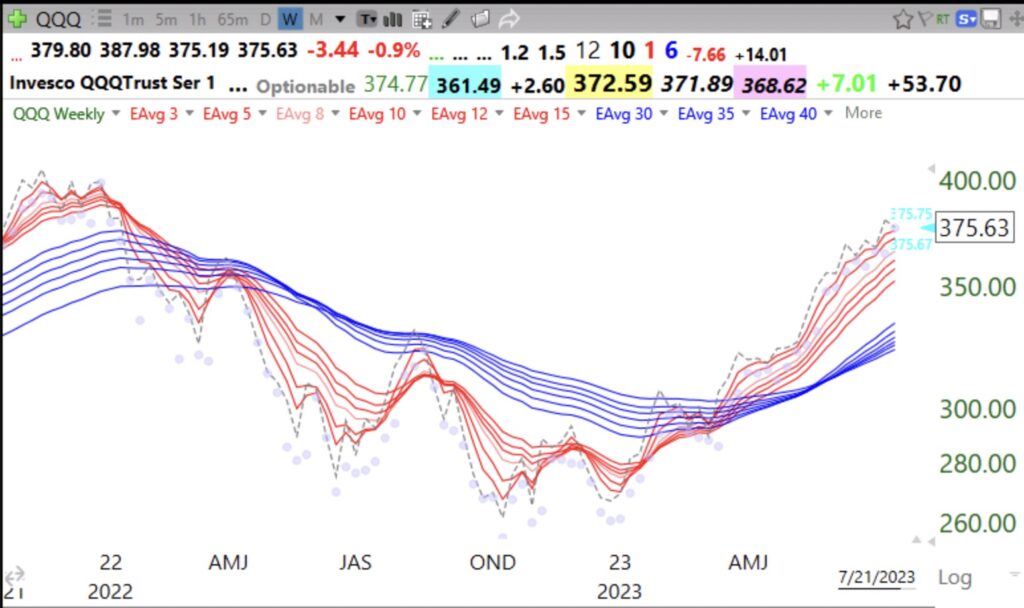

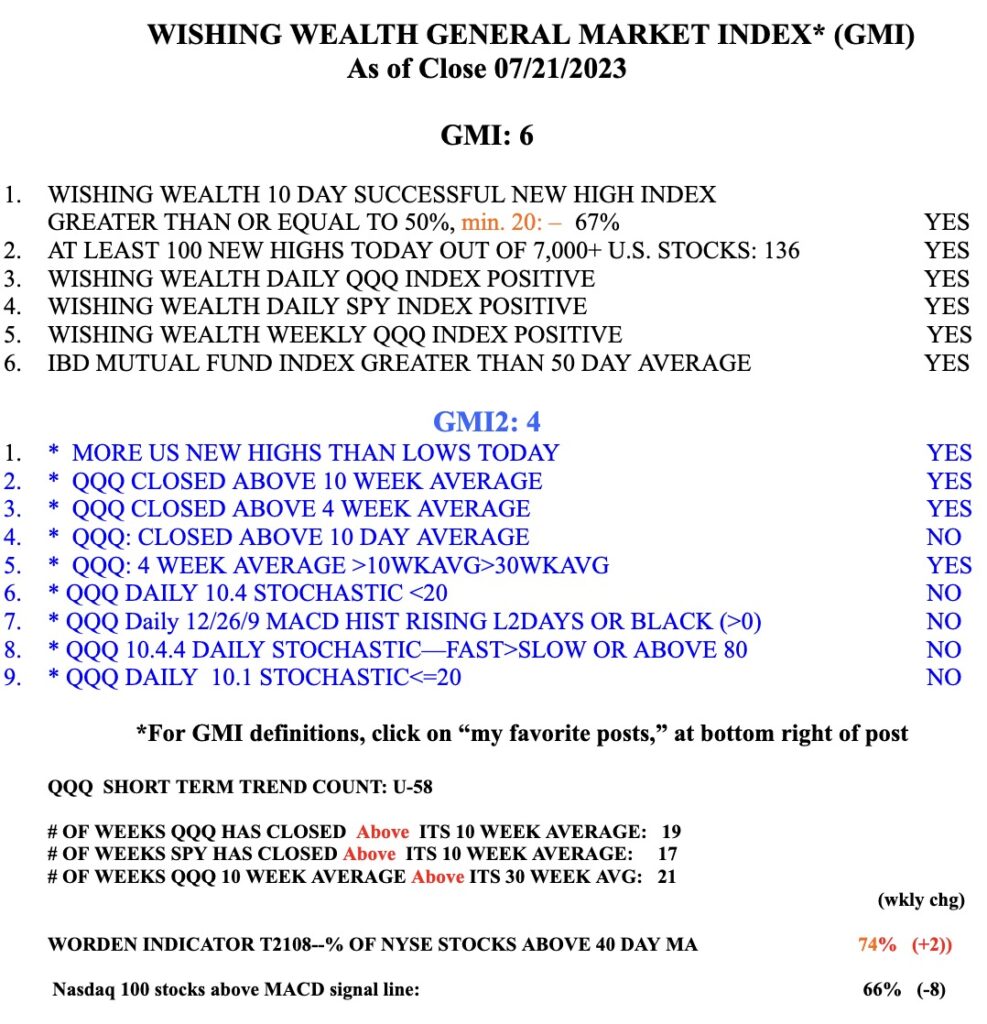

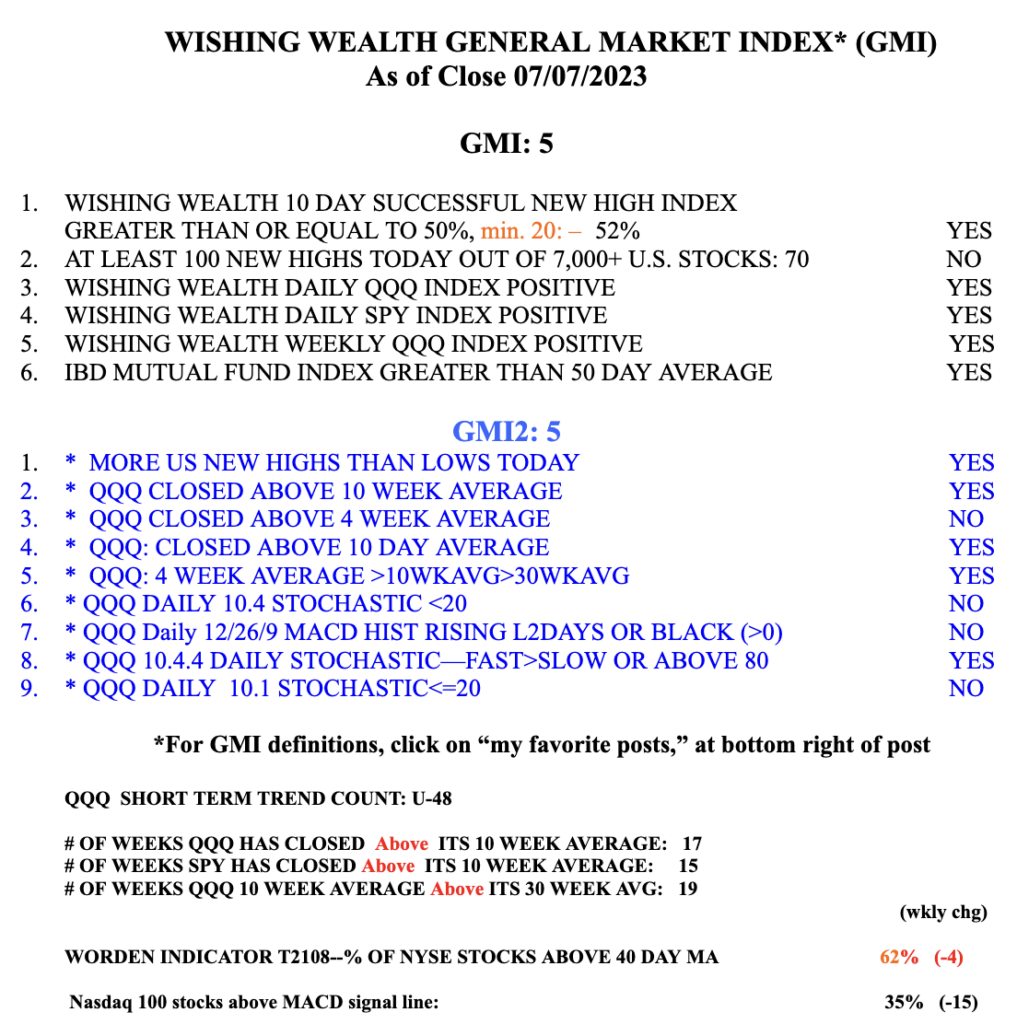

The GMI remains at 6 (of 6) and Green, but note that only 4 of the more sensitive components in GMI2 are positive. We need to get through the Fed meeting this week.

General Market Index (GMI) table

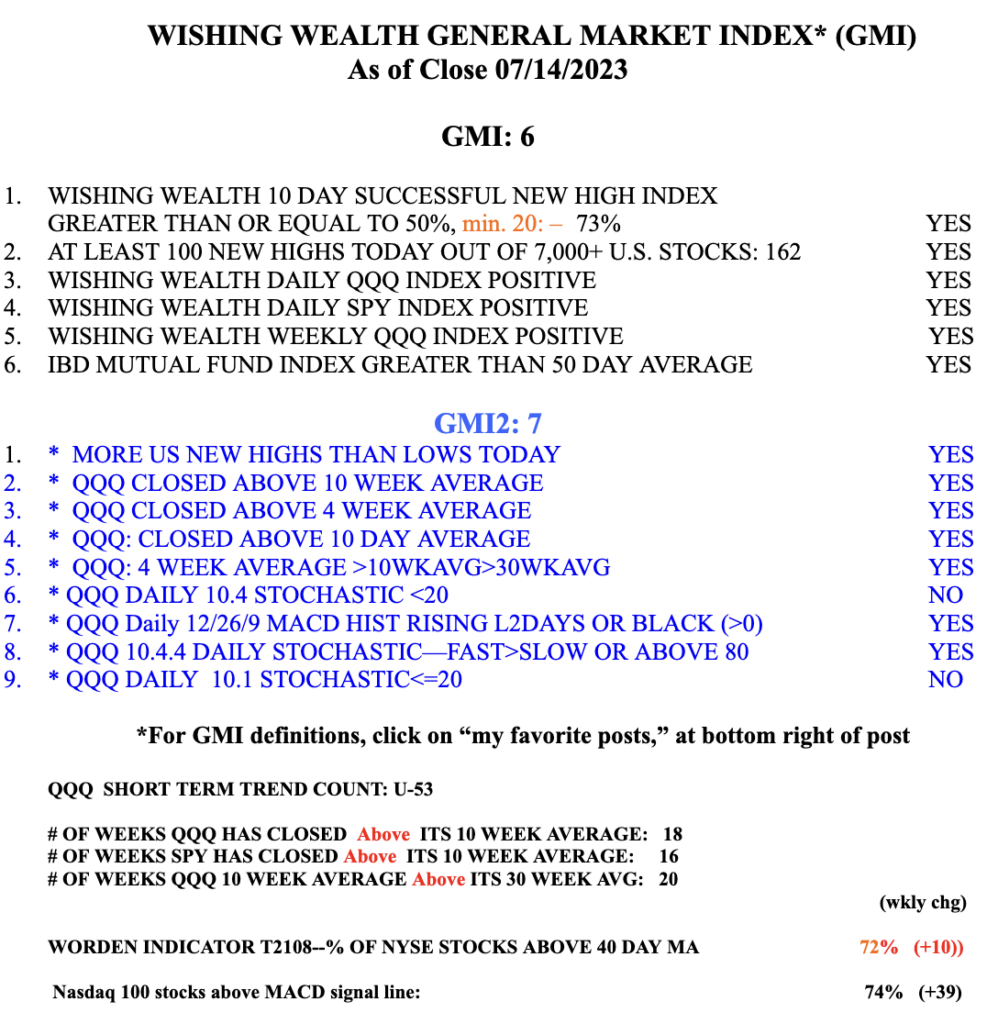

Blog Post: Day 53 of $QQQ short term up-trend; 162 US new highs and 20 lows; GMI remains 6 of 6 and Green; 3 Growth stocks with a black dot OSB set-up Friday: $WDAY, $KNSL, $GLF

As I have written recently I like my Black Dot OSB set-up. These stocks have hit a recent new high and bounced up from oversold. After researching the fundamentals, I might buy one of these stocks and place my sell stop below the low of the bounce. If the bounce fails I exit immediately with a small loss. I like WDAY the best of the three stocks that came from my IBD/MS watchlist of promising stocks. WDAY has had several black dots and is also finding support near its bottom 15.2 Bollinger Band. Note the prior successful black dot bounce in mid June. The “N” indicates a note I wrote after buying it.

