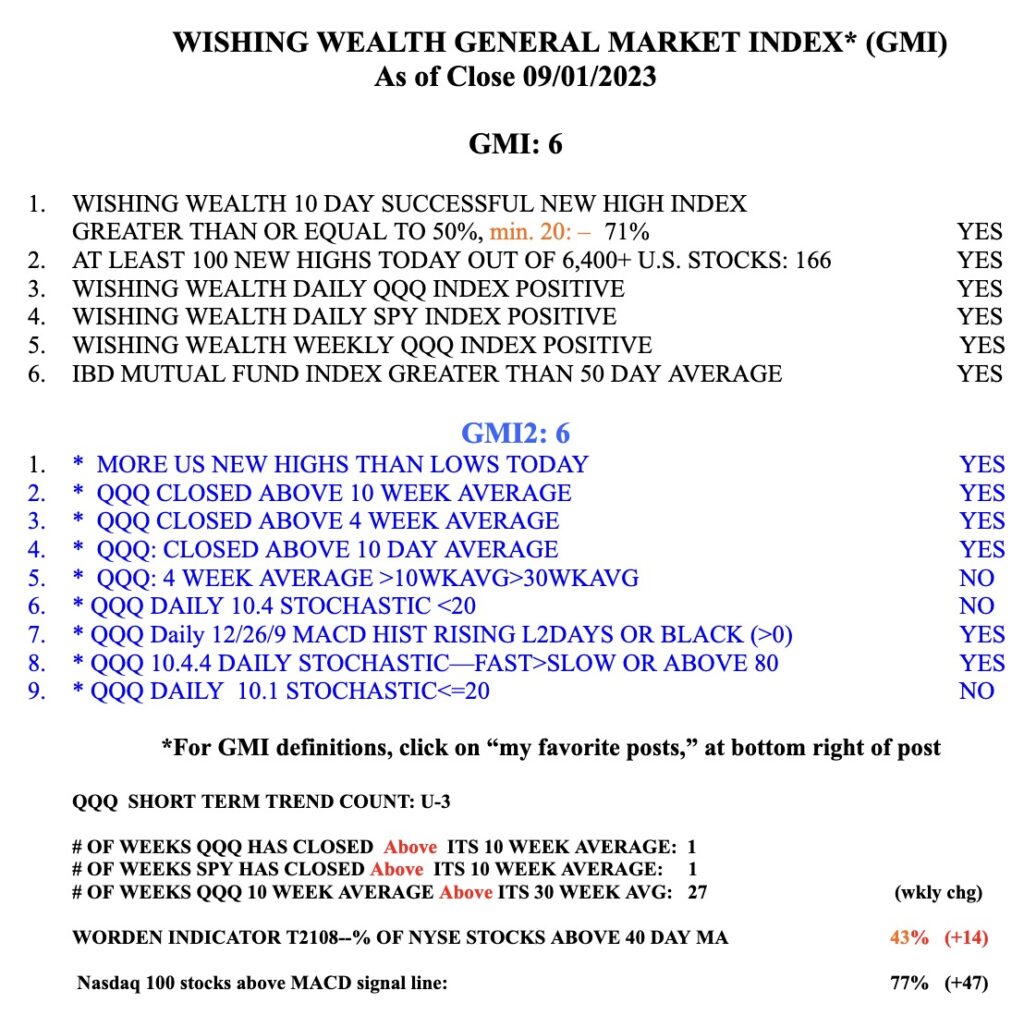

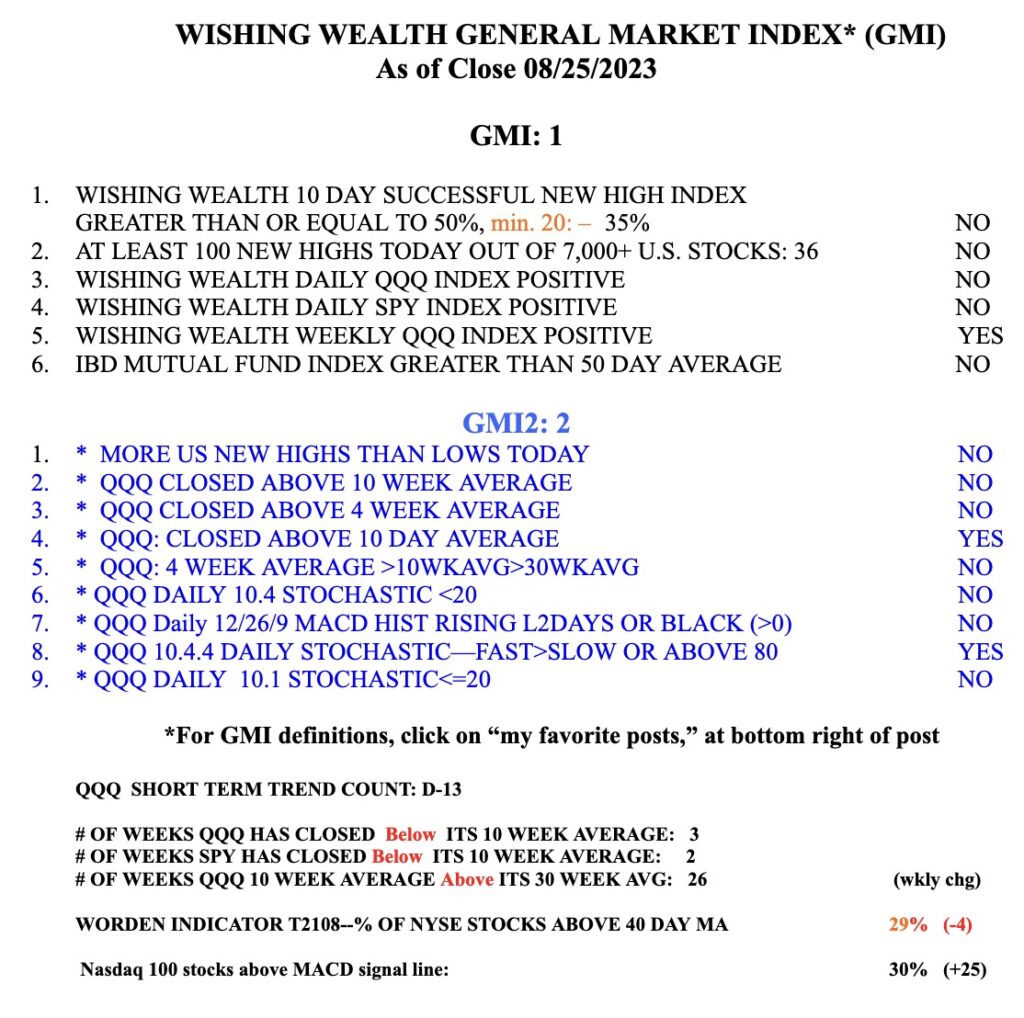

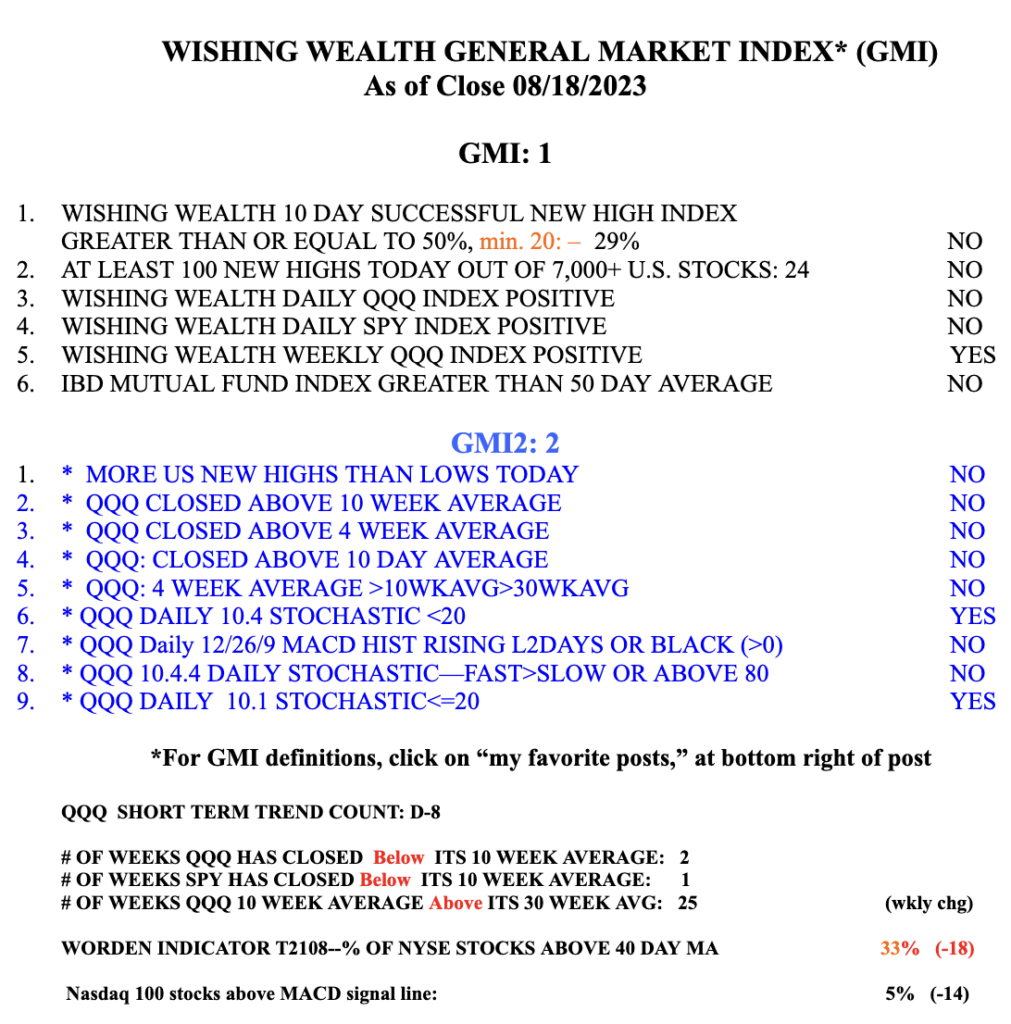

Many fear a weak September, especially with a government shut-down on the horizon. But the market may defy all and rise anyway. The QQQ short term trend count is now up and the longer term GMI is Green, see the GMI table below. I bought a little TQQQ last week and will add more if the new QQQ short term up-trend holds. I am more confident of a new short term up-trend once it holds for 5 days. My analyses show that about one quarter of new QQQ short term up-trends end within 5 days, so I add more TQQQ very slowly. The last short term up-trend lasted for 70 days and TQQQ ran up +26%. TQQQ climbed much higher than that if one had sold before the up-trend actually ended.

