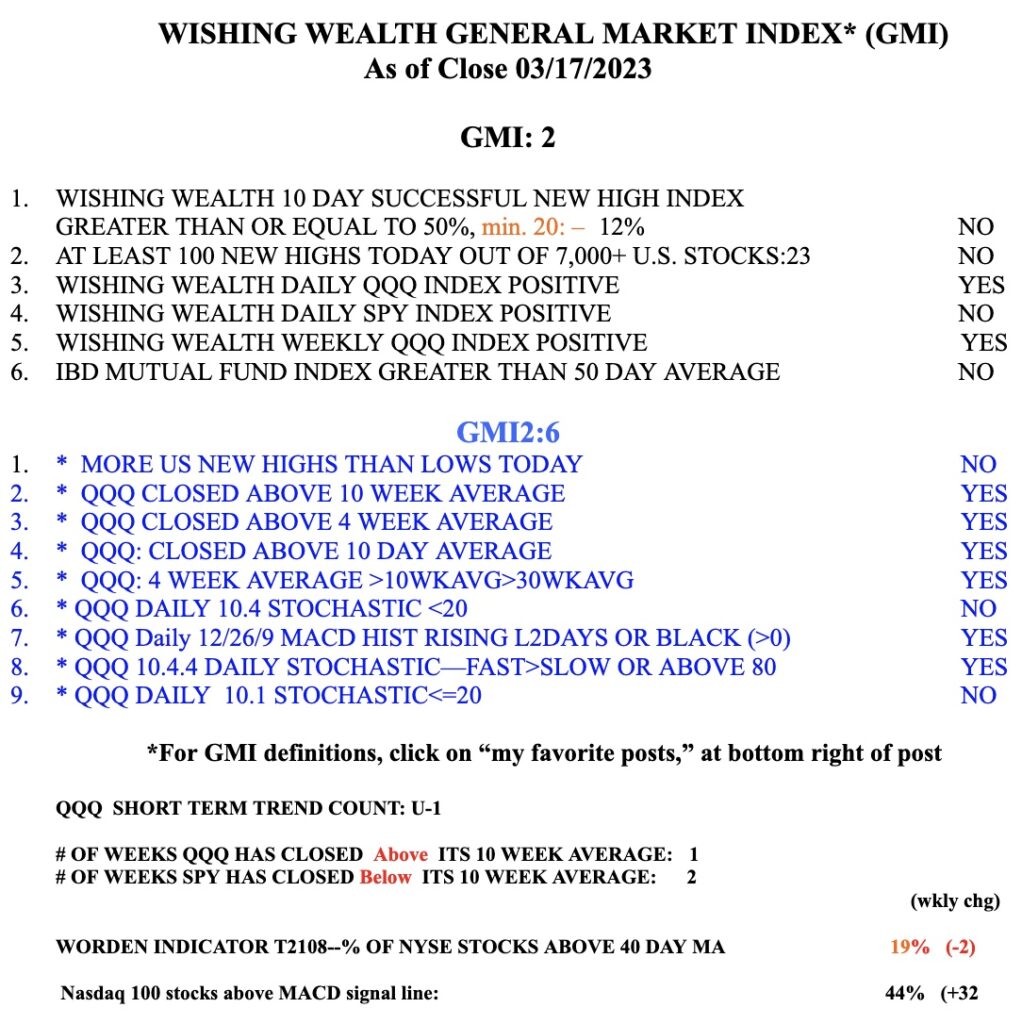

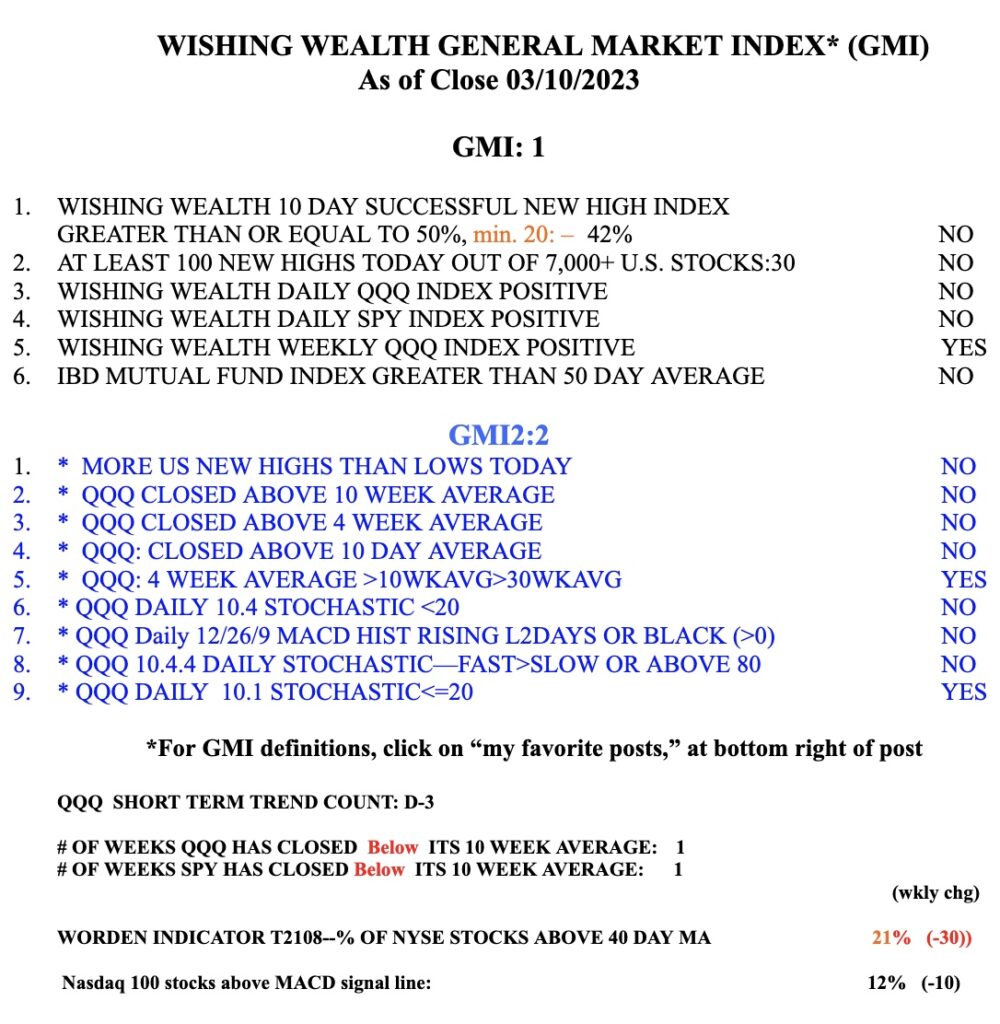

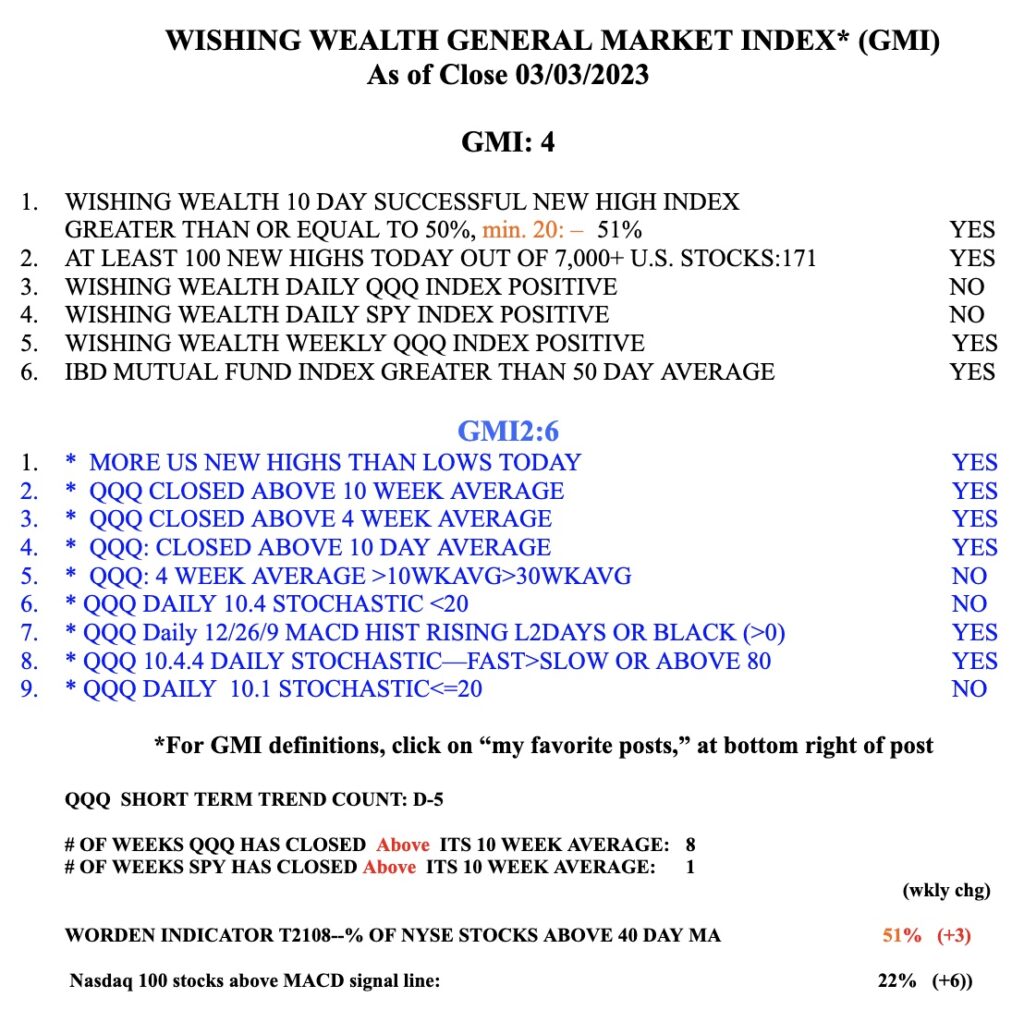

General Market Index (GMI) table

Blog Post: Day 3 of $QQQ short term down-trend; GMI=1 will likely flash Red signal on Monday; 642 new US lows Friday, most since the October low, IBD says market in correction; T2108 dives to 20%, $SPY back below critical declining 30 week average, see weekly chart

With the GMI at 1 (of 6), it is time to be on the sidelines in cash again. So many bullish set-ups failed last week. If T2108 declines to below 10%, I may buy a little SPY and only average up, slowly. But SPY looks quite weak now, below its declining 30 week average (red solid line), in a Stage 4 decline. Note the