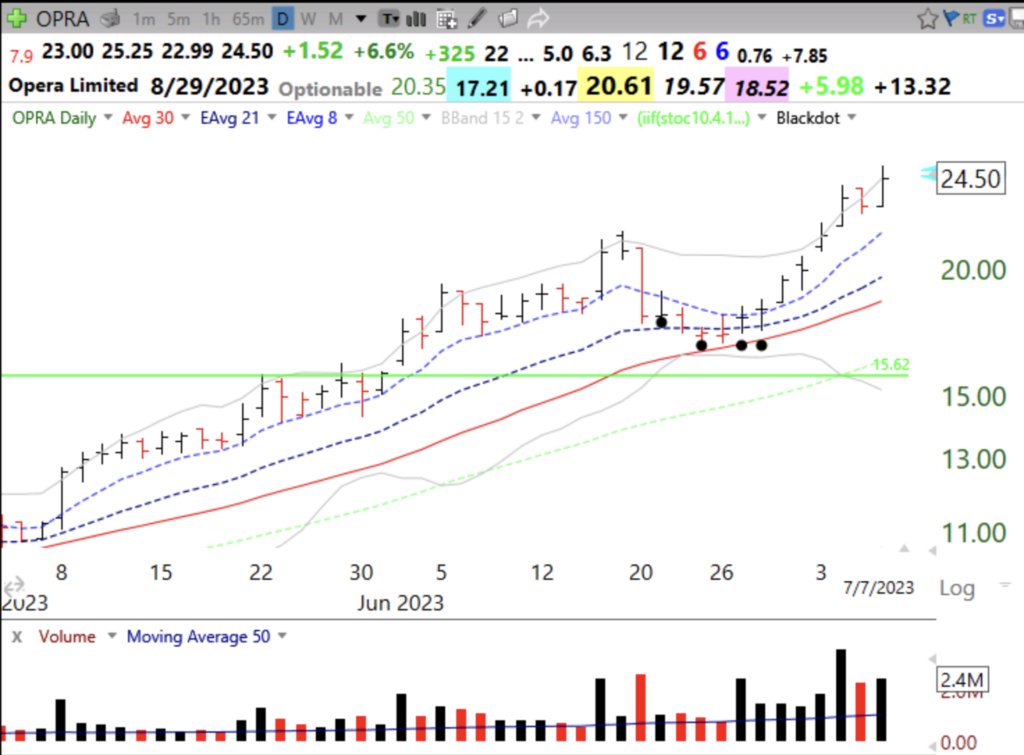

Blog Post; Day 48 of $QQQ short term up-trend; My favorite set-up, oversold bounce (black dot) after a recent yearly high, see charts of $OPRA, $BELFB and list of other stocks

I have been refining my black dot oversold indicator by requiring a prior recent yearly high. I am looking for a stock that has been strong enough to reach a high and then becomes oversold and starts to move up. The beauty of such a set-up is that I can place my stop loss below the low of the bounce day. If the bounce fails I am sold out with a small loss. OPRA kept showing up on my all-time high scans and then had the OSB, designated by the black dots. OPRA has an IBD composite rating=99, RS=97 and ACC/DIS=A+. Earnings are expected to rise +96% this year. It is involved with AI and has already advanced 6x its year’s low price. I missed this bounce and do not own it. It is above its last green line top.

BELFB triggered this set-up on Friday and I bought a little. Let’s see of it holds on Monday. Note it is also above its last green lie top.

Other growth stocks meeting this set-up on Friday appear below. They are sorted by the last column, which is close/minimum price last 250 days. BELFB is 3.3x its low.

The GIM remains Green.