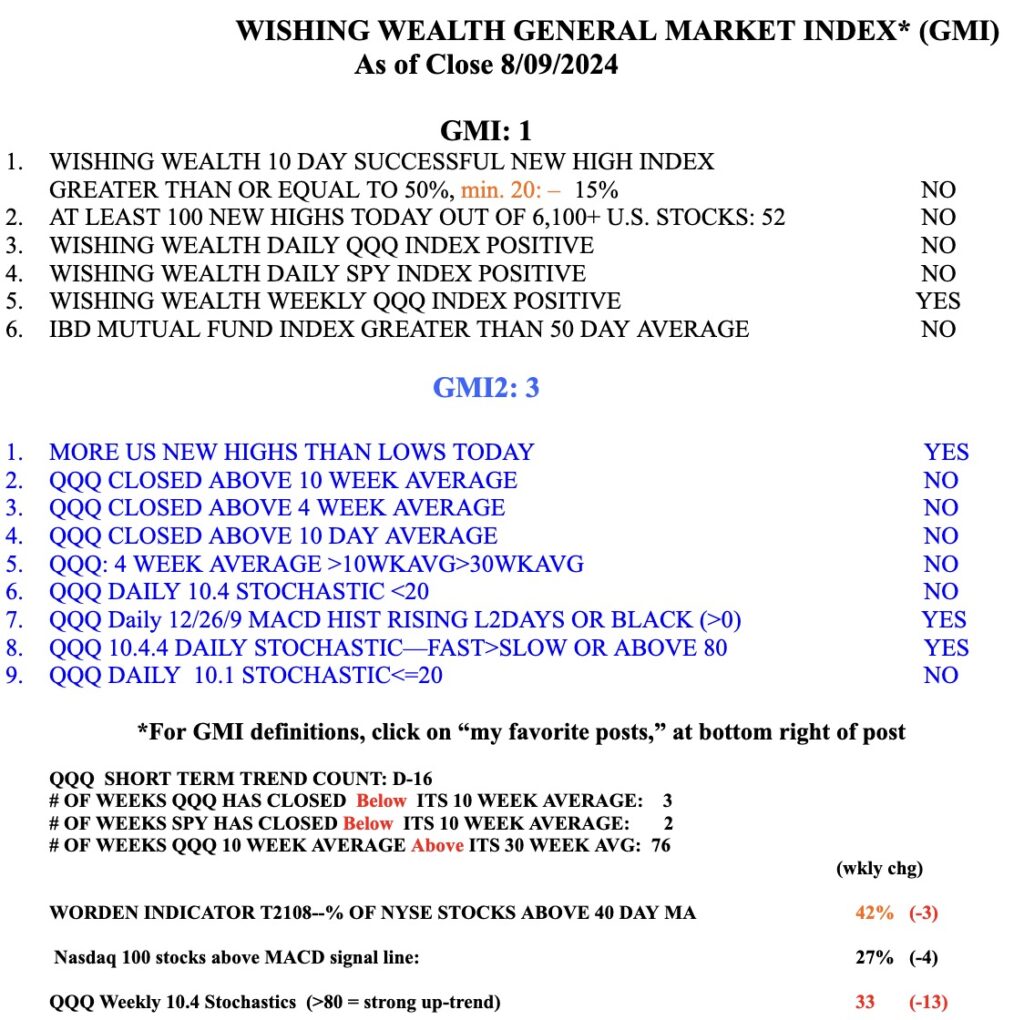

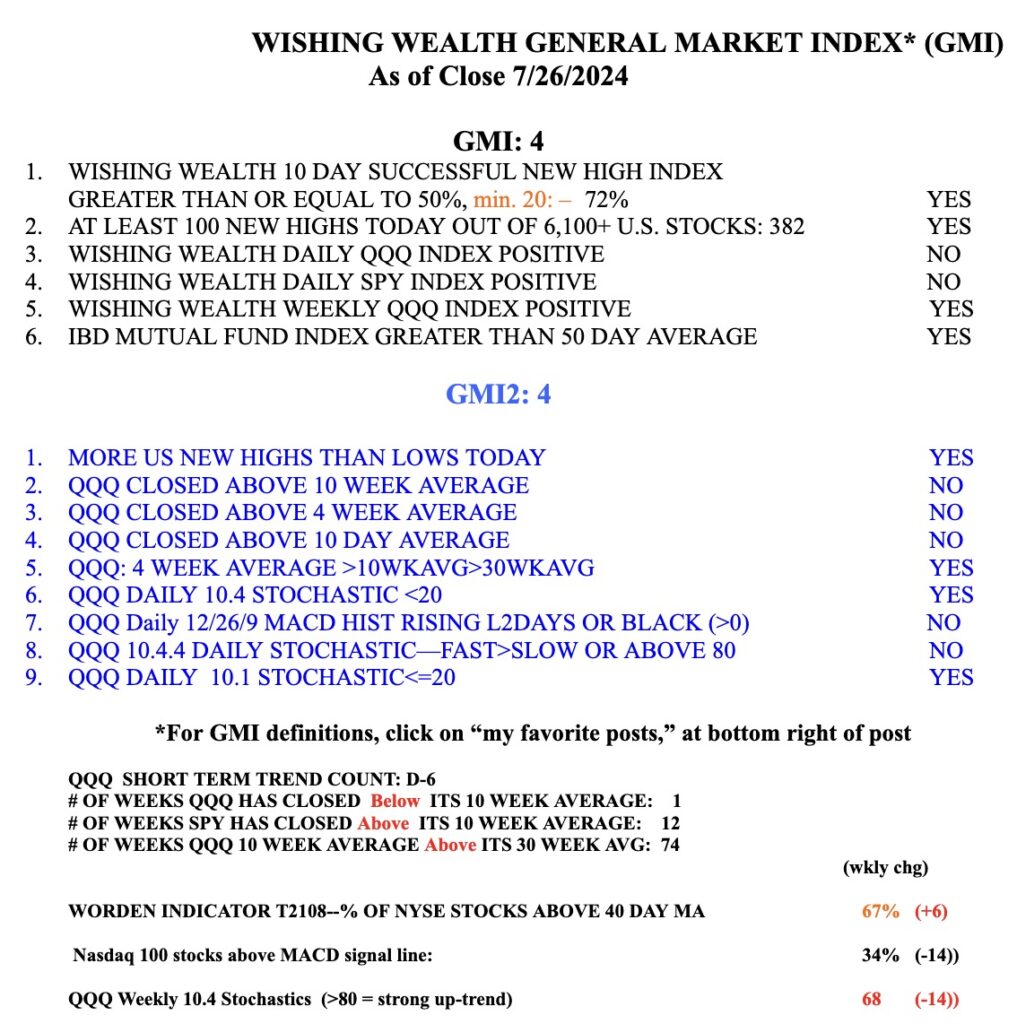

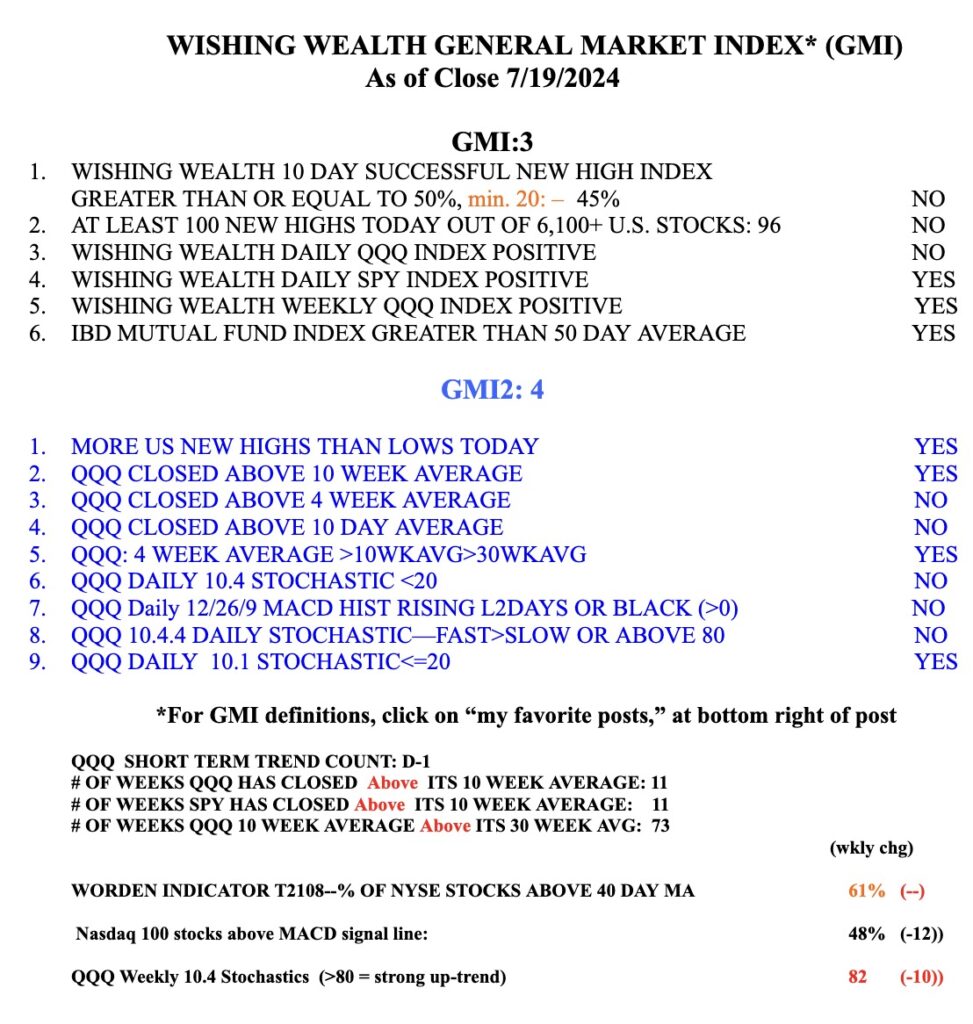

The GMI is RED and it makes sense to me to be in cash in my trading accounts. Vacation time! Plenty of time to get in once there is an up-trend and a daily RWB pattern. One loses a lot of $$$ trying to catch the bottom. NO ONE KNOWS WHERE OR WHEN IT WILL OCCUR. Traders who got in last May had lots of time to ride the up-trend. It is that simple.

Even the Magnificent 7 ETF is entering a daily BWR down-trend. Ride it in a RWB up-trend! Look at NVDA.

The weekly 10.4 stochastic for QQQ is at 33. Strong up-trends occur with this indicator consistently above 80. Look at the recent evidence for QQQ. We must be patient.