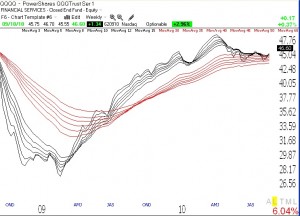

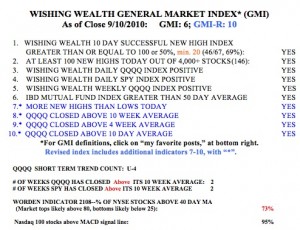

The QQQQ up-trend continues and all of my indicators are now positive, with the GMI at 6 (of 6) and the GMI-R 10 (of 10). The QQQQ and SPY indexes have now closed above their critical 10 week averages for the second straight week.  In addition, 95% of the Nasdaq 100 stocks closed with their MACD above its signal line, a sign of short term strength. The Worden T2108 indicator is now 73%, which is near overbought levels, but it can remain there for months. With options expiration coming at the end of this week and the end of the 3rd quarter with mutual fund window dressing at the end of the month, we could see a nice rally. I know everyone fears the market in October, so we may get some turbulence in October before earnings come out. Still, I am accumulating stocks , given the strong GMI reading. In addition, the GMMA weekly chart of the QQQQ (click on chart to enlarge) shows the averages holding their own. The shorter term weekly averages (in black) appear to be slowly rebounding off of the longer term averages (in red). Check out the column to the right to see the types of stocks I am trading.

In addition, 95% of the Nasdaq 100 stocks closed with their MACD above its signal line, a sign of short term strength. The Worden T2108 indicator is now 73%, which is near overbought levels, but it can remain there for months. With options expiration coming at the end of this week and the end of the 3rd quarter with mutual fund window dressing at the end of the month, we could see a nice rally. I know everyone fears the market in October, so we may get some turbulence in October before earnings come out. Still, I am accumulating stocks , given the strong GMI reading. In addition, the GMMA weekly chart of the QQQQ (click on chart to enlarge) shows the averages holding their own. The shorter term weekly averages (in black) appear to be slowly rebounding off of the longer term averages (in red). Check out the column to the right to see the types of stocks I am trading.

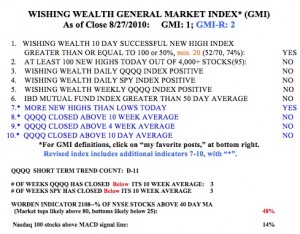

General Market Index (GMI) table

This rally may have legs–IBD100 top ten out-shine again!

When everyone is so bearish and expecting the worst, it is time to expect the opposite. Last week, the Investor’s Intelligence Survey of letter writers and advisers actually showed more bears than bulls (38% vs. 29%, percents rounded). This is an exceedingly rare phenomenon and should have told us all that the market would rally. The survey is known as a contrary indicator, when there are many bears, the market goes up, presumably because many persons have already sold or are afraid because stocks have declined. When there are more than 50% bulls, it is time to start looking for a market decline. I am posting more explanations these days because I have a new class of undergraduate students who are new to these concepts.

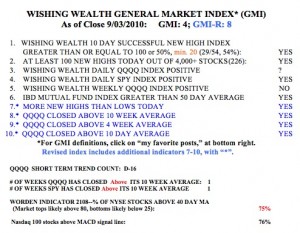

Meanwhile, the GMI is 4 (one more flat or up day could turn it to 5) and the more sensitive GMI-R is at 8.  It is now time for me to close out my few short positions and start going long. There are just too many stocks breaking out. There were 226 new 52 week highs on Friday in my universe of 4,000 stocks. This is the most new highs since August 9 (229). While the QQQQ short term trend is still down, by my count, it may end at Friday’s day 16 (D-16) if we have a flat or up day in the index on Tuesday. Both the SPY and DIA have closed above their critical 10 week averages, the level at which I can begin to trade profitably on the long side. 76% of the NASDAQ 100 stocks closed with their MACD above its signal line, a sign of near term strength. And the Worden T2108 indicator is now at 76%, getting close to overbought territory, but this indicator can remain around 80% for months. The T2108 measures the percentage of all NYSE stocks that closed above their 40 day simple moving averages. It behaves like a pendulum of the market, swinging from overbought to oversold…….

It is now time for me to close out my few short positions and start going long. There are just too many stocks breaking out. There were 226 new 52 week highs on Friday in my universe of 4,000 stocks. This is the most new highs since August 9 (229). While the QQQQ short term trend is still down, by my count, it may end at Friday’s day 16 (D-16) if we have a flat or up day in the index on Tuesday. Both the SPY and DIA have closed above their critical 10 week averages, the level at which I can begin to trade profitably on the long side. 76% of the NASDAQ 100 stocks closed with their MACD above its signal line, a sign of near term strength. And the Worden T2108 indicator is now at 76%, getting close to overbought territory, but this indicator can remain around 80% for months. The T2108 measures the percentage of all NYSE stocks that closed above their 40 day simple moving averages. It behaves like a pendulum of the market, swinging from overbought to oversold…….

