My adapted Guppy chart shows that a BWR down-trend pattern may be forming. Until QQQ closes (shown by dotted line) above all 12 of the red/blue averages, I will not go long TQQQ, or buy any Nasdaq 100 stocks. Look at the turnaround pattern that occurred last May. The key to success is to not go long until AFTER an up-trend is apparent. Access my blog at: www.wishingwealthblog.com.

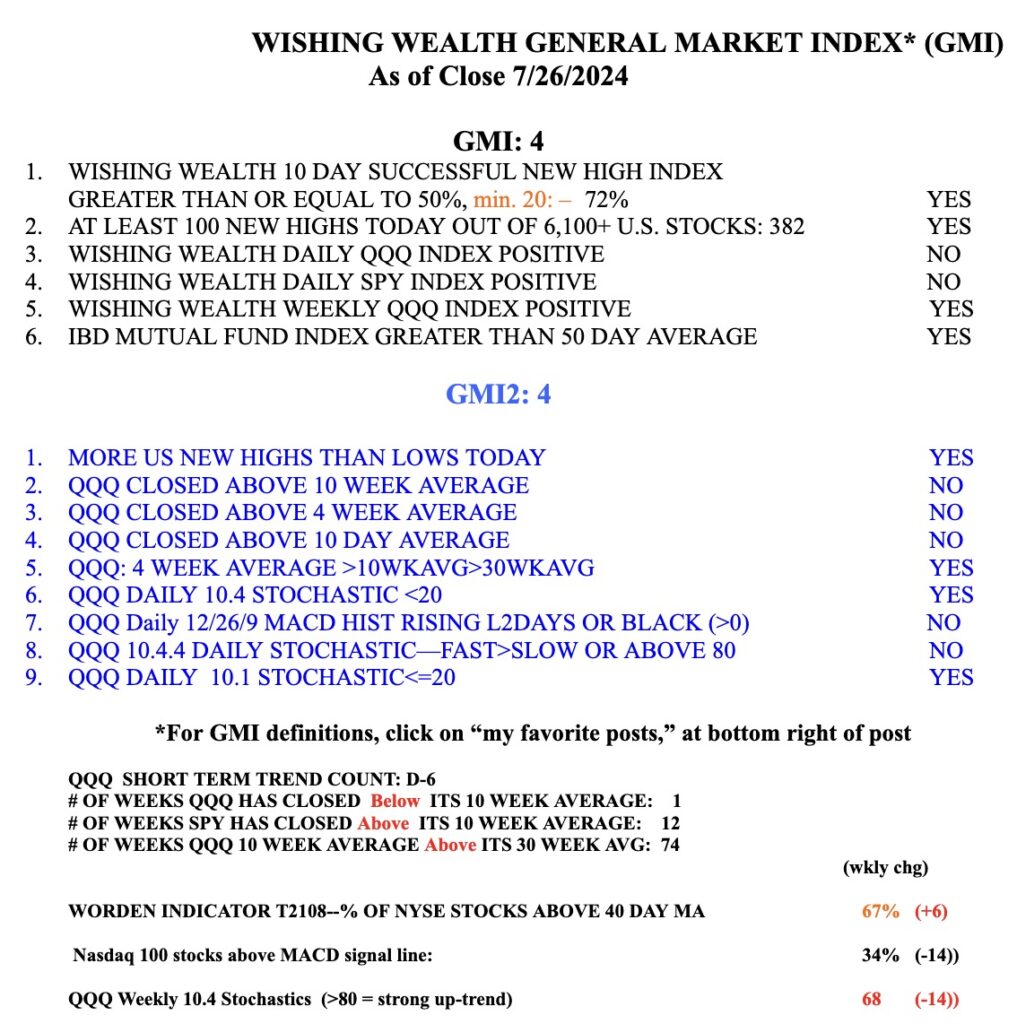

The GMI remains GREEN at 4 of 6. The weekly 10.4 stochastic is only at 68. Strong up-trends remain above 80.