above average volume last week. This could portend a massive decline to the lower trend channel line, around 320. That is a worst case scenario, but with a major bank failing and a debt limit fight on the horizon……… But if to avoid a spreading bank panic the Fed slows its rate increases, we could see a huge snap back rally. The main positive technical sign I see is that the 10 week average (dotted line) remains above the 30 week average. Where that ends up will tell the story.

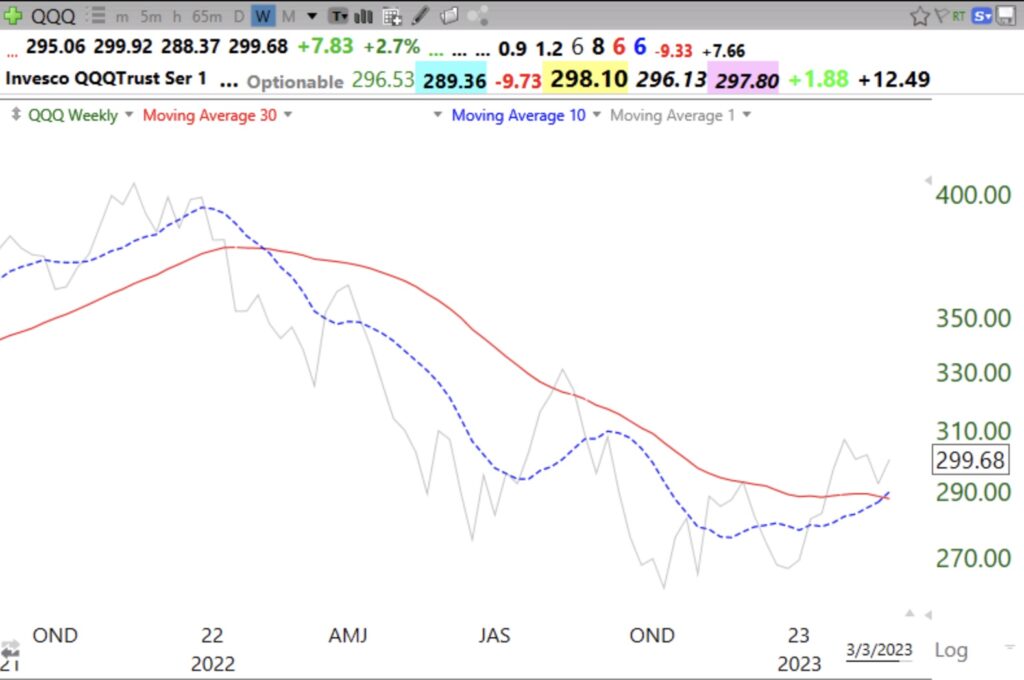

Blog Post: $QQQ short term down-trend could end Monday, the GMI is Green, Mr. Market appears to be getting ready to rally, compare current pattern with 10:30 weekly charts of bottoms in 2020, 2009 and 2002

After coming close to beginning a new longer term decline, the market appears to be getting stronger. MY QQQ short term trend indicator could turn up with a good day on Monday. This 10:30 weekly chart of QQQ shows its 10 week average (dotted line) is now above its 30 week average (red line). This pattern has been true for DIA and SPY for several weeks. This pattern of the 10 week above the 30 week typically indicates the beginning of a major longer term up-trend. The gray line is the weekly close. If the gray line should return below the two averages and lead the 10 week below the 30 week it would likely signal the end of the new up-trend.

And the bottom in 2008-9.

And the 2002 bottom.

The GMI continues to flash Green and is at 4 (of 6).