As you know, I think the IBD approach to trading stock is quite effective. My strategy is to select stocks from the IBD 100 list, the top 100 stocks that meet the IBD CAN SLIM criteria. I then time the entry according to my own trading rules. The IBD100 list is published every Monday (this week on Tuesday) and is also available on their website for persons who subscribe to the newspaper. I am always amused how some traders dismiss the IBD100 list as containing stocks that have already passed their time. They say that when a stock appears on this list, it is too late to buy them. I think the evidence does not support this assertion. IBD100 stocks often outperform most other stocks, except during a market decline when these growth stocks can fall more.

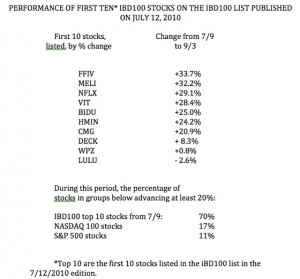

From time-to-time, I record the first 10 IBD100 stocks on the list and compare their performance to other stocks. I did this for the top ten stocks on the list published on Monday, July 12.  The top ten stocks are the first ten listed in the IBD100 table published each Monday, and presumably the most promising. I tracked the change in these ten stocks from the preceding Friday’s close (7/9) through last Friday. This table (click on to enlarge) shows the extraordinary out-performance of the ten IBD100 stocks. 90% (9/10) of these stocks rose in this period, with 70% rising 20% or more. In comparison, only 17% of the NASDAQ 100 stocks and 11% of the S&P 500 stocks rose at least 20%. This performance of the top ten IBD 100 stocks occurred while the QQQQ (NAASDAQ 100 index ETF) advanced 8%. While I do not necessarily concentrate my purchases among the top ten stocks on the IBD100 list, I do tend to concentrate on stocks that have appeared on the list or in the IBD New America daily columns. Almost every Friday, the New America page lists an archive of the companies written about during the past few months. I use this archive to update a watch list of promising stocks to follow. The first ten stocks on today’s IBD 100 list (published on Tuesday this week) are, in order: NFLX, ARUN, BIDU, PCLN, JKS, PPO, MELI, TSL, VIT, FFIV. I already own some of these. It will be interesting to see how these stocks perform over the next month.

The top ten stocks are the first ten listed in the IBD100 table published each Monday, and presumably the most promising. I tracked the change in these ten stocks from the preceding Friday’s close (7/9) through last Friday. This table (click on to enlarge) shows the extraordinary out-performance of the ten IBD100 stocks. 90% (9/10) of these stocks rose in this period, with 70% rising 20% or more. In comparison, only 17% of the NASDAQ 100 stocks and 11% of the S&P 500 stocks rose at least 20%. This performance of the top ten IBD 100 stocks occurred while the QQQQ (NAASDAQ 100 index ETF) advanced 8%. While I do not necessarily concentrate my purchases among the top ten stocks on the IBD100 list, I do tend to concentrate on stocks that have appeared on the list or in the IBD New America daily columns. Almost every Friday, the New America page lists an archive of the companies written about during the past few months. I use this archive to update a watch list of promising stocks to follow. The first ten stocks on today’s IBD 100 list (published on Tuesday this week) are, in order: NFLX, ARUN, BIDU, PCLN, JKS, PPO, MELI, TSL, VIT, FFIV. I already own some of these. It will be interesting to see how these stocks perform over the next month.

QQQQ trend remains flat; mainly in cash; beware September

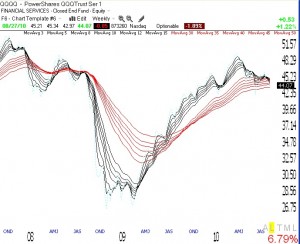

The QQQQ bounced on Friday from very oversold daily stochastic readings. The daily stochastic remains oversold, so Friday’s bounce may last a little longer. However this weekly GMMA chart of the QQQQ (click on to enlarge) shows all of the moving averages converging and flat. We are just going to have to wait for the market to break out one way or the other.

Meanwhile the GMI is one (of 6) and the more sensitive GMI-R is 2 (of 10). The Worden T2108 is at 48%, in neutral territory.  Only 14% of the Nasdaq 100 stocks closed Friday with their MACD above its signal line, an indication of general short term weakness. Friday was the 11th day (D-11) of the current QQQQ short term down-trend. And the QQQQ and SPY have closed below their 10 week averages for three straight weeks.

Only 14% of the Nasdaq 100 stocks closed Friday with their MACD above its signal line, an indication of general short term weakness. Friday was the 11th day (D-11) of the current QQQQ short term down-trend. And the QQQQ and SPY have closed below their 10 week averages for three straight weeks.

So, I remain largely in cash but holding a few shorts and a few long positions protected by put options. I know I shouldn’t own any stocks right now but there are a few stocks I cannot resist buying given that they have held up so well through the current market weakness. I list some of the stocks I am trading to the right in the “Stocks I’m Watching” section. Remember, September tends to be the weakest month of the year for the stock market.