I have observed that during the post-earnings release period, like now, the market often declines, setting up for the advance when the next quarter’s earnings are released. If the QQQ short term trend turns down on Monday, I will wait on the sidelines until it bounces. QQQ is not really down enough to be oversold but it could still turn up here. It is also right on the lower 15.2 daily Bollinger band, an area of support. Better for me to wait to see if QQQ holds. If it does not, the next line of support is the 50 day average, shown by the green dotted line. Next is the green line. Of concern to me are the red spikes in trading volume on recent down days. Also, QQQ has closed up on only 3 of the last 10 trading days. Beware!

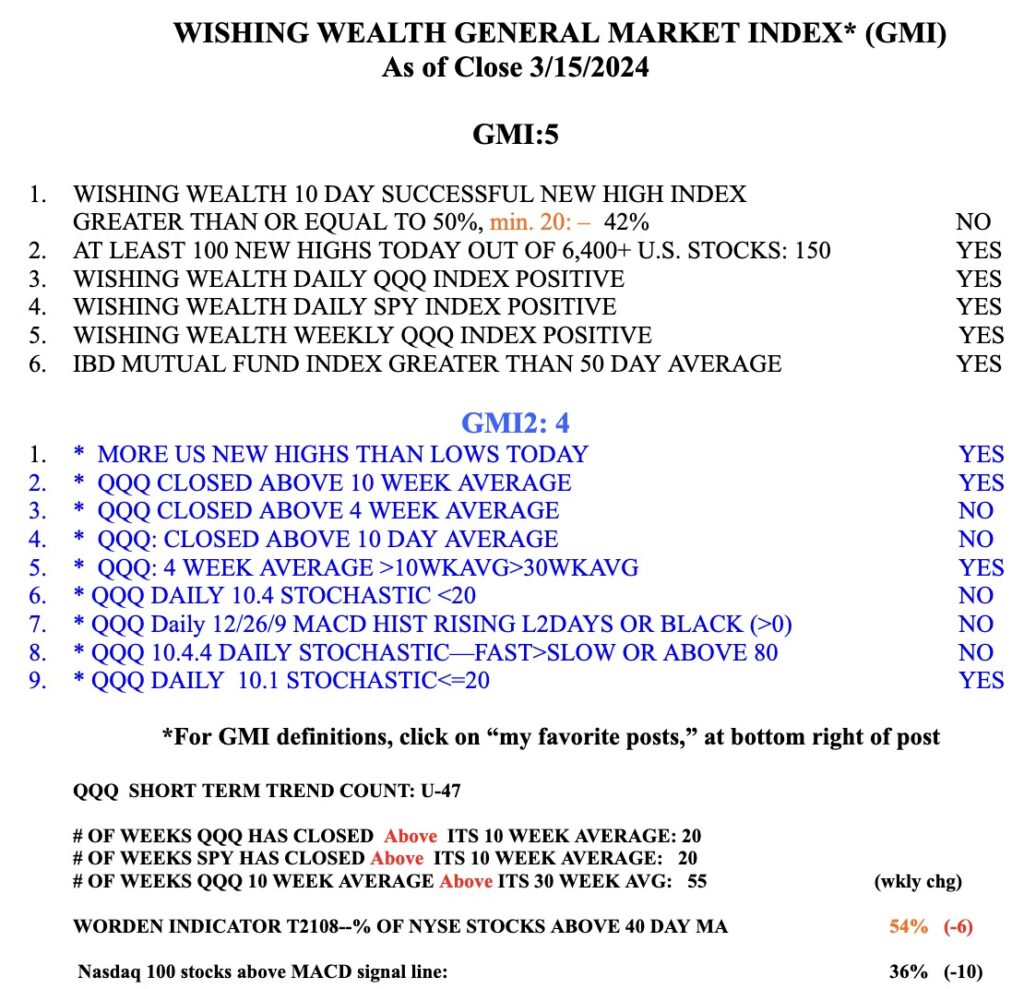

The GMI, which measures the longer term trend, is still Green, registering 5, of 6. Note in GMI2 section that the daily 10.1 stochastic is <20, indicating short term oversold. Declines are more likely to end, however, when QQQ’s daily 10.4 stochastic, currently 39, is <20.