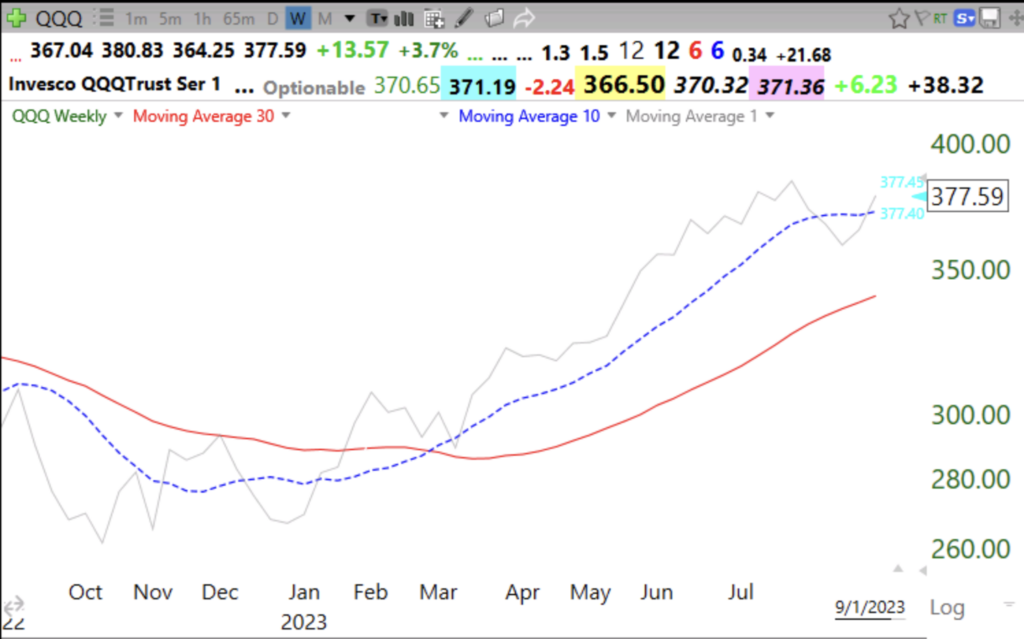

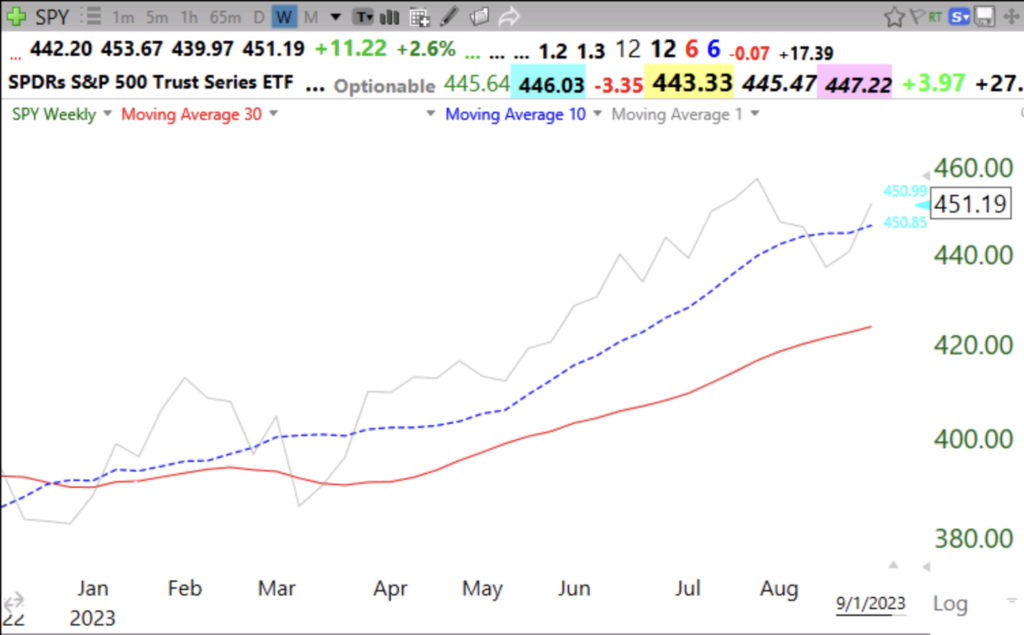

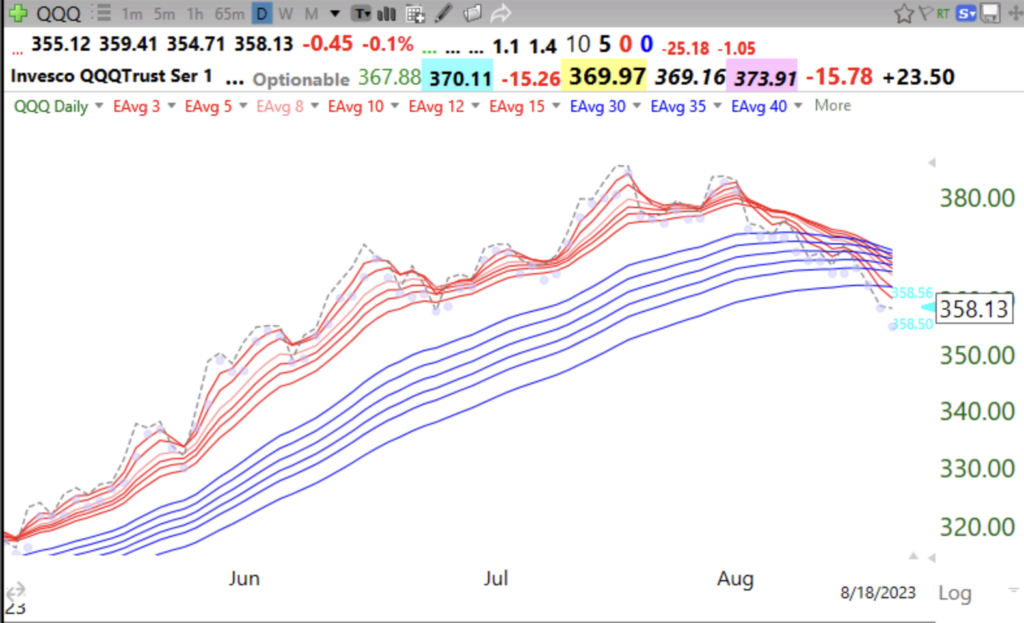

This 10:30 weekly chart shows QQQ in a continuing up-trend. Note that QQQ recently closed (gray line) back above its 10 week average (dotted line). The 10 week average has been rising above the 30 week average for 27 straight weeks, see GMI table below, and QQQ remains in a Weinstein Stage 2 up-trend. So is SPY.